Euro Talking Points:

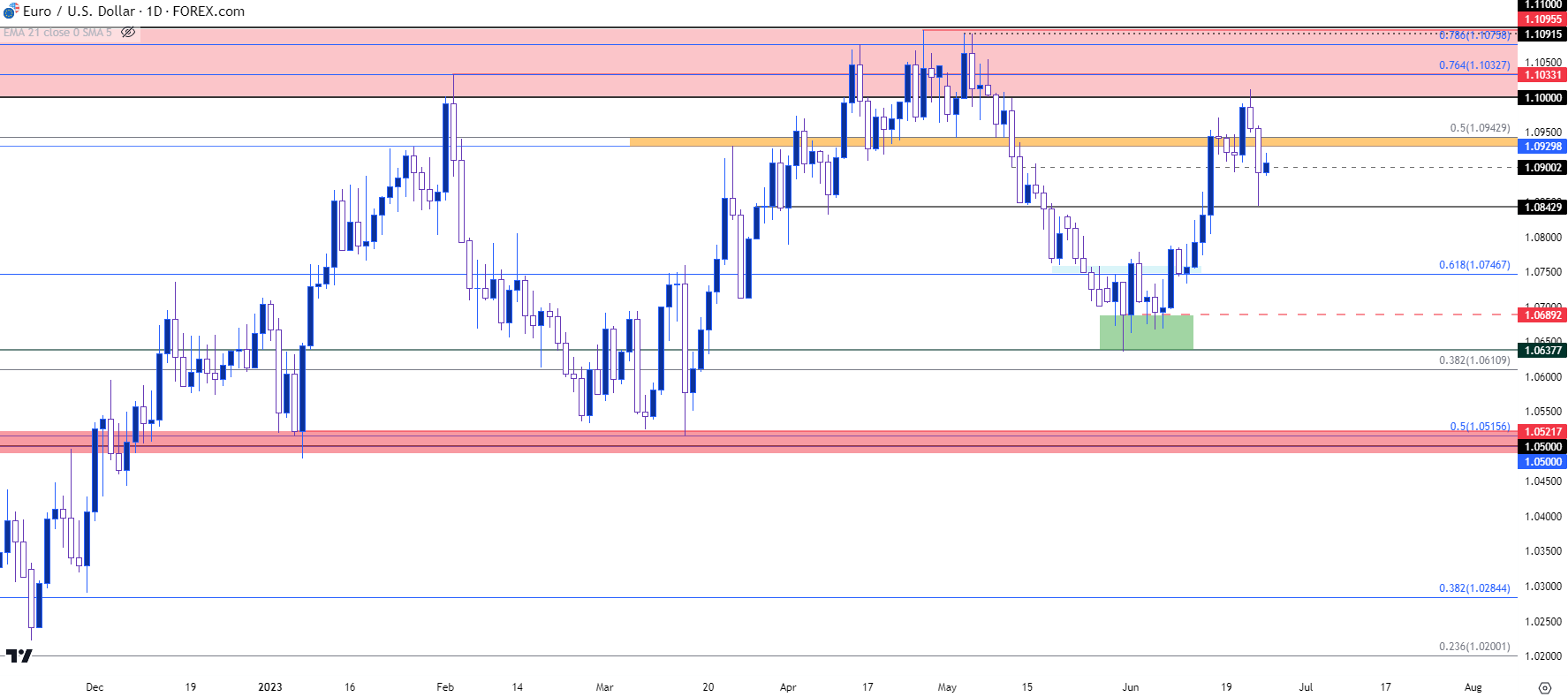

- EUR/USD continued its bullish month of June with a re-test of the 1.1000 handle last week.

- A strong pullback developed in early-Friday trade after the release of PMI numbers out of Europe, but so far EUR/USD has held support around the 1.0843 level.

- As we near the half-way point for 2023, EUR/USD has spent much of the year trading within a range between 1.0500 and 1.1000-1.1100.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

EUR/USD showed a strong bearish response in early trade last Friday and the fact that it happened just after a re-test of the 1.1000 handle is of interest given the struggle that the pair had around that resistance last month.

EUR/USD put in a strong move starting in early-March as USD weakness came in on the back of worries around the banking sector in the United States. That helped to propel EUR/USD back into the same zone of resistance that had held the highs in early-February at the 1.1000 psychological level. Bulls did not relent quickly, however, as EUR/USD grinded in the 1.1000-1.1000 zone for the better part of a month before finally pulling back in the latter portion of May.

And that sell-off ran all the way until the final day of the month when a big level came into play at 1.0638. This was the swing-low from March of 2020 when the pandemic was getting priced-in, and when it came into play on May 31st it cauterized the low in EUR/USD which currently stands as the three month low in the pair.

The first week of June was marked with considerable back-and-forth with bulls finally showing a greater push around the FOMC rate decision in the middle of this month, with another strong push the morning after as driven by the European Central Bank rate decision. Buyers continued to hold the lows with a higher-low showing at the 1.0900 handle in the early-portion of last week, which led to that eventual re-test of the 1.1000 handle on Thursday morning.

On Friday morning, a set of worrying PMIs out of Europe helped to compel another bearish move in the pair, although support held around the 1.0843 swing level and that remains in-place so far this week. But, as I had looked at on Friday – a lower-high showing in the 1.0930-1.0943 area could potentially keep the door open for bears, as that could be looked at as a lower-high inside of the 1.1000 handle that was in-play at the highs last week.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

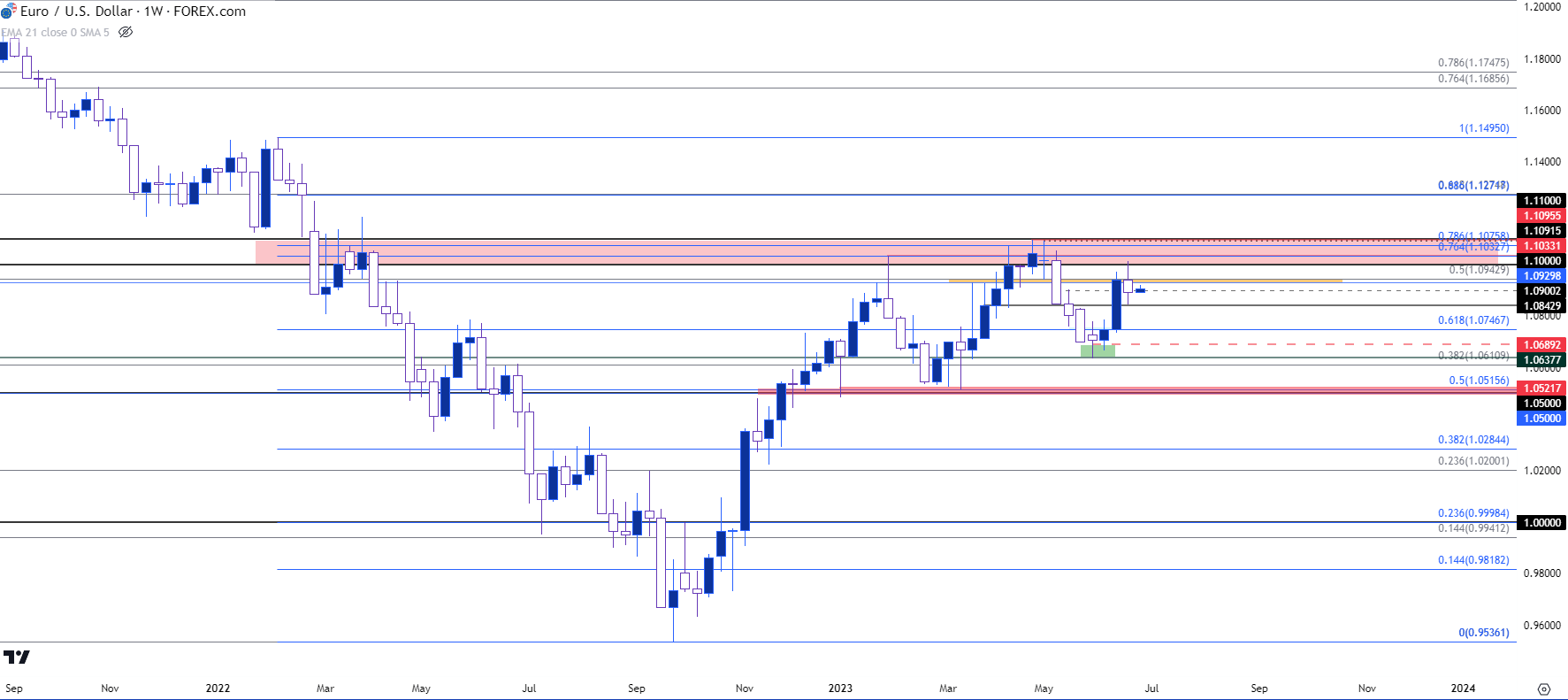

EUR/USD Longer-Term

Taking a step back to the weekly chart and we are dealing with consolidation as price has remained within a range now for the bulk of 2023 trade. While this could be setting up for a large directional break in the second-half of this year, we’re still very near the mid-point of that range and this is important to keep in mind for short-term strategies until greater evidence of trend continuation avails itself.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

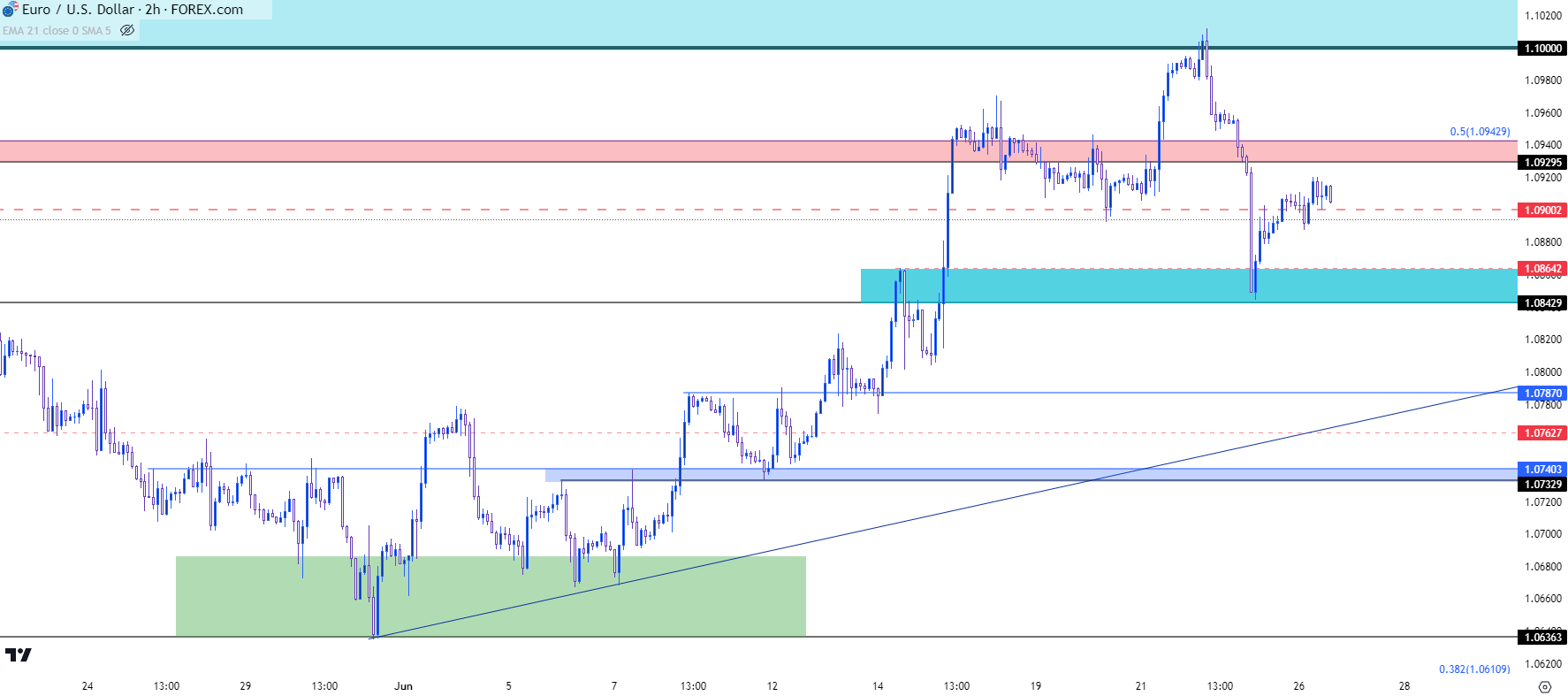

EUR/USD Shorter-Term

On a shorter-term basis, the big question is whether EUR/USD bears can continue to push for lower-lows after the move that posted last Friday. That helped to produce a short-term lower-low in the pair and at this point potential remains for a lower-high should sellers show up before a test of the 1.0930-1.0943 zone.

EUR/USD Two-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist