Euro, EUR/USD Talking Points:

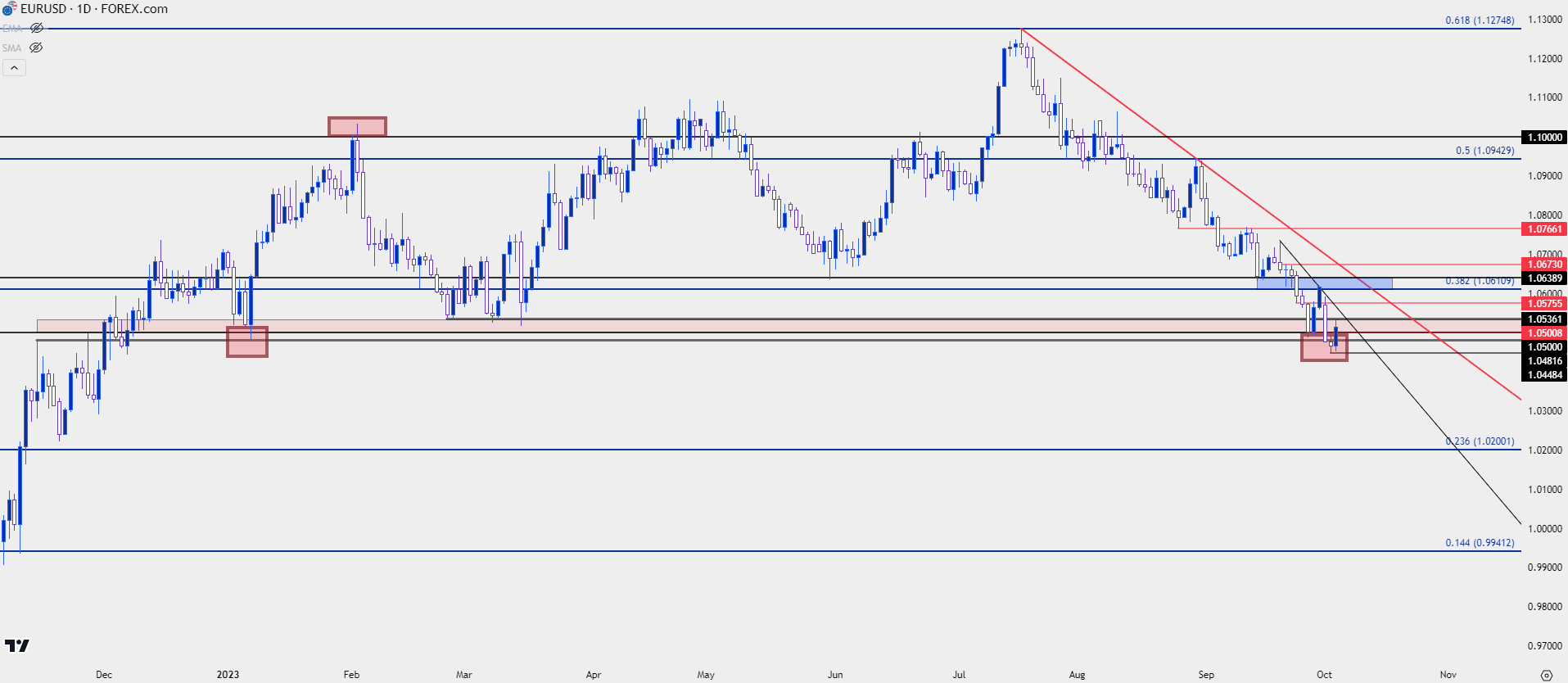

- EUR/USD showed a support test at 1.0500 for one day in the first week of 2023 trade, and until last week, that price had not been back in the picture.

- The bearish plunge in the pair has continued since price topped in July at 1.1275. The downside trend built an oversold RSI reading on the daily chart that appeared last week, and that would be the first such instance since the pair had bottomed last year. Despite that, sellers have went for the 1.0500 test this week, which I had discussed in yesterday’s webinar at-length.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The bearish trend in EUR/USD has moved to a new record after last week’s 11th straight loss. This would be the longest such streak on the weekly chart since the inception of the Euro in 1999, and it illustrates a theme that’s taken over global markets as US yields continue to rise, and on the longer-end of the curve, those gains are rather dramatic as yields have jumped higher in a near-parabolic fashion.

This has had impact across markets. USD strength has remained as a dominant theme in the FX market and gold has folded over, with last week as its largest weekly loss in more than two years. Equities have been on their back foot, as well, and as the yield jump continues more fear builds around he possibility of a larger correction.

That helps to explain the 1.0500 test in EUR/USD this week even with the pair showing its first oversold reading on the daily chart since it had bottomed last year. Along with that fear of rising US interest rates is anxiety over the trajectory of the European economy, and that’s helped to contribute to a consistent run of bearishness over the past couple of months.

But – as I shared in the webinar yesterday the test of a psychological level coming back into the picture could create some stall. The very nature of a psychological level is that prices ‘feel’ cheap below that level and more expensive above. If that test below the level can create the perception of bargain in a market, especially after a steep drop, there could be wherewithal for stall, or perhaps even pullback.

If the move does begin to stall, that could compel shorts to close which, by nature, would entail demand as closing short positions requires buying to cover. And at that point, there’s the possibility of a deeper bounce as the psychological level saw defense or stall, which was then met by an initial countertrend move.

From the daily chart below, we can see that dynamic at play with price testing back above the round number of 1.0500.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Psychological Levels

When I looked at the pair during yesterday’s webinar, price had already begun to display symptoms of stall, but given the fresh print of a low it wasn’t yet clear that the stall could lead to pullback.

I did, however, highlight how psychological levels can help such an item come into play. Many retailers use a similar strategy around human psychology in effort of influencing consumer behavior. With prices ending in increments of ‘0.99,’ the product feels cheaper. A product that costs $99.99 simply feels cheaper than just 2 cents less than $100.01. So, naturally, many retailers will use the $99.99 price as the perception of the product being cheaper could lead to more sales.

Well, this can play out in markets as well, and we had even seen it in EUR/USD on the other side as we came into the new year.

EUR/USD had one single day in which price tested below the 1.0500 handle until last week, and that took place in the first week of the New Year. But, it also cauterized the low, with price making a fast leap up to the 1.1000 handle over the next month.

But similarly, that was the cut point for bulls as that 1.1000 test marked the high in February, with price returning back below 1.0600.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Bigger Picture

From the weekly chart, a couple of important price zones come into the picture. For the next area of potential support, there’s a prior spot of swing support-turned-resistance that plots around the 1.0370 level. If that price comes in quickly, we could be looking at deep oversold conditions on the daily, and perhaps even an RSI nearing or in oversold territory on the weekly chart.

On the topside of price action, a familiar level remains of interest around 1.0611. That’s the 38.2% Fibonacci retracement of the 2021-2022 major move, and the 61.8% marker of that same study is what helped to catch the high in July; and the 50% mark was the spot of some significant grind in August at 1.0943.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

At this point, 1.0611 helped to hold short-term resistance last week after the initial test at 1.0500 – which then led to the breakdown test below the big figure which has since stalled.

If price can put in a bounce from 1.0500, that spot around 1.0611-1.0636 becomes key, and if bulls can budge above that, deeper resistance potential exists at 1.0673, which is a prior swing that becomes confluent with a bearish trendline around tomorrow morning, from the four hour chart. Above that, a key swing exists around 1.0766. If bulls can force that move quickly, there’ll be greater evidence of this bounce turning into a deeper pullback.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist