EUR/USD, Euro Talking Points:

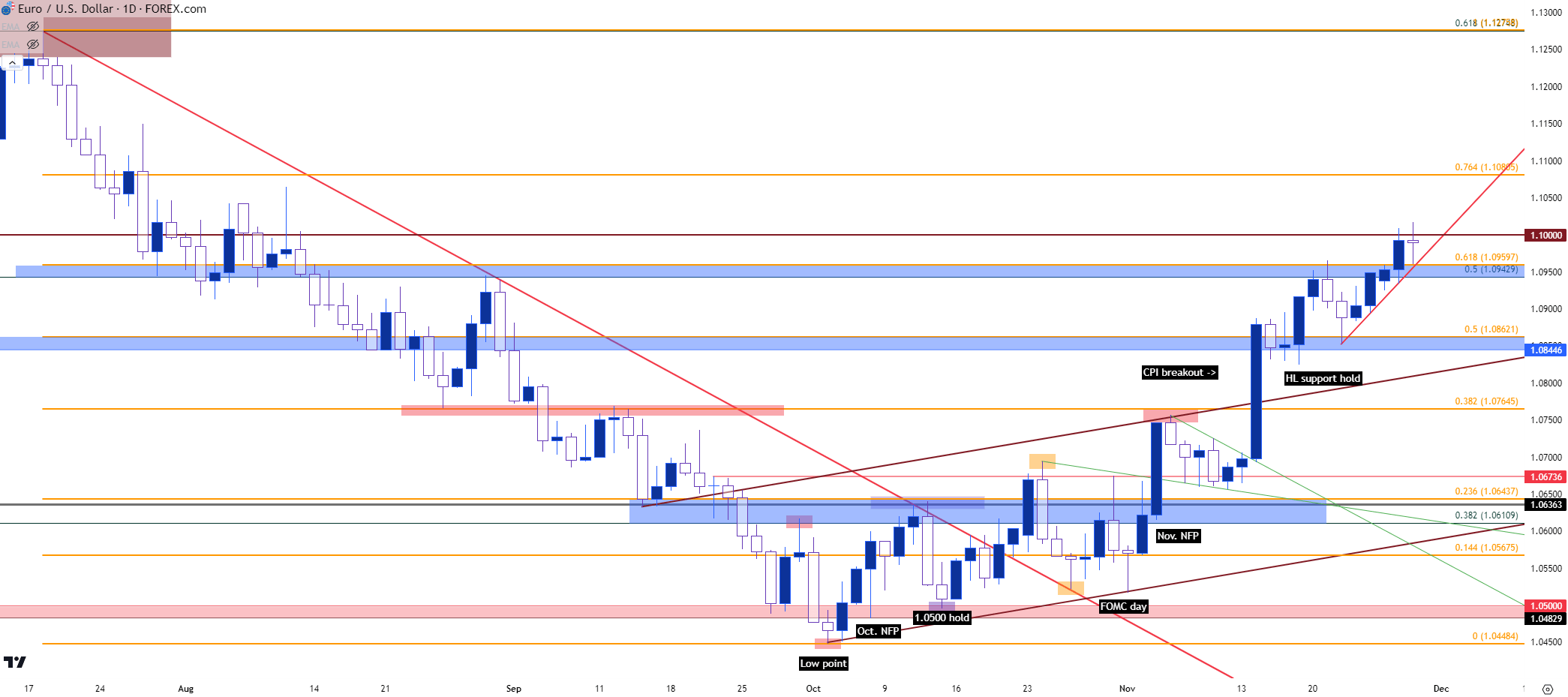

- Euro strength has continued to drive and EUR/USD has re-engaged with the 1.1000 psychological level.

- This is a fast change from the backdrop just two months ago, when EUR/USD was continuing to slide as oversold conditions appeared along with a test of the 1.0500 level.

- The CPI report in November was a large spark point of change, and this has some parallel to last year’s November outing in EUR/USD.

Euro strength has continued to show and less than two months after leaving oversold territory, EUR/USD has already pushed into overbought conditions via RSI on the daily chart.

To simplify, sellers dominated into and through much of September, eventually bringing in a support test at the 1.0500 psychological level. There was little hope, or so it seemed, as a heavy bearish trend started to spin its wheels through much of October, even with a bit of persistence from sellers. But, they began to cede ground as lower-high resistance continued to get higher and higher while prices remained within a bullish channel. The rally started small, and there was a major push starting from the FOMC rate decision on November 1st.

That morning, EUR/USD was looking like it was ready to breakdown and continue that bearish trend that had stalled in October. Price was holding just above a 1.0500 re-test and that was at a very key point on the chart as the month of October had already showed a steady build of higher lows. A low point of 1.0448 was traded on Tues, October 3rd, but the NFP report on that Friday showed a higher-low at 1.0482. And then a week later, on Friday the 13th, there was another higher-low and this time it was right at the 1.0500 level (which hasn’t traded since). 1.0520 held the next higher-low and, while small, there was the makings of a pullback that had started to show.

The FOMC rate decision helped to bring a pullback to the USD and this also allowed for a boost to EUR/USD, with another arriving a couple of days later on the heels of the NFP report on Nov. 3rd. The pullback from that remained orderly, building in a falling wedge and that led into the CPI report on the 14th. That drove a significant breakout that led into a bullish trend that remains in-play today.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

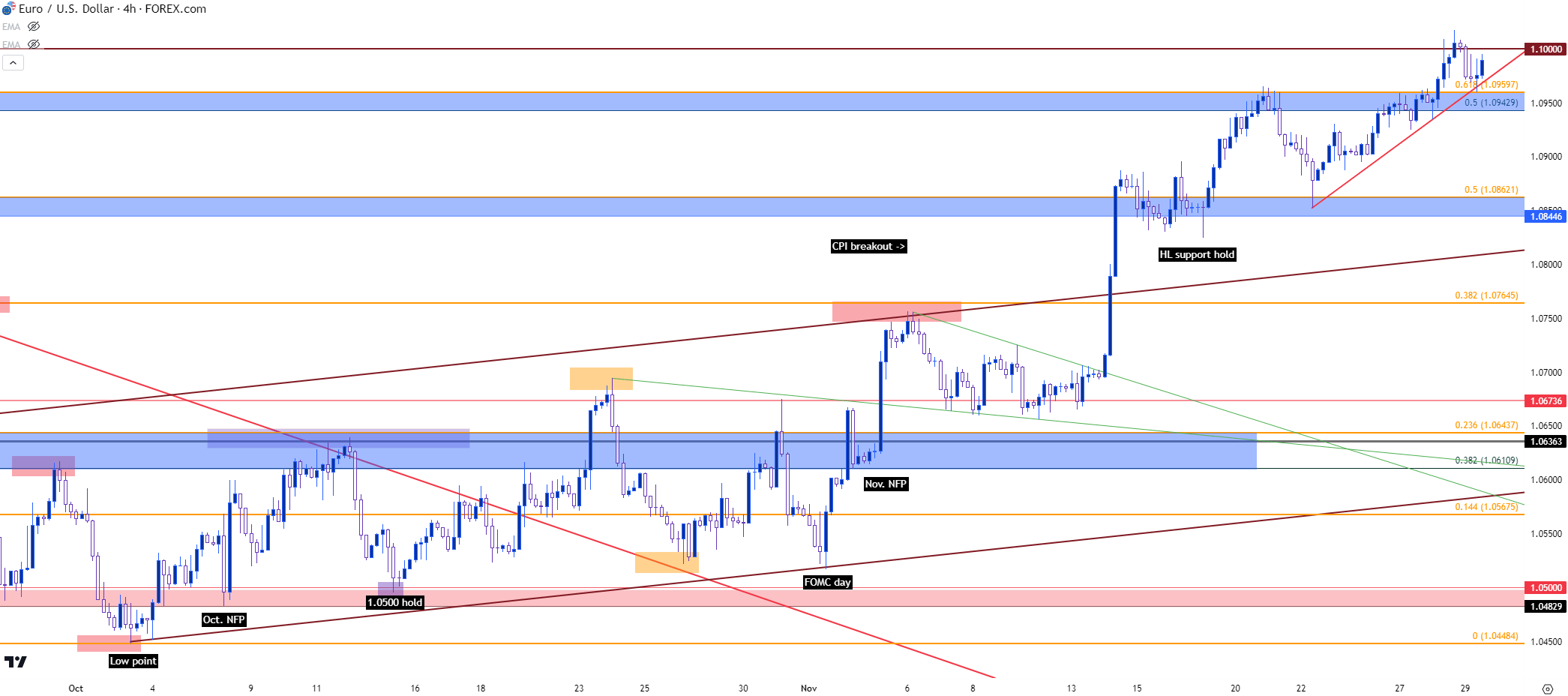

Bullish Continuation v/s Bearish Reversal

I talked about this setup at-length in yesterday’s webinar and it was the first market that I addressed as it has pertinence to the US Dollar, as well. While there is some context that could suggest reversal potential, such as a stall at 1.1000, or overbought RSI on the daily chart, the reality is that price has continued to hold the bullish trend.

As I shared there and which remains the case today, buyers have continued to drive and the higher-low support zone that I looked in that webinar has since come in to hold another swing-low. That support zone runs from 1.0943 up to 1.0960, and it was the very top of the zone that’s so far held the lows. This keeps the door open for another 1.1000 re-test, and if bulls fail to drive at that point, then there could be growing attraction to reversal scenarios.

But, at this point, bullish structure remains in EUR/USD and that hasn’t yet shown that it’s ready to change. What could begin to shift that is question marks on the bullish structure, and the first zone that bears would need to address is the same that was in-play earlier this morning, at 1.0943-1.0960. Below that, the zone that held the lows last week remains of importance, and this plots from 1.0838 up to 1.0862. If bears can evoke a push that area, there would be potential for lower-high resistance to appear at 1.0943-1.0960, which can start to open the door wider for reversal potential.

Given the focus on inflation in the US, tomorrow’s PCE report could certainly be a driver of change.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist