Euro, EUR/USD Talking Points:

- It was a muted week in EUR/USD last week despite the fireworks elsewhere. But – the pair did attempt to break out on Monday before reversing from the 1.1000 handle.

- The pullback from 1.1000 has been rather controlled despite the open door for sellers. The USD-side of the pair is in focus this week with PPI and CPI data due on Tuesday and Wednesday.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

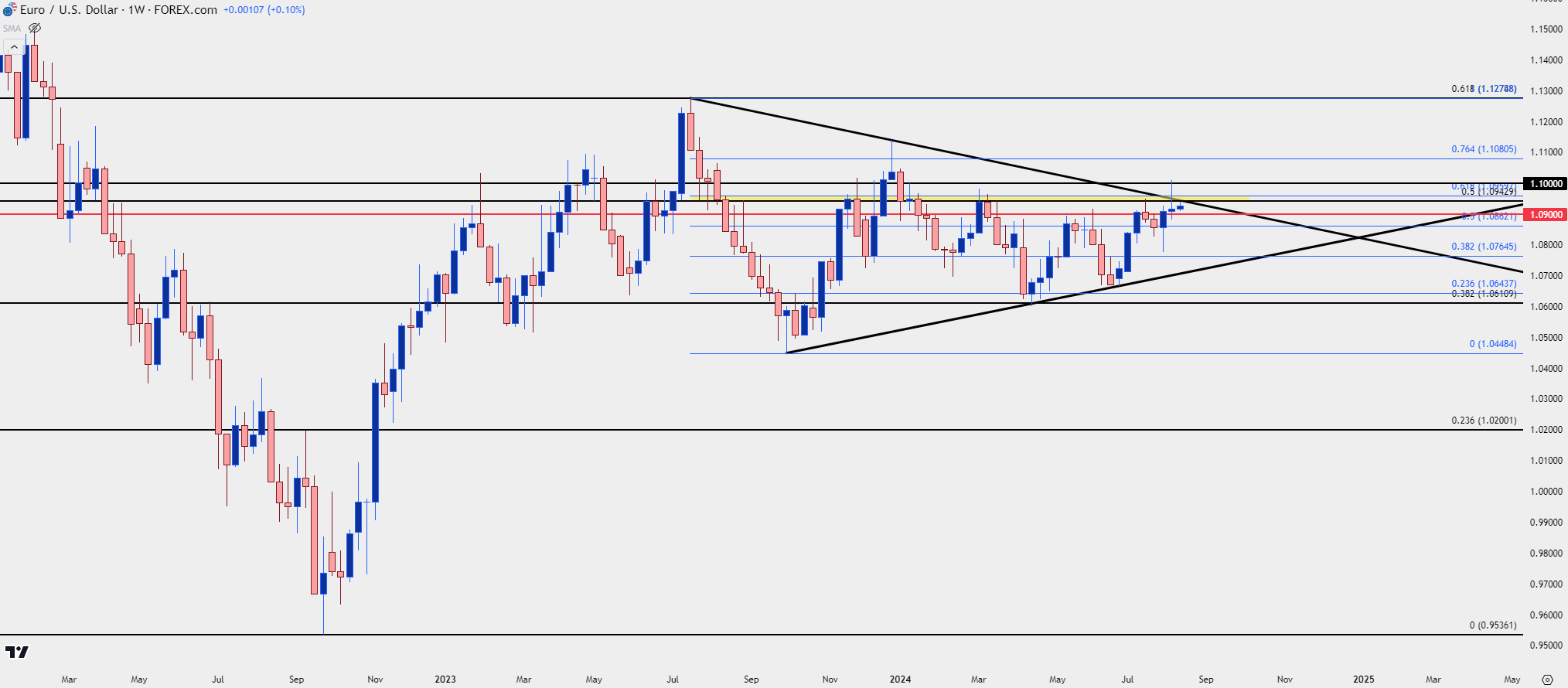

EUR/USD has been range-bound for more than 19 months now; and for the past 12 months, the pair has seen that range narrowing in the form of a symmetrical triangle.

As for rationale, both the ECB and FOMC have appeared to be in lock-step for much of this time with slight biases in either direction: When EUR/USD has been around support in the 1.0500-1.0600 area, the ECB has tended to bias towards hawkish and the Fed dovish. And with EUR/USD near 1.1000, the opposite has seemed to be the case, with the Fed has a bit more hawkish and the ECB more dovish. That fundamental leaning has helped the range to remain intact but we’re nearing a spot where that impasse may soon give way.

The Fed is widely expected to begin cutting rates at their next meeting in September and at the start of last week, those rate cut expectations had gotten aggressive, looking for a 50 bp cut in September and another 75 bps of cuts by the end of the year. There were even well-known market prognosticators calling for emergency rate cuts from the Fed after a 10% pullback in the S&P 500.

With that rate cut hope came USD-weakness, and this is of note as we near the PPI and CPI releases this week. If either of those data points prints significantly below-expectation, we could see another run of USD-weakness that could expose bullish breakout potential in EUR/USD.

Below from the weekly chart, we can see that failed breakout attempt from last week, which led into a doji for the weekly candle.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

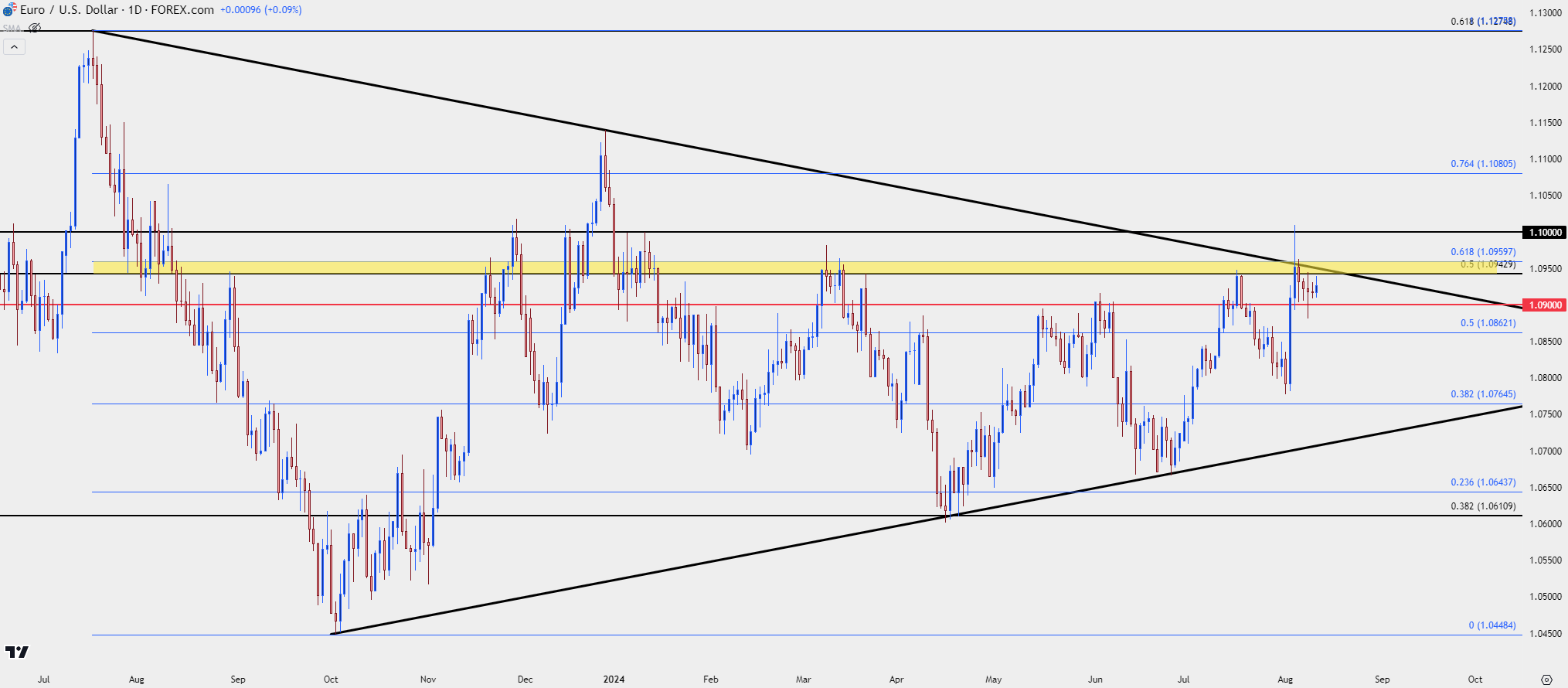

EUR/USD Daily

From the daily chart we can get some additional reference. There was a wide upper wick from the Monday breakout attempt; and something like that would normally be an open invitation for sellers. But despite four consecutive red bars on the daily, shorts were unable to take-out 1.0900 on a daily close basis. There’s a Fibonacci level at 1.0862 which would be a logical area to look for a test, but sellers couldn’t force that stretch.

Above price, however, remains a big zone at the 1.0943 Fibonacci level. This is the 50% mark from the same Fibonacci setup that caught the high last year at 1.1275 (the 61.8%) and the low so far this year at 1.0611 (the 38.2%). I’ve been following this level for some time now and it helped to hold the highs in July after doing the same in March.

At this point, that becomes an area for a lower-high that could open the door for pullback plays. If sellers can hold resistance in the 1.0943-1.0960 area, there’s interest for deeper pullback and consolidation scenarios.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD, US Dollar: Rates Matter

The big push point for the USD sell-off in the prior few weeks was growing expectation for more rate cuts out of the U.S. As rate cut expectations swelled, so did USD weakness, to the point where even EUR/USD attempted a breakout.

But this had far-ranging consequences as that push for lower-rate expectations also saw a massive bid in bonds, with capital leaving several markets in an effort to get in-front of FOMC rate cuts.

This story may not be completed yet: Last week produced a few positive U.S. data items which helped to bring reversion in many of those setups as rate cut expectations pared back, but this is still a backdrop that could quickly become worried again should PPI or CPI massively miss the mark. And as further confirmation of the good news being good for USD or bad news being bad, it was the NFP report from the week before that sparked the intense USD sell-off while also cratering stocks; of which produced a sizable breakout in EUR/USD.

So for those looking at EUR/USD breakout themes, they would appear to have some degree of alignment with the same backdrop of lower U.S. rate expectations, which could be a bearish driver for stocks, gold and USD/JPY.

--- written by James Stanley, Senior Strategist