Euro technical forecast: EUR/USD weekly trade levels

- Euro reverse sharply off confluent uptrend resistance

- EUR/USD at risk for further short-term losses

- Resistance 1.0943, 1.11, 1.1275– support 1.0705, 1.0457/61 (key)

Euro plummeted 3.3% off multi-month highs with EUR/USD reversing sharply off uptrend resistance last week. While the broader outlook remains constructive, the threat of a deeper correction remains while below the 1.09-handle. These are the updated targets and invalidation levels that matter on the EUR/USD weekly technical chart.

Discussing this Euro setup and more in the Weekly Strategy Webinars beginning February 27th.

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; EUR/USD on TradingView

Technical Outlook: Euro reversed off confluent uptrend resistance last week around the 50% retracement of the 2021 decline at 1.0943. The move marks the largest single-week range since November and takes EUR/USD back into objective yearly-open support here at 1.0705. The 2023 opening-range is set and we’re looking for a breakout in the weeks ahead.

A break / weekly close below this threshold would threaten a larger correction within the confines of the September uptrend with key support / broader bullish invalidation set to 1.0457/61- a region defined by the .38.2% retracement and the 52-week moving average.

Monthly-open resistance is eyed at 1.0864 backed by 1.0943 and the March high-week close at 1.1099- a breach / weekly close above this threshold is needed to mark resumption towards the 61.8% retracement at 1.1275.

Bottom line: Euro has responded to uptrend resistance and threatens a pullback towards uptrend support- we’re on the lookout for a possible exhaustion low in the weeks ahead. From at trading standpoint, losses should be limited to 1.0450s IF price is indeed heading higher on this stretch. I’ll publish an updated Euro short-term technical outlook once we get further clarity on the near-term EUR/USD technical trade levels.

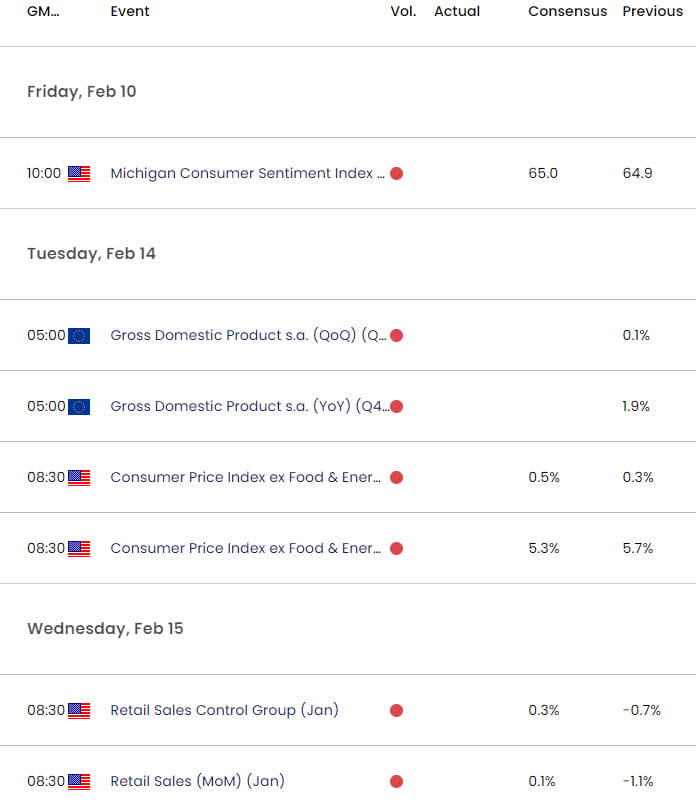

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex