Euro Outlook: EUR/USD

EUR/USD appears to be bouncing back ahead of the 50-Day SMA (1.0626) as it snaps the series of lower highs and lows from earlier this week, and the exchange rate may attempt to test the monthly high (1.0756) as it no longer responds to the negative slope in the moving average.

Euro Forecast: EUR/USD Bounces Ahead of 50-Day SMA to Eye Monthly High

EUR/USD extends the rebound from the weekly low (1.0659) to retain the advance following the softer-than-expected US Non-Farm Payrolls (NFP) report, and the exchange rate may attempt to further retrace the decline from the September high (1.0882) amid speculation of seeing US interest rates unchanged over the remainder of the year.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

CME FedWatch Tool

Source: CME

According to the CME FedWatch Tool, Fed Funds futures reflect a 90% probability the Federal Open Market Committee (FOMC) will retain the current policy as it last meeting for 2023, and it remains to be seen if Chairman Jerome Powell and Co. will adjust the forward guidance for monetary policy as the central bank is slated to update the Summary of Economic Projections (SEP).

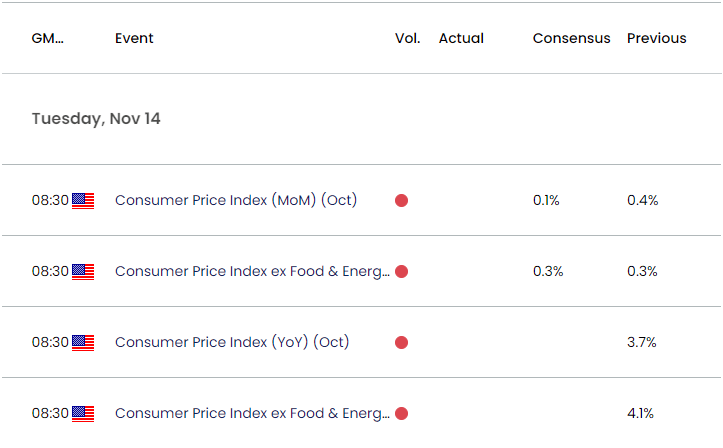

US Economic Calendar

Until then, data prints coming out of the US may sway foreign exchange markets as the Fed pledges to ‘make our decisions meeting by meeting,’ and the update to the Consumer Price Index (CPI) may force the FOMC embark on a more restrictive policy should the report reveal sticky inflation.

Although the headline CPI is expected to increase 0.1% in October, the core reading is projected to increase 0.3% for the third consecutive month, and evidence of persistent price growth may generate a bullish reaction in the Greenback as it fuels speculation for higher US interest rates.

However, a softer-than-expected CPI report may produce headwinds for the US Dollar as it encourages the Federal Open Market Committee (FOMC) to retain the current policy, and EUR/USD may push back towards the monthly high (1.0756) as it clears the series of lower highs and lows from earlier this week.

With that said, EUR/USD may extend the advance from the start of the month as it bounces back ahead of the 50-Day SMA (1.0626), and the exchange rate may attempt to further retrace the decline from the September high (1.0882) as it no longer responds to the negative slope in the moving average.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD appears to be bouncing back ahead of the 50-Day SMA (1.0626) as it extends the rebound from the weekly low (1.0659), and the exchange rate may test the monthly high (1.0756) as it clears the series of lower highs and lows from earlier this week.

- EUR/USD may attempt to further retrace the decline from the September high (1.0882) as it no longer responds to the negative slope in the moving average, but need a break/close above 1.0790 (61.8% Fibonacci retracement) to open up the above the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region.

- Nevertheless, the advance from the start of November may unravel if EUR/USD fails to clear the monthly high (1.0756), with a break/close below the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) area bringing the monthly low (1.0517) on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Vulnerable if Monthly Low Breaks

AUD/USD Susceptible to Test of Monthly Low on Post-RBA Weakness

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong