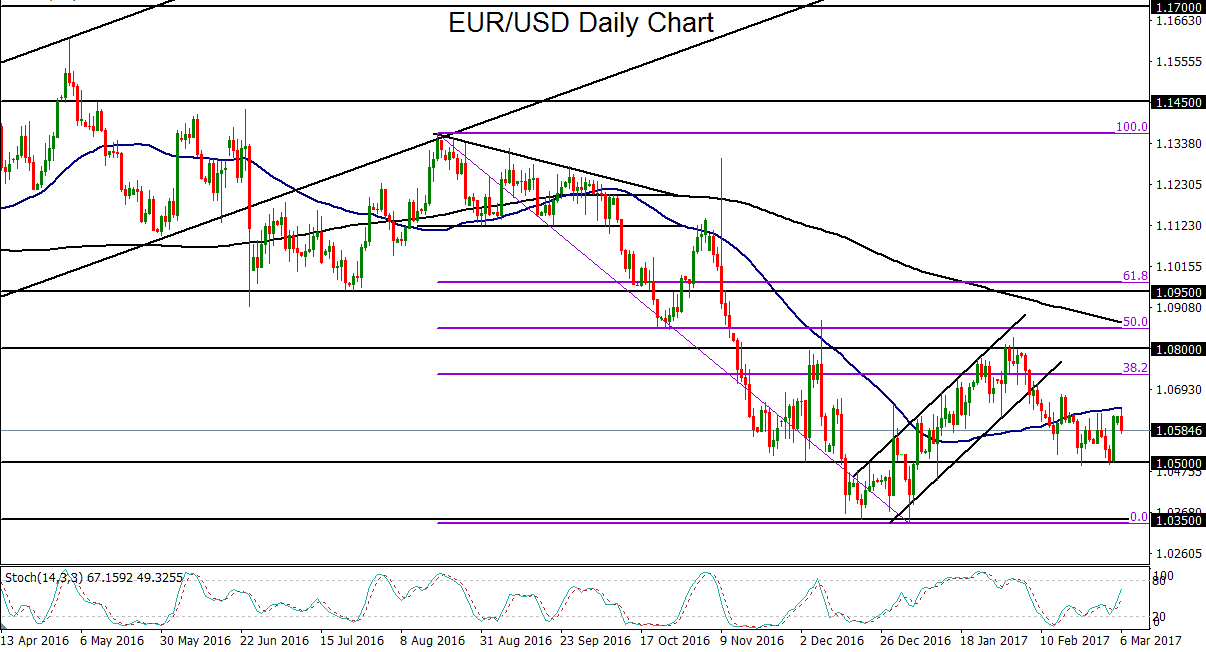

- EUR/USD pulled back on Monday after having rebounded sharply above the key 1.0500 support level last week.

- The past month has seen EUR/USD consolidate in a trading range above the 1.0500 level as shifting expectations of near-future monetary policy from both the US Federal Reserve and European Central Bank (ECB) have alternately pushed and pulled the currency pair.

- The ECB issues its monetary policy decision and holds a press conference this Thursday. On Friday, the potentially pivotal US jobs report will be released, which should have a critical influence on next week’s interest rate decision from the Fed.

- Eurozone inflation has been on the rise since December, with the latest Consumer Price Index estimate last week showing a higher-than-expected 2% rise in February following January’s 1.8% increase. While this data alone is not expected to prompt the ECB this week to change the direction of its substantial quantitative easing program, the prospect of further inflationary pressures going forward could potentially result in an earlier tapering of QE stimulus than planned. If this occurs, the euro could get a boost from its recent lows.

- At the same time, however, the Fed has repeatedly signaled the likelihood of a March rate hike next week. The overall hawkishness from Fed officials, including Fed Chair Janet Yellen, within the past two weeks has been loud and clear. These hawkish signals have pushed the Fed Fund futures market’s probability assessment up to a current 86% likelihood of a March hike, up from around 20% only two weeks ago.

- The US jobs report, which includes the vital non-farm payrolls and hourly wage data, will have a critical impact on next week’s Fed decision. This time, however, there is likely a relatively low bar for the report, as Janet Yellen has noted that even a number as low as 75,000-125,000 could be enough to constitute steady employment growth. Current consensus expectations for non-farm payrolls in February is around 185,000 jobs added.

- In the short-term, with the Fed increasingly likely to raise rates next week and the ECB unlikely to make any major changes on Thursday to its policy outlook, the directional bias for EUR/USD remains bearish.

- The downside level to watch continues to be the key 1.0500 support level. With any major breakdown below 1.0500 amid the ECB decision, the US jobs report, and next week’s Fed announcement, the short-term downside target remains around 1.0350, which is the area of the December-January lows.

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM

Yesterday 07:48 PM