Euro Technical Forecast: EUR/USD Weekly Trade Levels

- Euro plunges into pivotal, multi-month consolidation support- risk for price inflection

- EUR/USD – Eurozone Elections and NFPs on tap into July / Q3 open

- Resistance 1.080/14, 1.0860s, 1.0933/42 (key)– Support 1.0641/77 (key), 1.0587/96, 1.05

Euro snapped a three-week losing streak against the US Dollar on Friday with EUR/USD poised to close June down nearly 1.3%. Price has been testing critical support for weeks now and heading into the July / Q3 open and the Eurozone elections next week, the focus is on a reaction off this key pivot zone. These are the updated targets and invalidation levels that matter on the EUR/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In last month’s Euro Technical Forecast we noted that EUR/USD was at risk, “for topside exhaustion while below 1.0942 heading into the June open- losses would need to be limited to 1.0641 for the October consolidation structure to remain viable..” A final test of resistance the following week registered an intraweek high at 1.09016 before reversing sharply with Euro plunging nearly 2.3% off the monthly high.

The decline has been testing key support for the past three-weeks at 1.0641/77- a region defined by the 2024 low-close & the low-week close and converges on the basic slope support extending off the 2023 low. We are looking for a reaction off this mark with a break / close below 1.0587/96 ultimately needed to validate a break of the yearly opening-range and the October consolidation pattern towards subsequent objectives at 105 and the 2023 low at 1.0448.

Initial weekly resistance is eyed at the June high-week reversal close / 52-week moving average around 1.0801/14 and is backed by longer-term slope resistance (blue), currently near 1.0860s. Key resistance / bearish invalidation remains unchanged at 1.0933/42- a region define by the 61.8% Fibonacci retracement of the December decline and the objective 2024 high-week close (HWC).

Bottom line: Euro has been testing key technical support for the past three-weeks and the immediate short-bias remains vulnerable while above this hurdle. Form at trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops- rallies should be limited to the 200-day moving average IF price is heading lower on this stretch with a close below 1.0641 needed to fuel the next major leg in price.

Keep in mind we are heading into the start of a new month / quarter on Monday with French elections and US Non-Farm Payrolls (NFP) on tap next week. Stay nimble into the July open and watch the weekly closes for guidance here. I’ll publish an updated Euro Short-term Outlook once we get further clarity on the near-term EUR/USD technical trade levels.

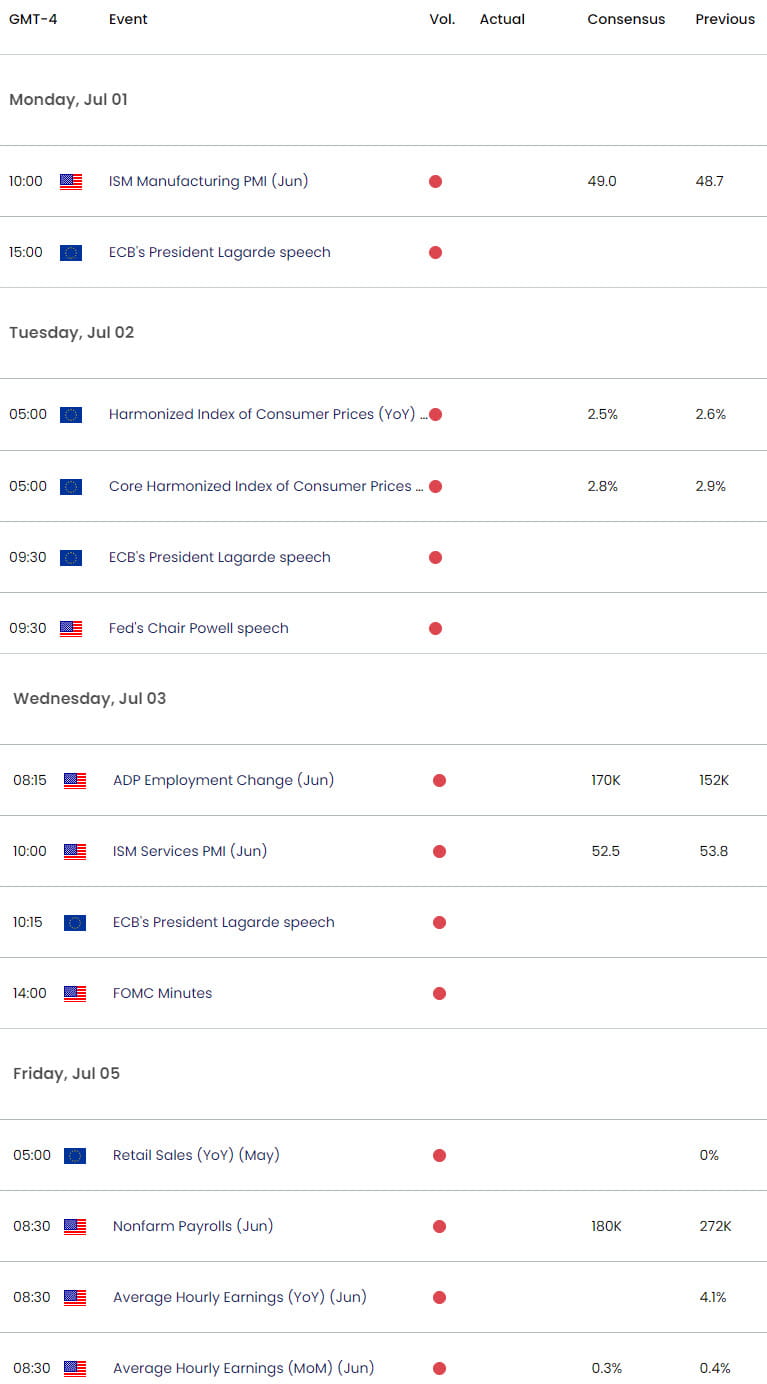

Key Euro / US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Gold (XAU/USD)

- British Pound (GBP/USD)

- Crude Oil (WTI)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- US Dollar Index (DXY)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex