Euro Outlook: EUR/USD

EUR/USD may attempt to retrace the decline from the start of the week as it preserves the advance following the Kansas City Fed Economic Symposium in Jackson Hole, Wyoming, but data prints coming out of the Euro Area may sway the exchange rate as the Consumer Price Index (CPI) is anticipated to show slowing inflation.

Euro Forecast: EUR/USD Preserves Advance Following Fed Symposium

EUR/USD may establish a bullish trend as the 50-Day SMA (1.0888) starts to reflect a positive slope, and the exchange rate may continue to retrace the decline from the 2023 high (1.1276) as the Relative Strength Index (RSI) clings to overbought territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

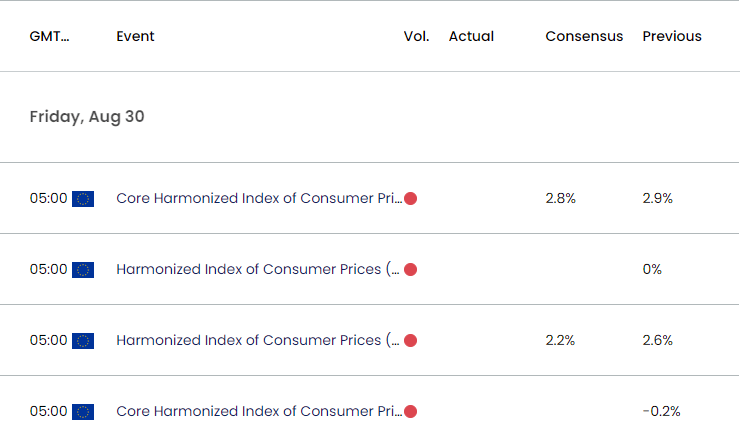

Euro Area Economic Calendar

However, a downtick in both the headline and core Euro Area CPI may drag on EUR/USD as it encourages the European Central Bank (ECB) to further unwind its restrictive policy, and the Governing Council may support the monetary union over the remainder of the year as ‘the risks to economic growth are tilted to the downside.’

At the same time, a higher-than-expected Euro Area CPI report may keep the ECB on the sidelines as President Christine Lagarde and Co. insist that ‘our interest rate decisions will be based on our assessment of the inflation outlook.’

With that said, EUR/USD may further retrace the decline from the 2023 high (1.1276) ahead of the next ECB meeting on September 12, but the exchange rate may face a near-term pullback if it struggles to defend the weekly low (1.1150).

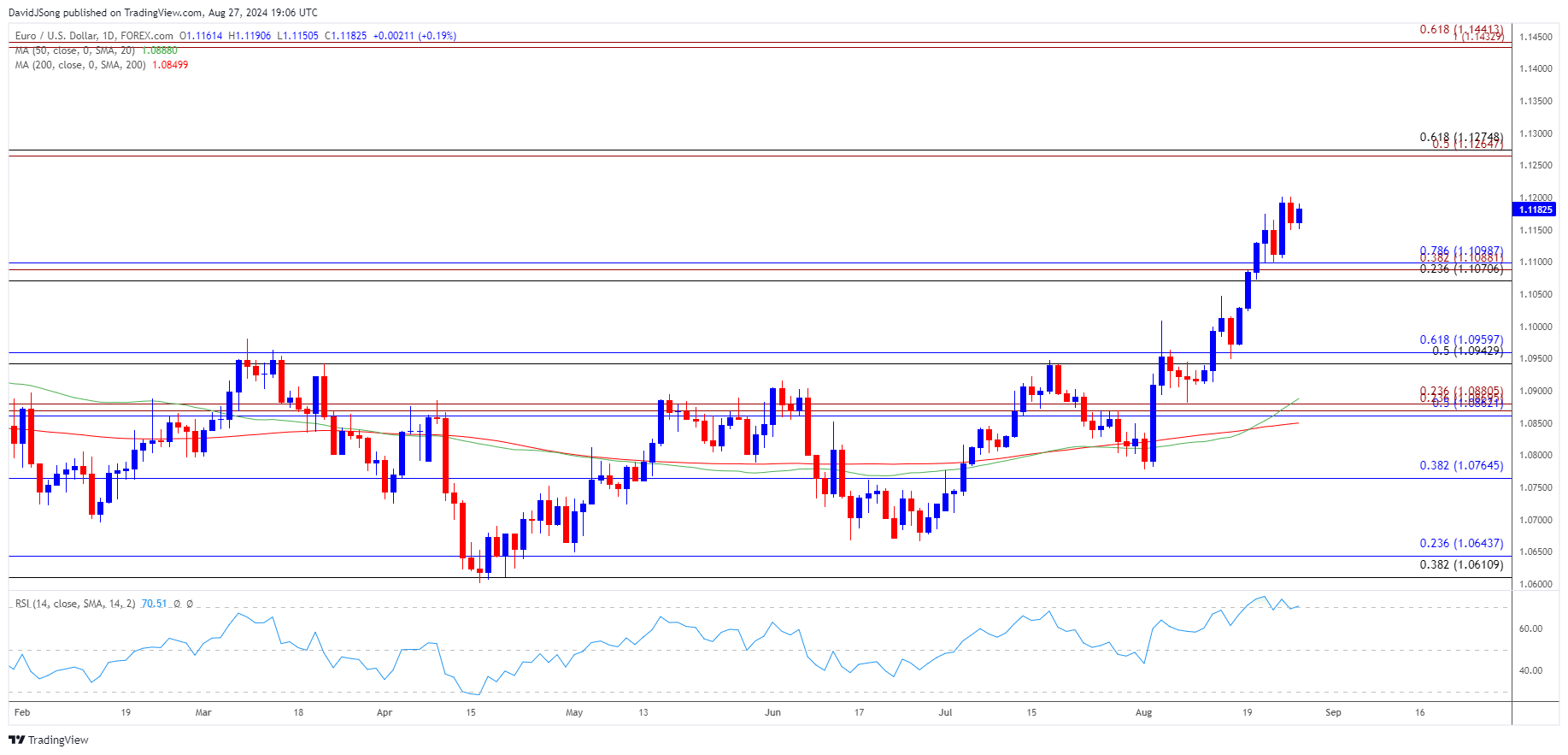

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may attempt to retrace the decline from the monthly high (1.1202) as the Relative Strength Index (RSI) holds above 70, with a further advance in the exchange rate opening up the 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region, which incorporates the 2023 high (1.1276).

- Next area of interest comes in around 1.1430 (100% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) but failure to hold above the weekly low (1.1150) may pull the RSI back from overbought territory.

- A break/close below 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone may push EUR/USD back towards the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region, with the next area of interest coming in around the monthly low (1.0778).

Additional Market Outlooks

British Pound Forecast: GBP/USD Rally Eyes 2023 High

Gold Price Forecast: XAU/USD Pullback Keeps RSI Below 70

AUD/USD Rally Pushes RSI Towards Overbought Territory

US Dollar Forecast: USD/JPY Rebound Unravels Ahead of Fed Symposium

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong