Euro Talking Points:

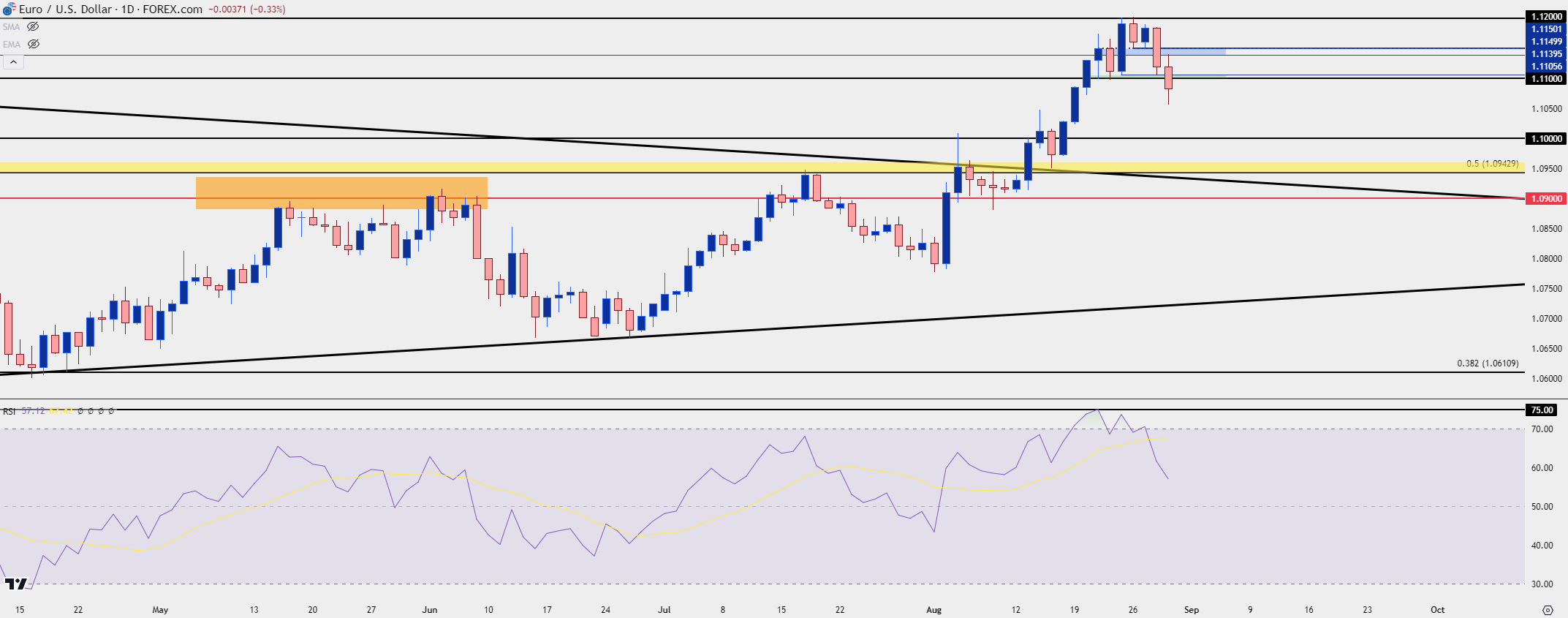

- EUR/USD has been in an aggressively bullish trend, with RSI on the daily chart going over 75 last week – the first time for such an occurrence since December of 2018.

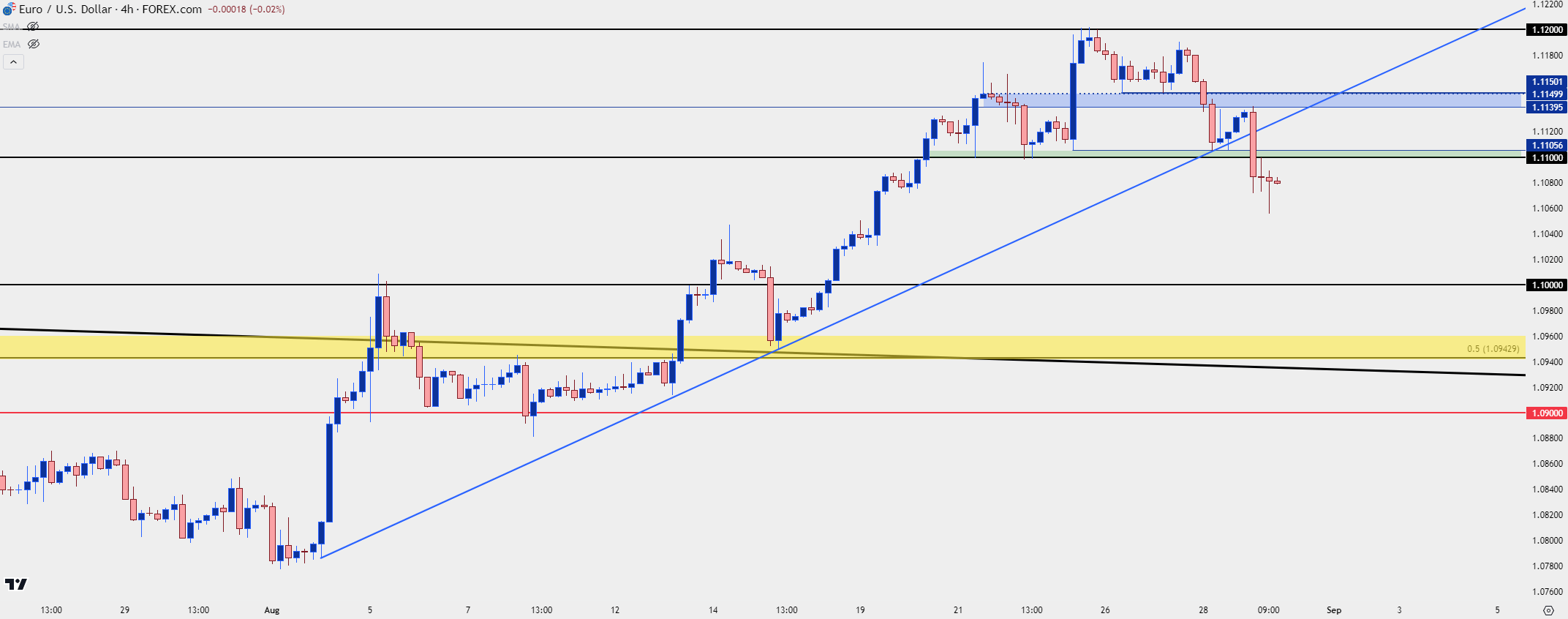

- The weakness began to show more clearly over the past couple of days and from the four-hour chart, there’s now a build of lower-lows and lower-highs.

EUR/USD continues to fall after the failed breakout attempt at 1.1200 to start the week. Initially, bulls held strong, with support at prior resistance of 1.1150. But the bounce from that held a lower-high and sellers have been going to work since, making for a bearish weekly bar at this point. Given the prior lower-low, there’s also some reference for bearish continuation, so long as sellers are able to defend the structure. That prior support from 1.1100-1.1106 looms overhead and a hold of lower-highs there would keep the door open for a continued run down to the 1.1000 psychological level which, notably, has not been tested for support since the breakout two weeks ago.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Daily

The big data items for this week around the US Dollar are on the calendar for tomorrow, with considerable interest around the Core PCE report set for release at 8:30 AM ET.

The USD had become massively oversold with its first sub-30 reading in RSI on the weekly chart last week, with a push from Powell’s speech at the Jackson Hole Economic Symposium. And while the Fed is ready to begin cuts, the European Central Bank has already been down that road, and are expected to go down it again with more cuts by the end of the year. So there’s not a significant fundamental deviation in rate expectations between the two economies, yet USD continued to drop as EUR/USD pushed into overbought territory.

That helps to rationalize this week’s move as somewhat of a mean-reverting pullback in a trend that’s difficult to back with fundamentals, but we’re going to see another illustration of market sentiment tomorrow on the back of the Core PCE print. And making matters even more interesting is the fact that a few hours before that we’ll get flash Eurozone inflation data for the month of August, expected at 2.8%.

From the daily chart, EUR/USD has now left overbought territory and the 1.1000 level sticks out as a point of interest, particularly if we see continuation of the near-term bearish trend that’s built this week. That would be a major test for the market and a hold there into the weekly close would keep the door open for bullish scenarios in EUR/USD next week. But – for now – bears have hope as the recent build of lower-lows and lower-highs remains in-force.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist