Euro Outlook: EUR/USD

EUR/USD extends the advance from the June low (1.0666) following the first round of elections in France, but the exchange rate may track the flattening slope in the 50-Day SMA (1.0777) as it struggles to trade back above the moving average.

Euro Forecast: EUR/USD Vulnerable to Slowing Euro Area Inflation

It remains to be seen if the second-round of French elections on July 7 will influence EUR/USD as the European Central Bank (ECB) starts to alter the path for monetary policy, and the Governing Council may continue to unwind its restrictive policy after delivering a 25bp rate-cut in June.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Until then, developments coming out of the Euro-Area may sway EUR/USD as the ECB promotes a data-dependent approach in managing monetary policy, and the Consumer Price Index (CPI) may put pressure on the Governing Council to implement lower interest rates as the update is anticipated to show easing inflation.

Euro Economic Calendar

Both the headline and core Euro-Area CPI are expected to narrow in June, and evidence of slowing price growth may drag on EUR/USD as it fuels speculation for another ECB rate-cut at the next meeting on July 18.

However, a higher-than-expected CPI print may push the Governing Council to the sidelines as President Christine Lagarde and Co. endorse a ‘meeting-by-meeting approach,’ and signs of persistent inflation may keep EUR/USD afloat as it limits the scope for back-to-back ECB rate-cuts.

With that said, the failed attempt to test the May low (1.0650) may lead to a larger recovery in EUR/USD as it breaks out of the range bound price action from last week, but the exchange rate may track the flattening slope in the 50-Day SMA (1.0777) as it struggles to trade back above the moving average.

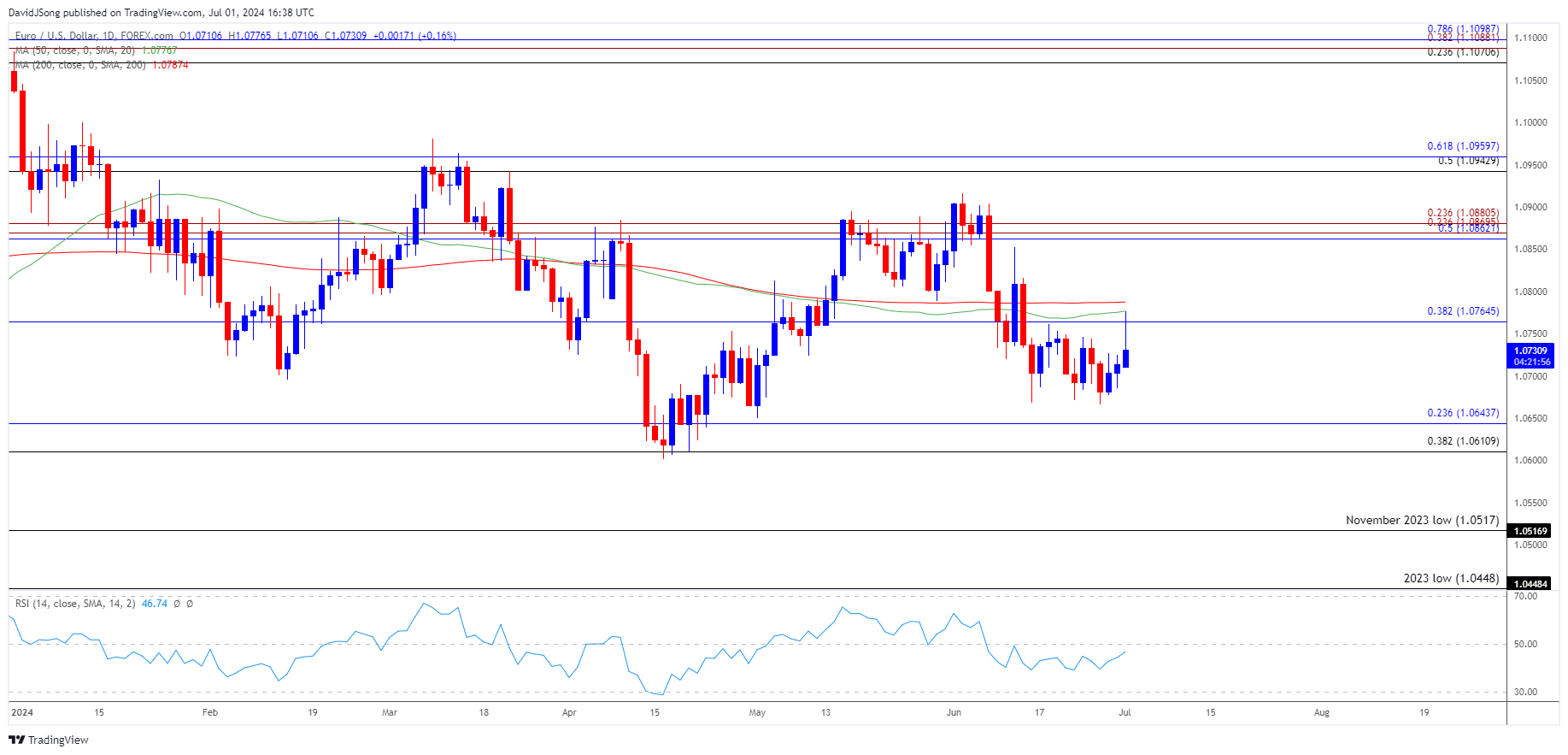

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD bounced back ahead of the May low (1.0650) to stage a three-day rally with a close above 1.0770 (38.2% Fibonacci retracement) bringing the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region on the radar.

- Next area of interest comes in around the June high (1.0916) but EUR/USD may track the flattening slope in the 50-Day SMA (1.0777) as it struggles to push back above the moving average.

- Failure to defend the June low (1.0666) may lead to another run at the May low (1.0650), with the next area of interest coming in around 1.0610 (38.2% Fibonacci retracement) to 1.0640 (1.0640 (23.6% Fibonacci retracement).

Additional Market Outlooks

USD/JPY Forecast: RSI Holds in Overbought Territory

US Dollar Forecast: GBP/USD Falls to Fresh Monthly Low Ahead of US PCE

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong