Euro Technical Outlook: EUR/USD Short-term Trade Levels

- Euro carves well-defined weekly / monthly opening ranges – breakouts pending

- EUR/USD constructive above 200DMA- risk for deeper pullback while below monthly open

- Resistance 1.1038/39, 1.11, 1.1139- Support 1.0542, 1.0466, 1.0340-1.0405 (key)

Euro is poised for a breakout as EUR/USD holds within well-defined weekly / monthly opening-ranges. While the broader outlook is still constructive, the threat for a deeper pullback remains after last month’s rally and we’re looking for possible topside exhaustion in the days ahead. These are the updated targets and invalidation levels that matter on the Euro short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In our November Euro Short-term Technical Outlook we noted that Euro had broken out of a multi-month downtrend and that, “From trading standpoint, the focus is on a pivot at this key support zone with the bears vulnerable while above 1.0540.” That support held with Euro staging a rally of more than 6.6% off the October low into the close of the year.

The early-month pullback rebounded last week off the 38.2% retracement at 1.0875 and the January opening-range is now set below the objective monthly-open / 61.8% Fibonacci retracement at 1.1038/39. We are on the lookout for a breakout of the 1.0875-1.1040 range for guidance here.

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD trading within the weekly opening-range, just below the median-line (red). Initial support rests at 1.0875 and is backed closely by the July low / 200-day moving average at 1.0835/46- a break / close below this threshold would threaten the broader October uptrend and we’ll reserve this threshold as our short-term bullish invalidation level. Subsequent objectives rest at the December low day close (LDC) at 1.0763 followed by more significant support at 1.0704/12 (critical).

A topside breach above the monthly opening-range highs / 1.1039 is needed to fuel another run at 1.11 and the December highs at 1.1139– ultimately, we need a daily close above this threshold to mark uptrend resumption towards the 2023 high-day close (HDC) at 1.1228.

Bottom line: Euro has carved a well-defined monthly opening-range just above uptrend support- the focus is on a possible breakout in the days ahead. From at trading standpoint, the threat of a larger correction lower remains while below 1.1040- losses should be limited to 1.0835 for the October uptrend to remain viable with a breach above 1.1140 needed to mark trend resumption. Review my latest Euro Weekly Technical Forecast for a closer look at the longer-term EUR/USD trade levels.

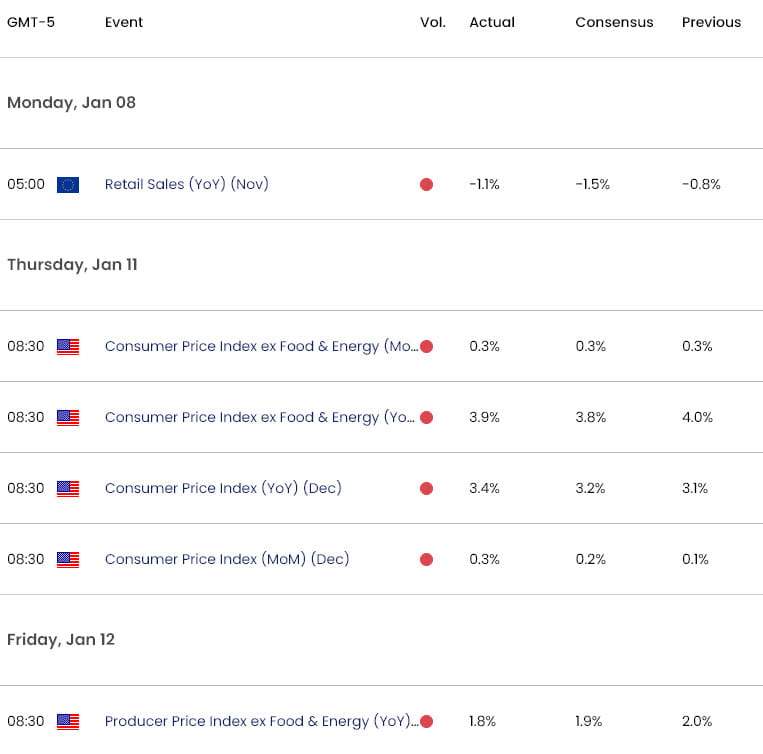

EUR/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- British Pound Short-Term Outlook: GBP/USD Breakout Looms

- Gold Short-term Technical Outlook: Gold Bull Battle Lines Drawn

- Canadian Dollar Short-term Outlook: USD/CAD Bears Straddle Yearly Open

- US Dollar Short-term Technical Outlook: USD Bulls Emerge

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex