Euro Talking Points:

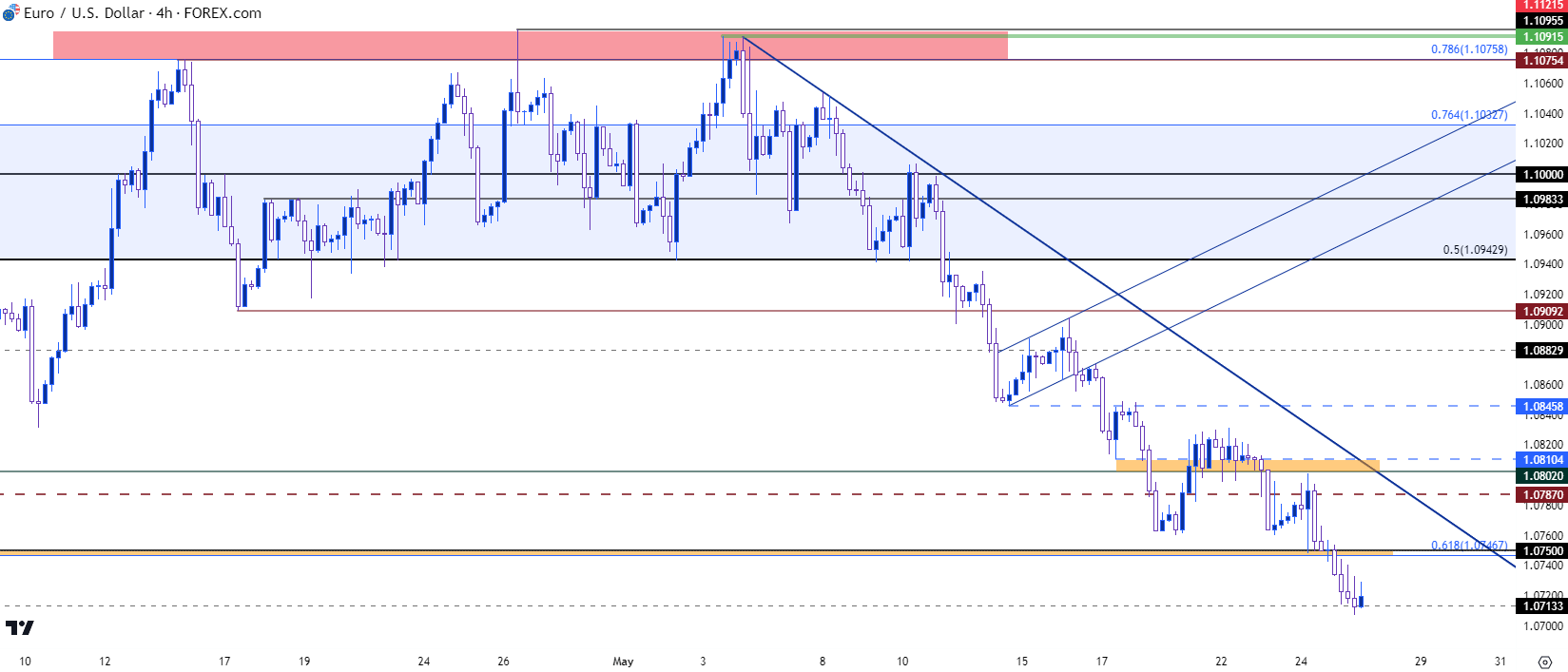

- EUR/USD has set a fresh monthly low this morning as USD strength remains in-place.

- EUR/USD has tested a support level just above the 1.0700 handle and the sell-off has been fast, begging the question as to whether the pair may have pullback potential as we near the end of the week. And notably, the upcoming weekend is a long holiday weekend in the United States with observance of Memorial Day on Monday.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

Well, EUR/USD isn’t stalled at resistance any longer.

It took about a month, and this was at a key zone on the chart with quite a bit going on, but the 1.1000 handle proved too much for bulls to leave behind and over the past two weeks EUR/USD and has snapped back. When I looked at the pair yesterday, support had started to show around the 1.0750 level. That’s since been taken out as sellers have pushed price down to the next spot of short-term support at 1.0713. This was a swing-high just before the 2022 close that was in as support in late-March.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Shorter-Term

The sell-off in EUR/USD has remained brisk, although there have been some proper hues of construction of the bearish move as illustrated by yesterday’s test of lower-high resistance at prior support of 1.0800.

The complication at this point is just how quickly that move has priced-in. From the four-hour chart, the RSI indicator has just made a move out of oversold territory, which doesn’t necessarily imply that a low is in, in and of itself; but it does highlight how aggressive sellers have been, and it raises the possibility of an oversold bounce, especially ahead of the long holiday in the United States.

This could keep the door open for resistance potential around the bearish trendline, which is nearing a point of confluence with another level of note at 1.0787, which I had discussed yesterday.

If buyers push the break above the trendline, there’s deeper resistance potential around the 1.0846 level. If that comes into play, we’ll likely see some questioning of the bearish move, but realistically that pullback could stretch all the way up to the 1.0943 Fibonacci level while still retaining a bearish trend continuation potential.

EUR/USD Four-Hour Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist