Euro Outlook: EUR/USD

The opening range for September is in focus for EUR/USD as it climbs to a fresh weekly high (1.1095).

Euro Forecast: EUR/USD Opening Range for September in Focus

Keep in mind, EUR/USD reversed ahead of the 2023 high (1.1276) to pull the Relative Strength Index (RSI) back from overbought territory, and the recent weakness in the exchange rate may persist as the bullish momentum abates.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Nevertheless, the Euro may continue to outperform its US counterpart in 2024 as EUR/USD registered a fresh yearly high (1.1202) during the previous month, and the exchange rate may stage further attempts to test the 2023 high (1.1276) should it track the positive slope in the 50-Day SMA (1.0931).

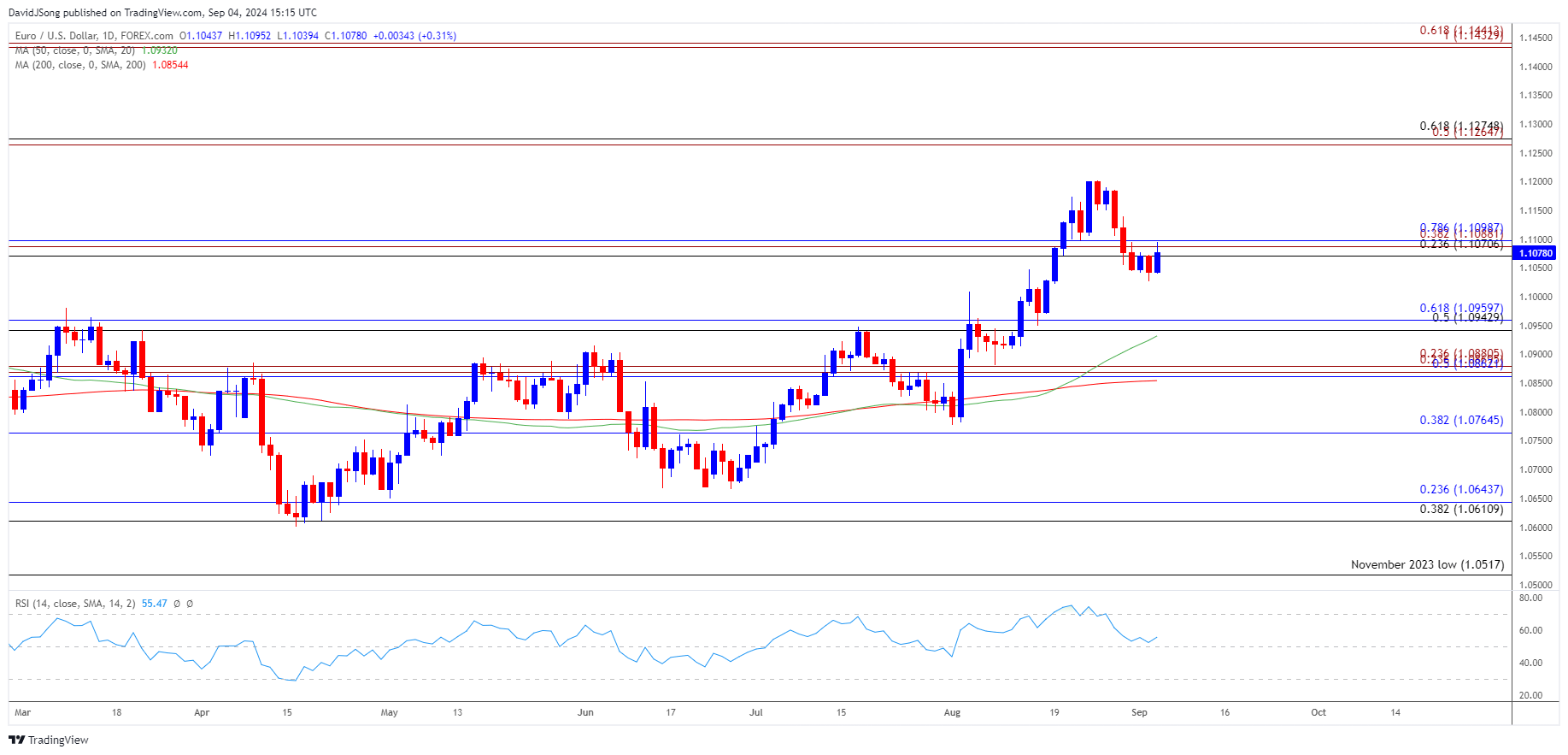

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD attempts to trade back above the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) region as it snaps the series of lower highs and lows carried over from last week.

- A breach above the August high (1.1202) bringing the 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) area back on the radar, which incorporates the 2023 high (1.1276).

- Next hurdle comes in around 1.1430 (100% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) but lack of momentum to close above the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) region back towards the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone.

Additional Market Outlooks

AUD/USD Under Pressure Ahead of Australia GDP Report

US Dollar Forecast: USD/JPY Rally Persists After Defending Weekly Low

Canadian Dollar Forecast: USD/CAD Rebound Emerges Ahead of March Low

GBP/USD Pullback Brings RSI Back from Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong