Euro Technical Forecast: EUR/USD Weekly Trade Levels

- Euro poised for third-weekly decline into pivotal support- risk for price inflection

- EUR/USD – Fed rate decision, NFPs on tap into August open- Breakout pending

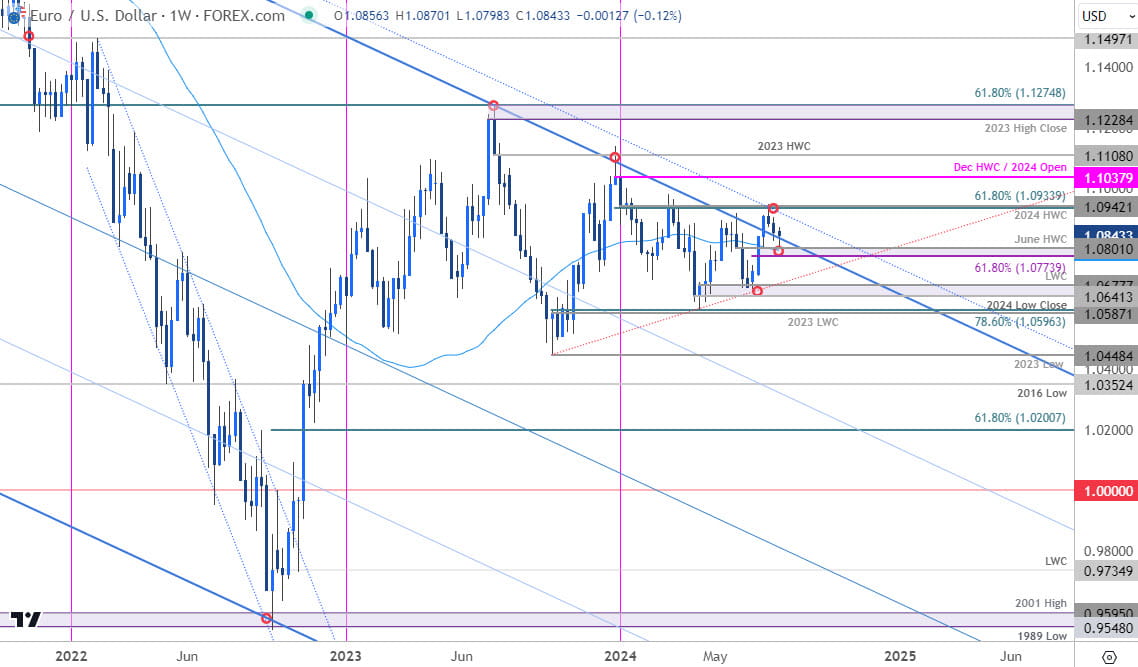

- Resistance 1.0933/42 (key), 1.1038, 1.1108– Support 1.0774-1.0801, 1.0641/77 (key), 1.0587/96

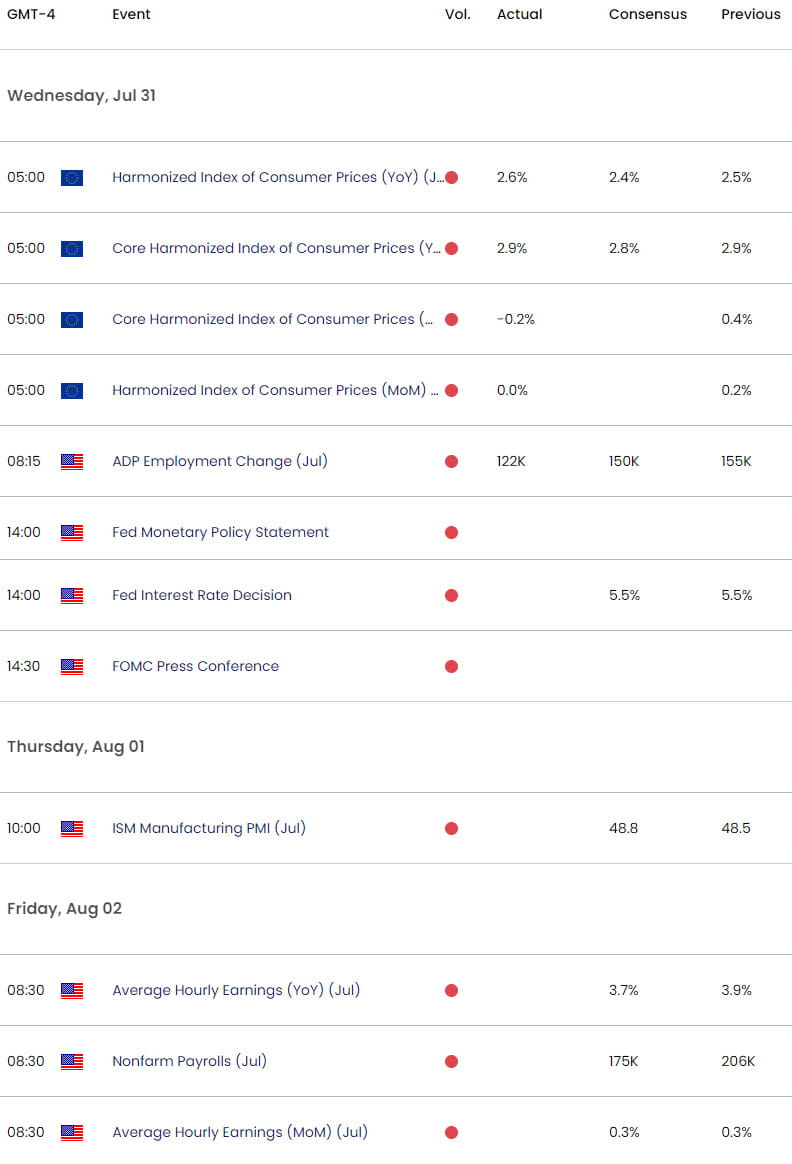

Euro is on defense for a third consecutive week with EUR/USD trading just above weekly technical support on Wednesday. The battle lines are drawn heading into the August open with the FOMC interest rate decision and Non-Farm Payrolls (NFP) on tap into the close of the week. These are the updated targets and invalidation levels that matter on the EUR/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In last month’s Euro Technical Forecast we noted that EUR/USD had been, “testing key technical support for the past three-weeks and the immediate short-bias remains vulnerable while above this hurdle. Form at trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops.” That week marked the monthly low for Euro with price rallying more than 2.6% into mid-July.

The rally failed at major technical resistance at 1.0933/42- a region define by the 61.8% Fibonacci retracement of the December decline and the objective 2024 high-week close (HWC). A decline of nearly 1.4% takes EUR/USD back into technical support this week at 1.0774-1.0801- a zone defined by the 61.8% retracement of the June rally, the 52-week moving average, and the June high-week reversal close. The immediate focus is on a breakout of this critical range heading into the August open (1.0774-1.0942) as the multi-month consolidation tightens.

A break / close below this key pivot zone would threaten a plunge towards consolidation support at the yearly low-week close / low close at 1.0641/77 – look for a larger reaction there IF reached. Ultimately, a weekly close below the 2024 opening-range lows / technical support at 1.0587/96 would be needed to validate a breakout of the year-long consolidation pattern Euro (red).

Look for initial resistance along the upper parallel (blue) with a break / weekly close above 1.0942 needed to validate a breakout / mark uptrend resumption towards the objective yearly open / December HWC at 1.1038 and the 2023 HWC at 1.1108- both levels of interest for possible topside exhaustion / price inflection IF reached.

Bottom line: The reversal off key resistance takes Euro into the first major test of support and we’re looking for a reaction down here into the August open. Keep in mind EUR/USD is continuing to tighten into the apex of a multi-month consolidation pattern off the 2023 highs. From at trading standpoint, a good region to reduce portions of short-exposure / lower protective stops – look for a breakout of the 1.0777-1.0942 range for guidance in the weeks ahead.

Keep in mind the Fed is on tap today with NFPs slated for Friday- watch the weekly close here and look for a breakout of the August opening-range for guidance. I’ll publish an updated Euro Short-term Outlook once we get further clarity on the near-term EUR/USD technical trade levels.

Key Euro / US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- British Pound (GBP/USD)

- Crude Oil (WTI)

- Gold (XAU/USD)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- US Dollar Index (DXY)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex