Euro Talking Points:

- The European Central Bank held rates at their meeting this morning, but the door remains open for additional cuts in September and/or later in the year.

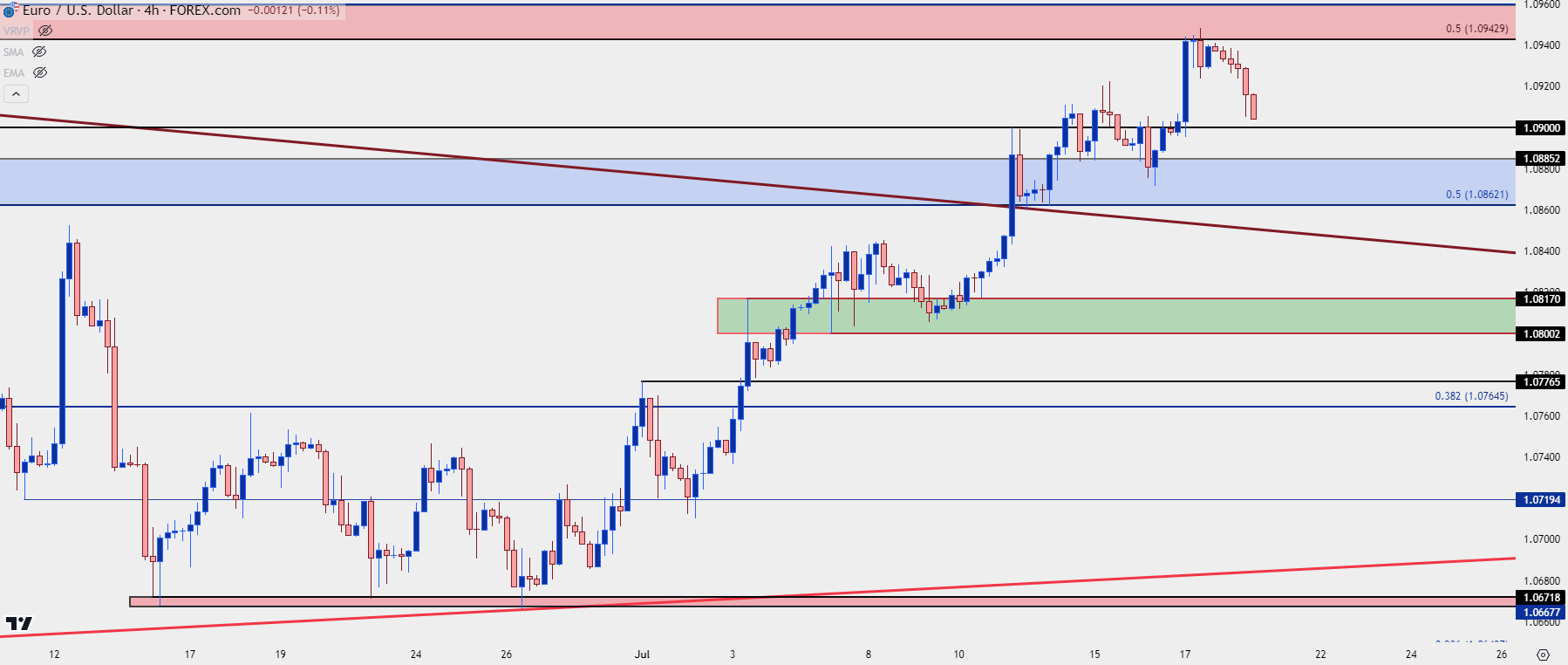

- EUR/USD pushed up to a key spot of resistance earlier in the week, and that held the highs on Wednesday as we moved into the ECB rate decision. That has since prodded a pullback in the pair, but bulls could still have something to say about that if they’re able to hold a higher-low point of support around prior resistance.

- EUR/JPY was smashed over the past week following the BoJ intervention, but the 170.00 psychological level came into play and has since held the lows in the pair.

- I highlighted resistance in EUR/USD at the Tuesday webinar just after it had started to come into play. To join next week’s webinar, the following link will allow for registration: Click here to register.

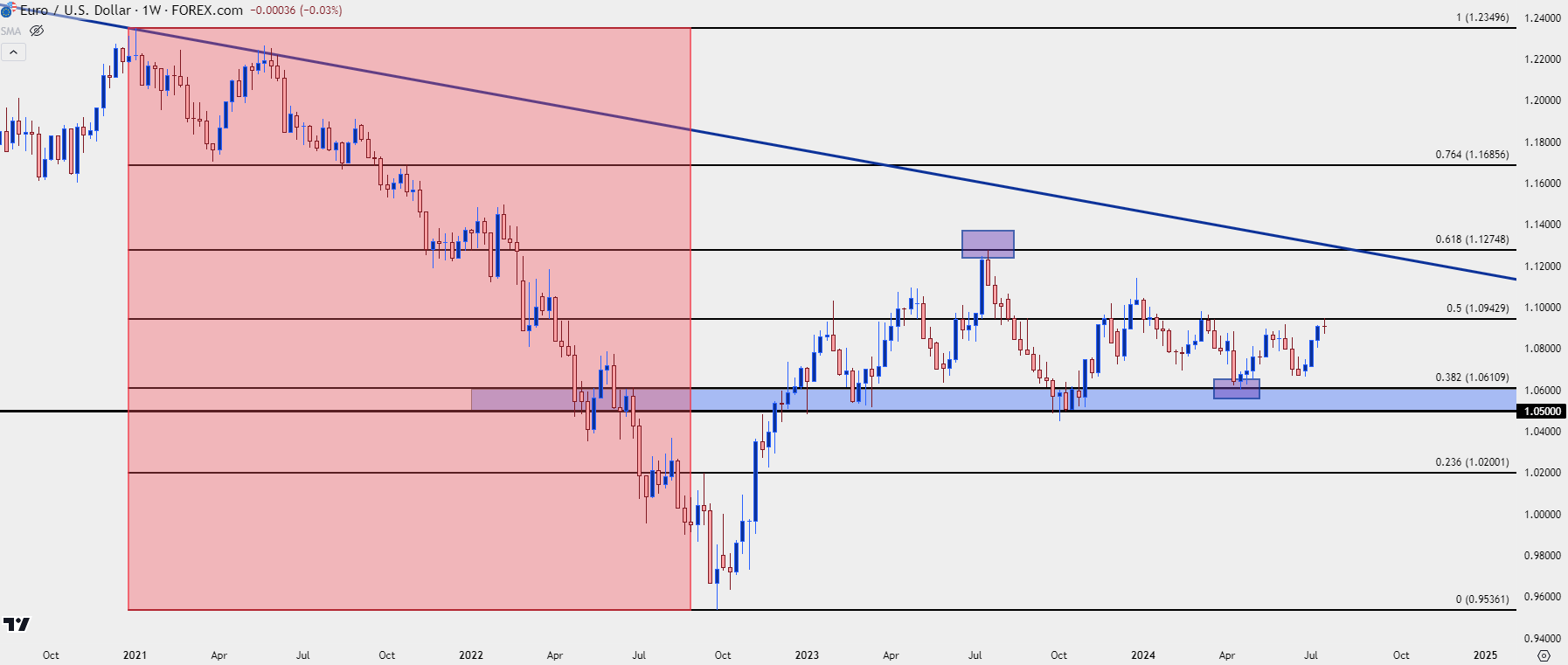

It’s been a strong month of price action for EUR/USD. It was in mid-June on the heels of the FOMC meeting that the pair was hurdling down towards longer-term range support, and that level was clearly marked as the 38.2% retracement of the 2021-2022 major move in the pair. That price had held the lows in April and the zone spanned all the way down to 1.0500 to highlight support for the longer-term range.

But, bears lost enthusiasm as prices grinded at 1.0667 and that lasted for a couple of weeks. Eventually, USD weakness began to show and this helped the pair to start pushing higher and this led to a very strong start to Q3 trade.

Since then, there’s been a continued progression of higher-highs and lows, with bulls finally running into the 1.0943 Fibonacci level on Wednesday.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

Taking a step back to the weekly chart gives better view of the range that I was speaking of earlier. This also highlights the 1.0943 level that’s related to the 1.1275 price that held the 2023 swing high; as well as the 1.0611 level that has so far held the 2024 low.

There’s another spot of resistance a little higher, around the 1.1000 level that was last in-play during the first two weeks of 2024 trade. So, if buyers can force a push above 1.0943 there’s going to be another important price for them to contend with shortly after.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

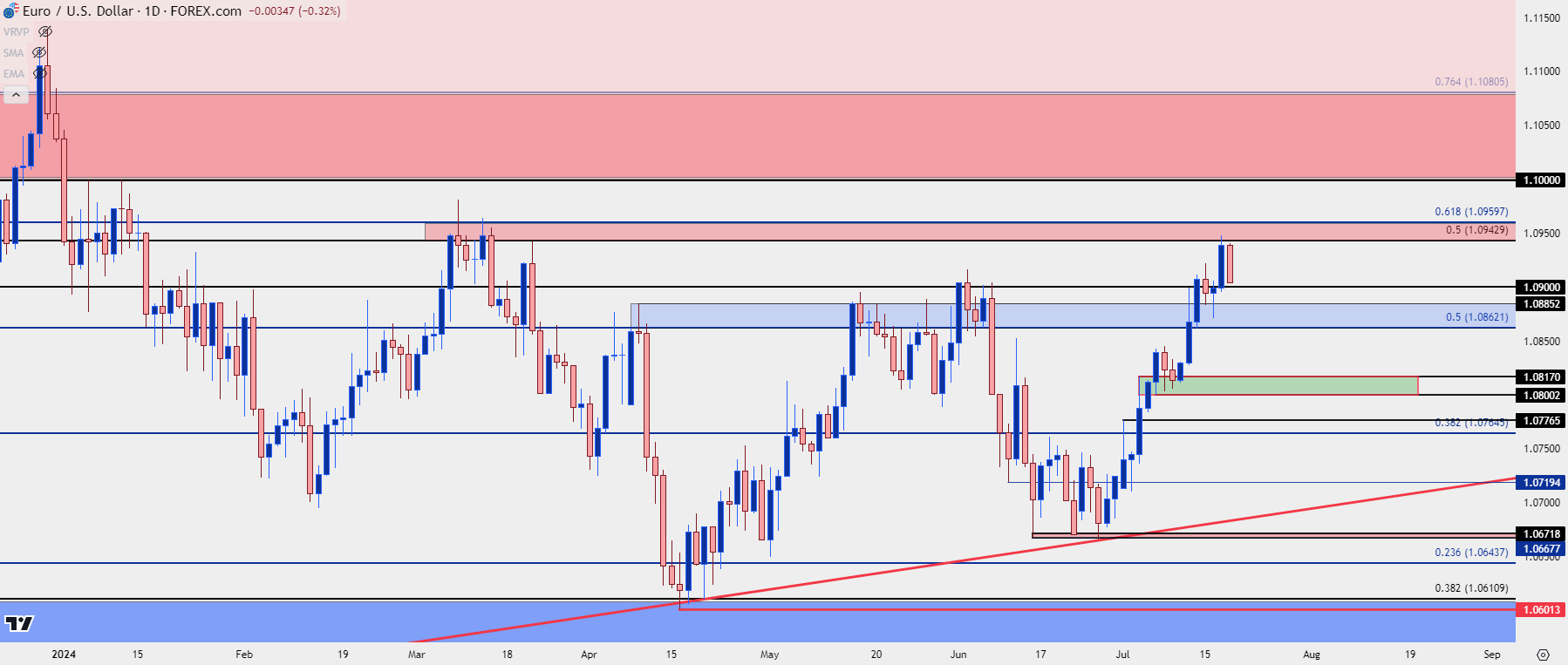

EUR/USD Daily

From the daily we can get clear vision of two recent support tests, both of which took place around prior resistance. This also provides some structure to work with in effort of gauging whether bears can push the next leg of the range.

The 1.0862-1.0885 resistance was in-play in April and May and, more recently, this helped to set support earlier this week before bulls pushed up for the 1.0943 test.

And last week, I had highlighted the zone just above the 1.0800 handle which held the lows on Monday and Tuesday before buyers pushed another higher-high after the US CPI report.

If bulls can still muster continuation, I’m tracking the current resistance zone as 1.0943-1.0960, and that leads into the 1.1000 level that was last in-play in the first two weeks of the New Year. That’s a major psychological level and a price of that nature can have a tendency to produce change, such as I described in the article on Gold yesterday. But, on that topic, there’s another relevant item related to the Euro and EUR/JPY, which I’ll look into below.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

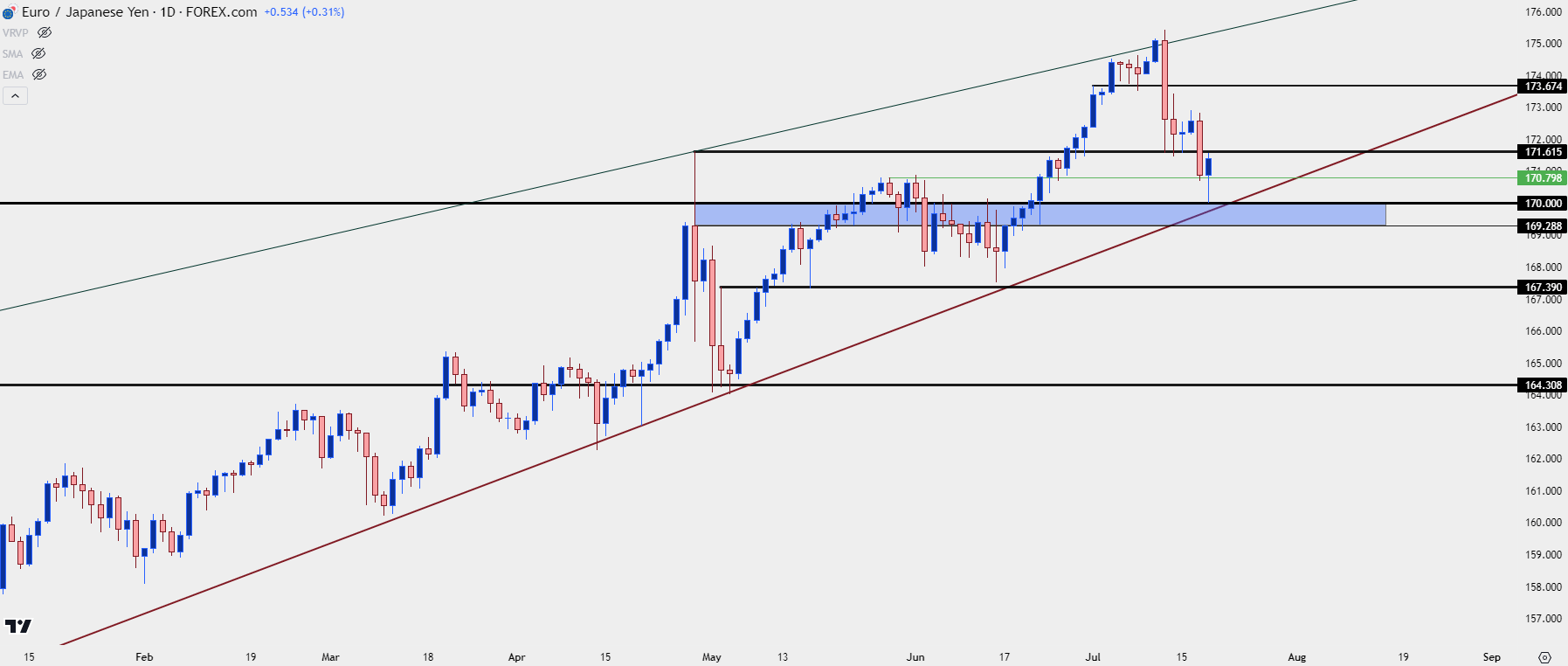

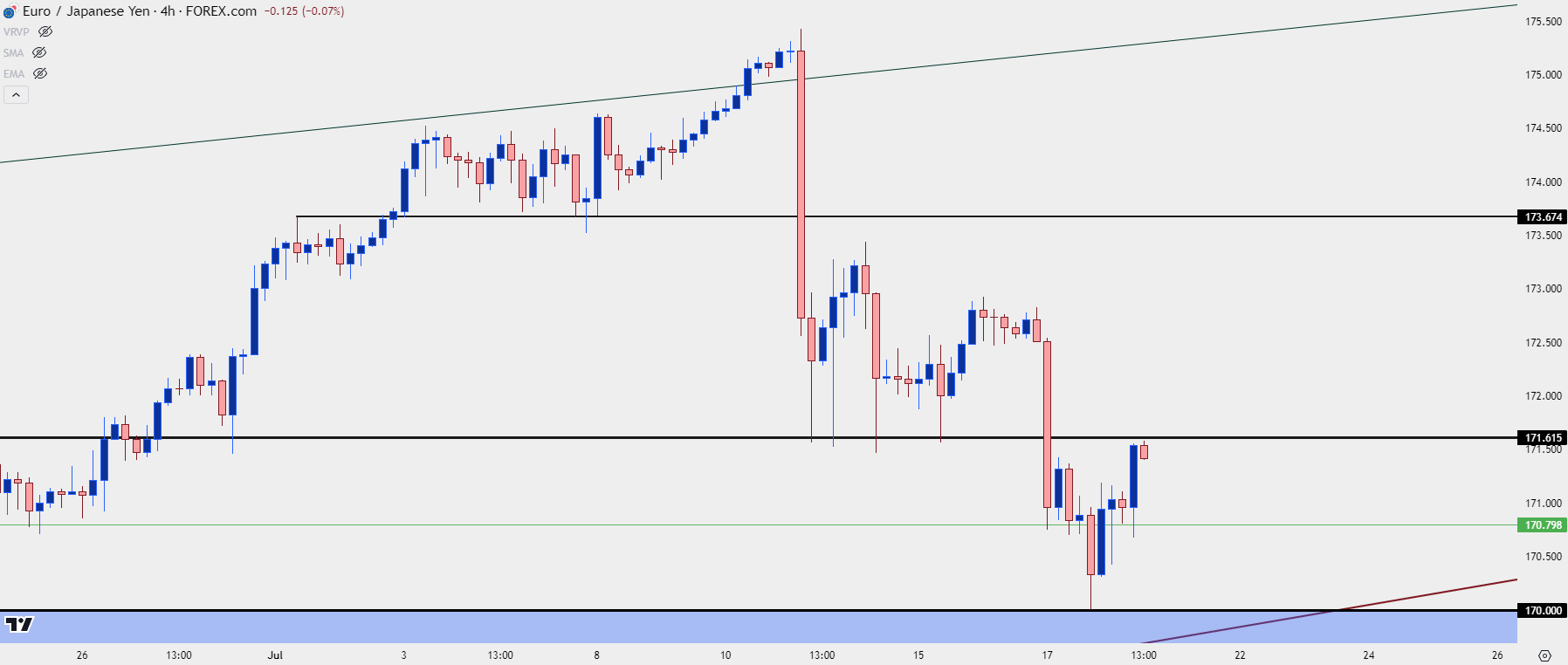

EUR/JPY

The Bank of Japan made a splash last week with their intervention efforts. This pushed a broad-based move of Yen-strength across several markets, EUR/JPY included. In early trade this week, support had held at prior resistance taken from the 171.62 level, but the downside move wasn’t finished yet as yesterday showed continuation and a fresh near-term low.

But – that sell-off ran down for a test of the 170.00 psychological level and, so far, bulls have responded. The current non-completed daily bar is taking the shape of a hammer formation, accented with an extended underside wick that highlights intra-bar reversals and this one pushed right off of that 170.00 price.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

EUR/JPY Strategy Shorter-Term

At this point there’s been a very visible bounce from that support, but there could be context for bearish continuation. The prior point of support from prior resistance of 171.62 is almost back in the picture – and a hold there could illustrate a resistance test at prior support.

Whether bearish continuation gets another shot-in-the-arm probably relates to whether the Bank of Japan goes for another round of intervention, which is a completely unpredictable variable. But – if bulls are able to force a break above 171.62, the prospect of bullish trend continuation, and not just a reversal bounce from support, could start to look as more attractive.

EUR/JPY Four-Hour Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

--- written by James Stanley, Senior Strategist