Euro Talking Points:

- EUR/USD remained in the 17-month range this week, with the weekly bar currently showing as a doji. Elsewhere, Euro-strength remained in EUR/JPY while Euro-weakness set a fresh 21-month low in EUR/GBP.

- The European Central Bank rate decision takes place next Thursday and the wide expectation is that the ECB will begin to cut. But that’s likely priced-in to a large degree, so the bigger question is what might be around the next corner and whether the ECB highlights another near-term rate reduction.

- I’ll be discussing these themes in-depth in the weekly webinar. It’s free for all to register: Click here to register.

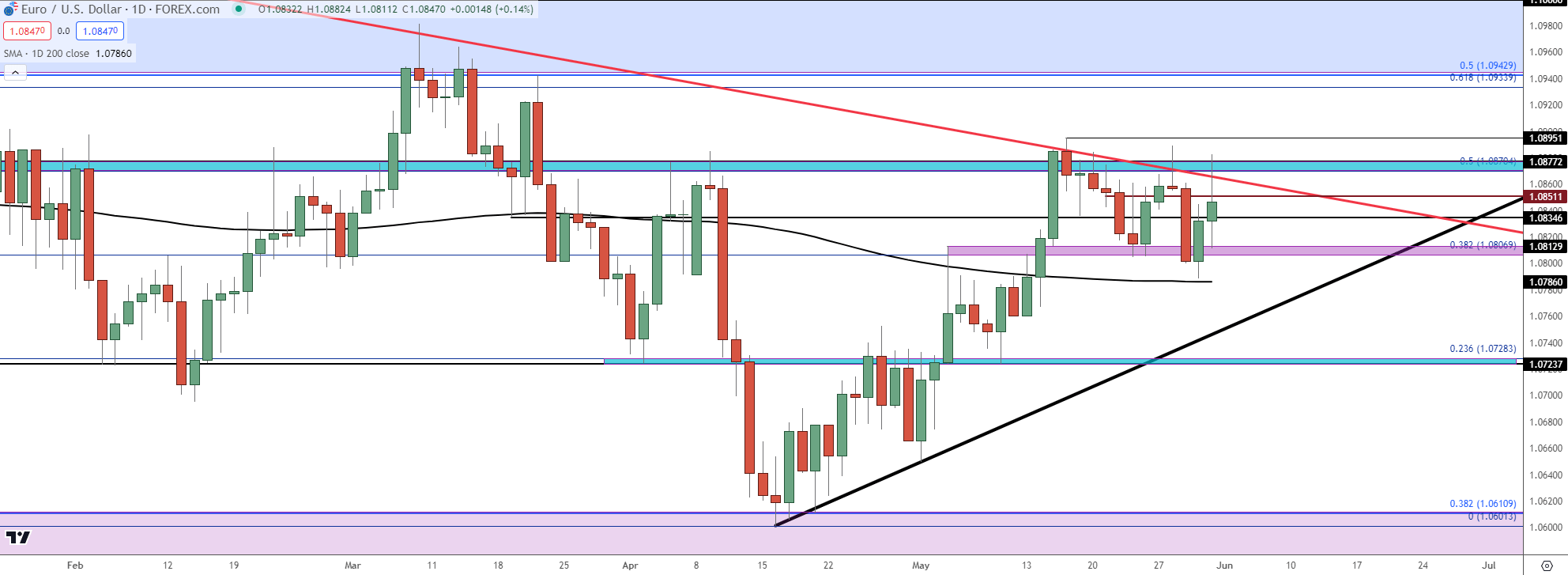

It was an indecisive week in EUR/USD as the pair remains near the middle of the 17-month-old range. There’s a bearish trendline that’s been in-play for the past three weeks and it helped to hold the high again this week, with an assist from the 1.0870-1.0877 resistance zone.

While the Fed does not appear to be near any rate cuts the same can’t be said for the ECB, who is widely-expected to begin a rate cutting campaign next week. But perhaps one of the smartest things the bank has done was doing away with forward guidance, so what happens after a rate cut still very much remains up in the air. And likely, this is one of the reasons that the currency has been able to hold strength against the US Dollar since the support test in mid-April, even as US data has remained stronger on a relative basis.

From the weekly chart, we can see the range on full display along with that bearish trendline that’s so far helped to hold the highs.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

The daily chart from the past week looks jagged, but there is a sequence of lower-lows and lower-highs in here and that remains of interest as we move into next week.

Sellers seemed to have an open door to push down to a fresh low after a strong response to resistance on Tuesday and Wednesday; but bulls showed up ahead of a re-test at the 200-day moving average on Thursday. The Core PCE release on Friday morning gave bulls another excuse to test the highs but, again, that led to a lower-high as buyers were unable to extend a breakout.

This begins to open the door a bit wider to sellers ahead of next week’s ECB rate decision.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/JPY

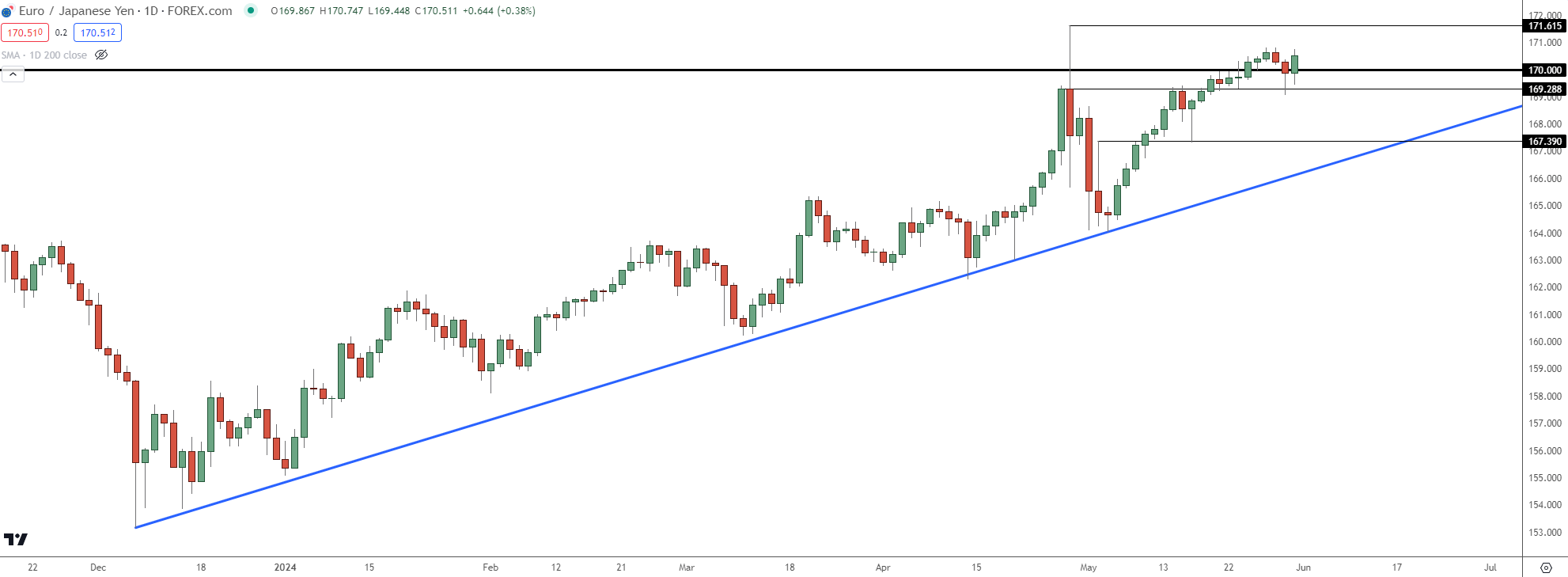

For those that are looking for Euro-strength, EUR/JPY may offer a more attractive backdrop. While the Euro could see weakness on the back of rate cut potential after next week, the Japanese Yen has remained as very weak against several major currencies, the Euro included.

The BoJ intervention that took place in late-April prodded a pullback that lasted into early-May. But, at this point, buyers have responded to that aggressively and the monthly chart below paints a bullish picture.

EUR/JPY Monthly Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

The daily chart of EUR/JPY below has a similar bullish appeal as prices has re-engaged with the 170.00 psychological level. There was a pullback that developed last week but bulls didn’t let the low get very far below prior resistance at 169.29.

And with the bounce from that already pushing above the 170.00 figure, there’s now the potential for lower-high resistance to show around the psychological level in the event of pullback in the early-portion of next week. And if the ECB holds the line regarding future rate discussions even while cutting rates next week, there could even possibly be a bullish fundamental case for the Euro in the pair.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

Chart prepared by James Stanley, EUR/JPY on Tradingview

EUR/GBP

EUR/GBP technically set a fresh 21-month low last week. There may not have been many headlines about it as there was very little selling pressure below the .8500 psychological level that’s been support for a year now; but if we do see the Euro break down on dovish talk from the ECB, there could be deviation with GBP-trends and that could possibly offer breakout potential.

EUR/GBP isn’t normally a pair tracked for breakouts, however. As a case in point, much of this year’s price action has been confined in an approximate 120 pip range. But, where this one can become more interesting is if an initial breakout move could lead into a fresh bearish trend, and that .8500 level sticks out as a spot of interest for such.

There’s a descending triangle on the below weekly chart, which is often approached with aim of bearish breakdown potential. And given GBP-strength over the past few weeks, that could be opening the door for such a situation, but there will need to be the prod of Euro-weakness to bring this to fruition and given that next week’s rate cut is likely priced-in to a large degree, any such breakdown will probably need to be pushed by forward-looking rate expectations.

EUR/GBP Weekly Price Chart

Chart prepared by James Stanley, EUR/GBP on Tradingview

Chart prepared by James Stanley, EUR/GBP on Tradingview

--- written by James Stanley, Senior Strategist