Euro Outlook: EUR/USD

EUR/USD may attempt to test the June high (1.0916) ahead of the European Central Bank (ECB) interest rate decision as it extends the advance following the slowdown in the US Consumer Price Index (CPI).

Euro Forecast: EUR/USD Eyes June High Ahead of ECB Rate Decision

EUR/USD seems to be unfazed by the rise in the US Producer Price Index (PPI) as it climbs to a fresh monthly high (1.0909), and it remains to be seen if the Federal Reserve will switch gears later this year as the core PPI climbs to 3.0% in June from 2.6% per annum the month prior.

The rise in in factory-gate prices may push the Federal Open Market Committee (FOMC) to further combat inflation as Chairman Jerome Powell endorses data-dependent approach in front of US lawmakers, but Fed officials may continue to adjust the forward guidance for monetary policy as the central bank ‘projects that the appropriate level of the federal funds rate will be 5.1 percent at the end of this year.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, speculation for a looming Fed rate-cut may keep EUR/USD afloat ahead of the next interest rate decision on July 31, and the exchange rate may continue to carve a series of higher highs and lows going into the ECB meeting as the Governing Council is expected to retain the current policy.

Euro Economic Calendar

The ECB is expected to keep Euro Area interest rates on hold after implementing a 25bp rate-cut at the June meeting, and the meeting may fuel the recent advance in EUR/USD should the central bank promote at a meeting-by-meeting approach in managing monetary policy.

However, President Christine Lagarde and Co. may prepare households and businesses for a more accommodative stance as Euro Area inflation is ‘expected to decline towards our target over the second half of next year,’ and hints of a further change in regime may drag on EUR/USD as it raises the scope for another ECB rate-cut in 2024.

With that said, EUR/USD may struggle to retain the advance from earlier this month if it fails to test the June high (1.0916), but the exchange rate may stage a further advance ahead of the ECB meeting as it carves a series of higher highs and lows.

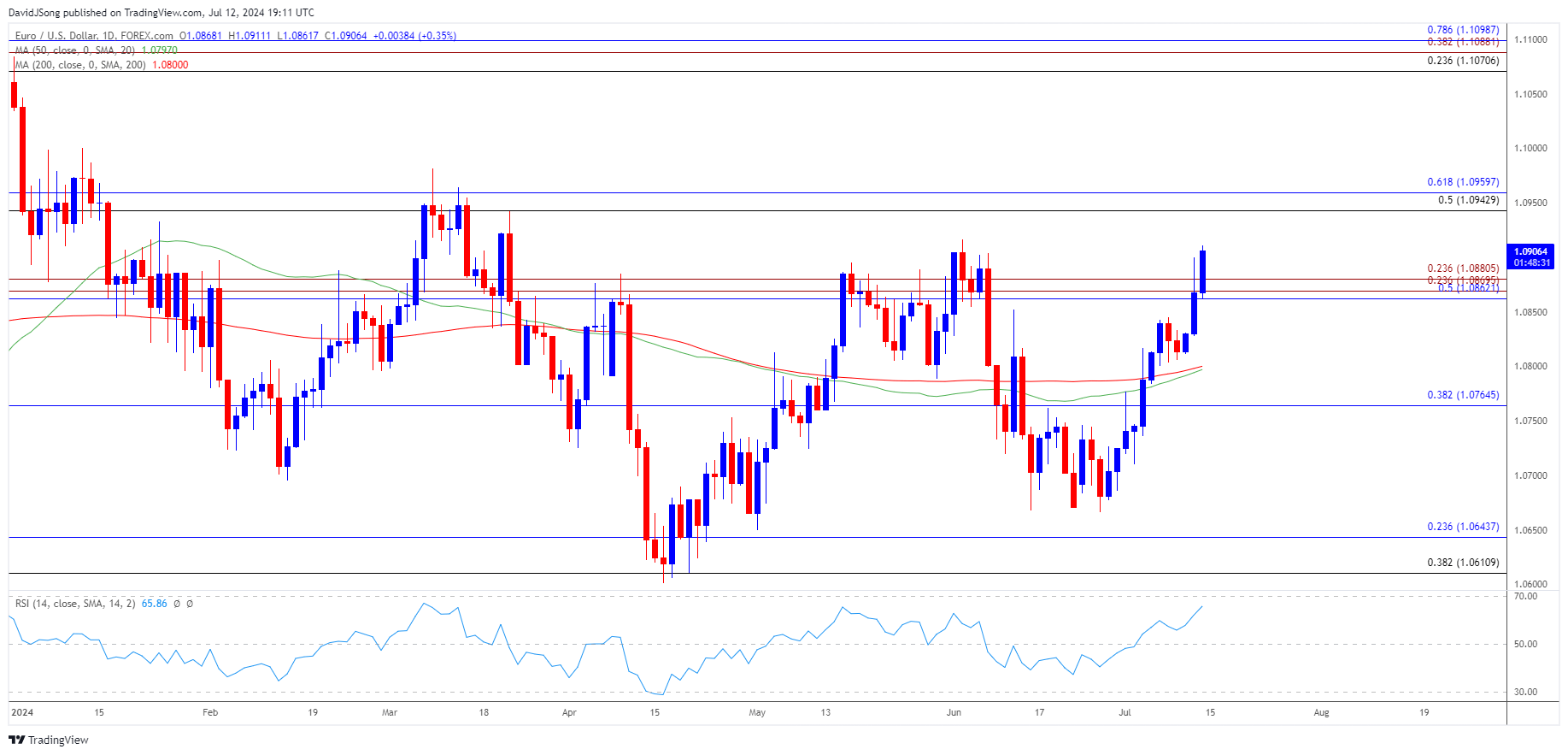

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD approaches the June high (1.0916) as it stages a three-day rally, with a breach above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) region bringing the March high (1.0981) on the radar.

- A further advance in EUR/USD may continue to push the Relative Strength Index (RSI) towards overbought territory, with the next area of interest comes in around the January high (1.1046).

- However, the recent series of higher highs and lows in EUR/USD may unravel if it struggles to hold above the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region, with a move below 1.0770 (38.2% Fibonacci retracement) opening up the monthly low (1.0710).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Rally Pushes RSI Towards Overbought Zone

USD/JPY Forecast: RSI Approaches Overbought Territory Again

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong