Euro Talking Points:

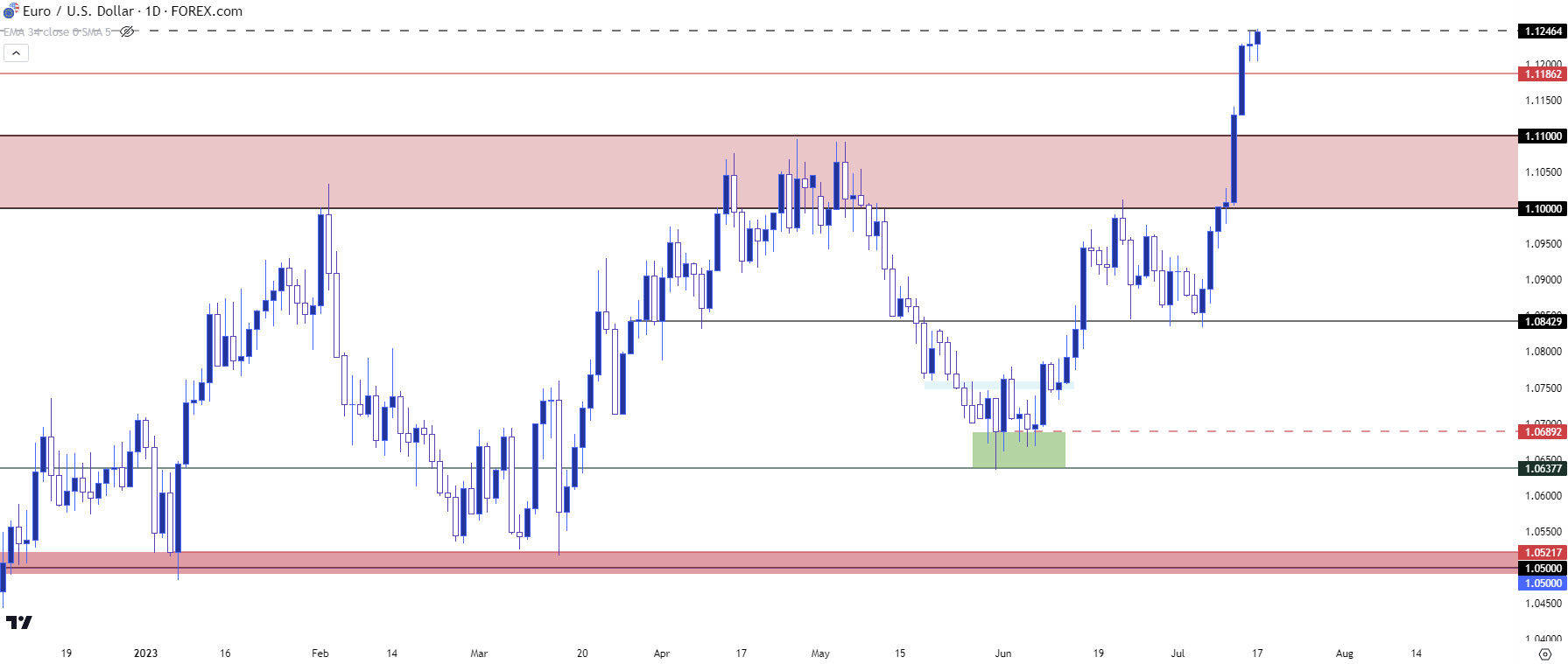

- Last week was the strongest weekly outing for EUR/USD in 2023, and the second strongest since the pair bottomed in September of last year.

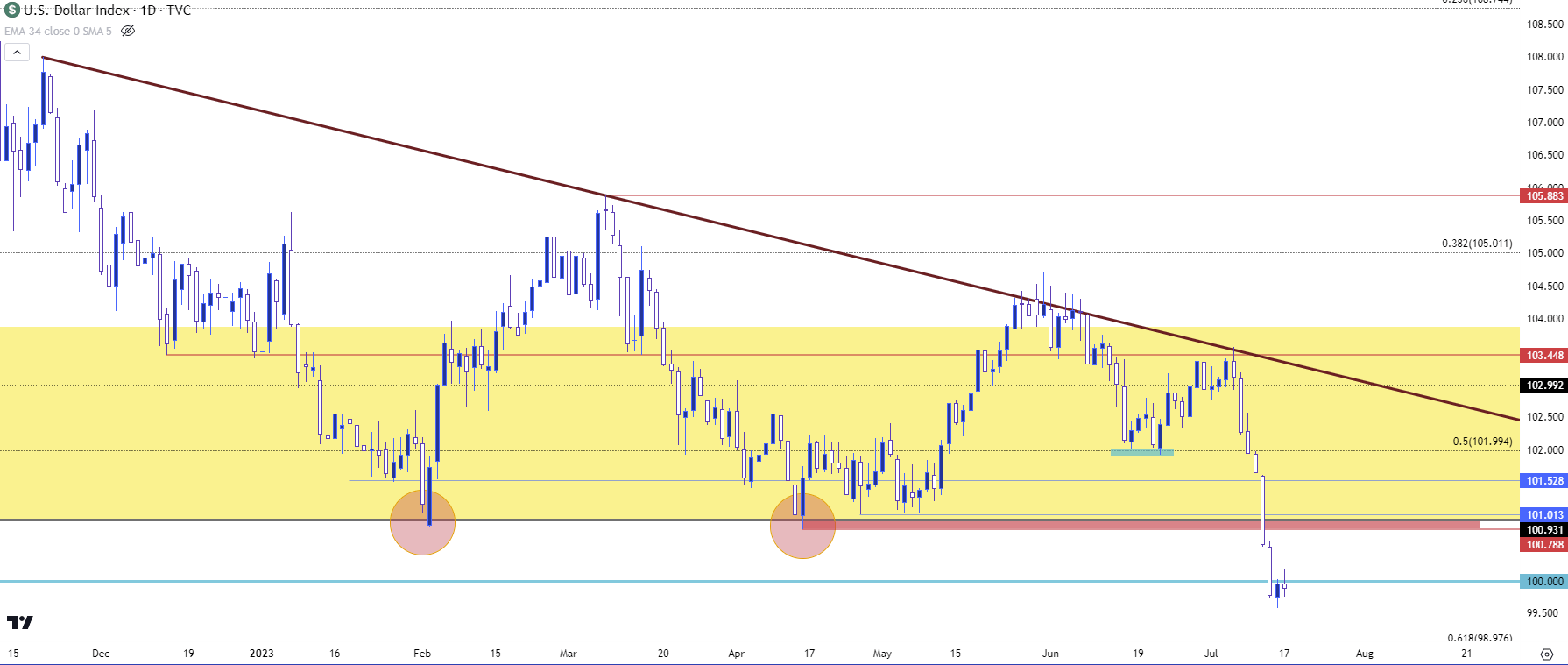

- DXY put in a massive breakdown to go along with that bullish move in EUR/USD so the question of continuation is two-fold: Can Euro bulls continue to push and can USD bears continue to drive?

- This article includes an archived webinar from today. You’re welcome to join these in the future as they’re hosted every Tuesday at 1PM ET. Click here to register.

Last week saw a massive move develop in the FX market as EUR/USD broke above a spot of resistance that had held the highs all year. Alongside that move the US Dollar breached a key spot of support, and this opens the possibility of trends in major FX pairs in the second half of the year after the US Dollar spent much of the past six months in varying forms of consolidation.

The question now in both USD and EUR/USD is whether the trend can continue to push, as all that we have at this point is a breakout that hasn’t yet seen much for tests.

If the breakout in USD and EUR/USD is going to turn into fresh trends, there’s still work to do, and in EUR/USD, that would require an element of higher-low support to show. Given the six-plus months of consolidation that had built ahead of last week’s move, there’s a plethora of higher-low support potential as taken from prior resistance.

At this point, resistance is holding just inside of the 1.1250 psychological level which had come into play last Friday, and that led to a doji on the daily chart. Price so far this week has jumped right back to that resistance, and this keeps the door open for short-term breakouts.

On the support side of the matter, and relevant for longer-term trend approaches, is the 1.1000-1.1100 zone that held the highs in February and again in April. There’s quite a bit going on within that 100-pip space, so it would be difficult to be too perfect about support potential in that area. Before that comes into play, there’s a possible level around 1.1186 which was a prior swing high. If this ends up showing as the higher-low, this would also illustrate quite a bit of optimism from bulls unwilling to allow prices to pullback to the bigger area of prior resistance.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

USD: Breakout Pullback

I had looked into this on Friday after the breakout had hit, but similar to EUR/USD above, the big question is how aggressive traders are going to treat the move after the break from six-plus months of consolidation hit.

In DXY, the currency drove through a massive spot of support in the 100.80-101.00 area, and bears didn’t stop there as prices continued to drop through the 100 psychological level. That price came back on Friday as bulls forced a pullback, and it remains in-play today as sellers have returned to moderate that pullback move.

The big question from here is balance of power after the break. Are there enough bears on the sidelines that can come in to drive the currency to fresh lows? Or is there more room for bears to take profit which can allow for a deeper pullback, with focus on that prior spot of support for follow-through resistance.

Given that the Euro is 57.6% of the DXY quote, this could come along with a pullback theme similar to what was looked at above in EUR/USD with the pair peeling back for a re-test of the 1.1000-1.1100 zone of prior resistance.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist