Euro Talking Points:

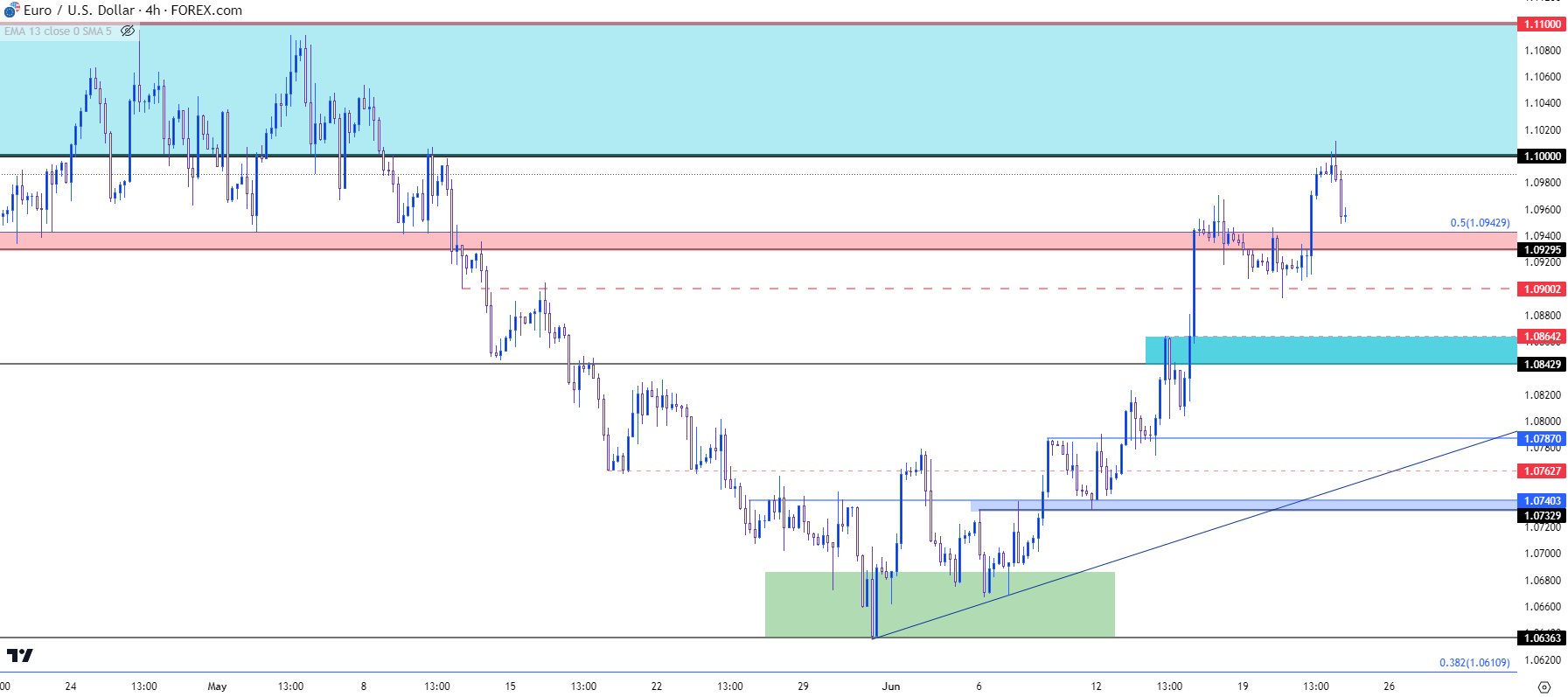

- EUR/USD has continued the bullish move from last week, running into resistance at the 1.1000 handle earlier today which has so far held the highs.

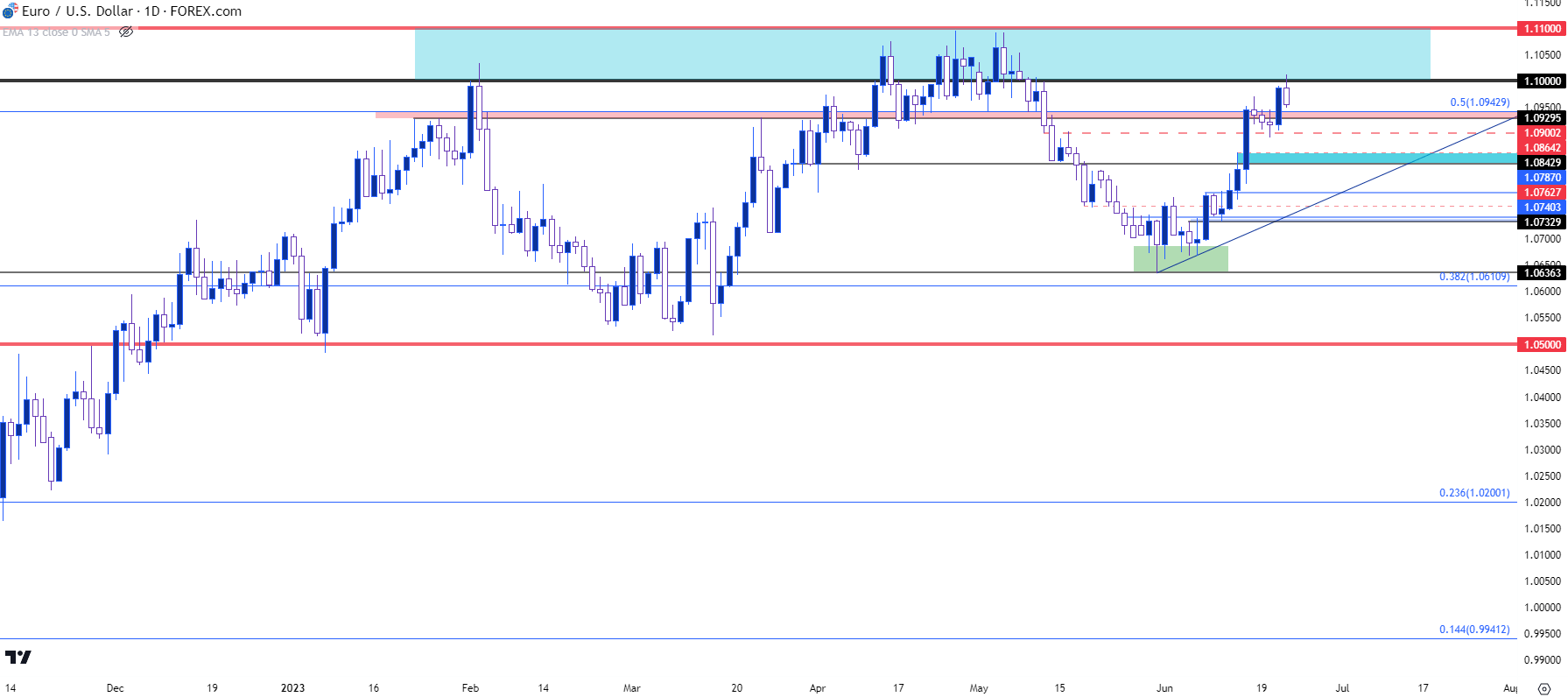

- The resistance zone running from 1.1000-1.1100 has seen quite a bit of action already this year, helping to hold highs in February and then again in April. Below, I look at the matter from a couple of different time frames.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

EUR/USD bulls continue to push, bringing price back to the 1.1000 psychological level after the pair spent six weeks below.

The low set on the final day of May – at the same level that caught the lows in March of 2020 as the pandemic was getting priced-in, and buyers have been in varying stages of control since.

The zone of resistance around 1.1000 has become somewhat of a deal for the single currency this year as it’s held advances in February and then again in April and into May. That second episode lasted for almost a full month, so the question remains as to whether resistance has been softened a bit and whether bulls might fare better than they did during the last episode. But, the question of monetary divergence similarly begs whether the ECB has instilled that much confidence in their hawkishness, to the degree where a strong bullish trend could remain above the 1.1100 handle.

First things first – near term price action remains bullish as this higher-high continued after a higher-low that posted earlier this week. That higher-low printed at the 1.0900 level that I had looked at on Tuesday has so far held the lows for this week and there’s now another spot of possible support, taken from prior resistance at the 1.0930-1.0943 zone.

If buyers show up soon to hold another higher-low in that zone, the potential remains for a deeper push into the 1.1000-1.1100 zone of resistance. That would offer a read into just how bullish buyers remain to be, although this would likely have some relation to the DXY re-test of the 102 support level that I had looked at on Tuesday.

If buyers can’t hold support in that zone, 1.0900 remains a potential support inflection but with perhaps a bit less optimism, given a failure to hold support at prior resistance. This could open up a couple of different scenarios but perhaps the more operative would be looking for a bounce from 1.0900 to find lower-high resistance in that same 1.0930-1.0943 area, which could put bears back on the map if they’re able to hold lower-high resistance inside of the 1.1000 handle.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Longer-Term

It’s worth noting at this point, as we near the half-way point for 2023 trade, that EUR/USD has spent pretty the entirety of the year in an approximate 500 pip range. The 1.1000 level helps to mark the resistance side of that observation which further keeps in-play bearish potential under the possibility of range continuation. But, as can visibly seen from the below daily chart that range test has just begun and until some of the prior higher lows are taken out, it would be presumptive to say that bears are in prime position to take back over.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist