Following last week’s 1% drop, the EUR/USD has been a little more stable so far this week. The stabilisation of French bonds and the resulting narrowing of the German-French yields suggest investors are a little calmer about the EU’s political situation. This may only be a temporary respite. A lot will depend on the outcome of the general election, starting on June 30. It will be in two rounds, with the second one to be held on July 7. I don’t imagine we will see a significant rally in the EUR/USD at least until after the election. Any gains that may be witnessed beforehand will likely come as a result of a potential drop in the dollar. The EUR/USD outlook thus primarily hinge on the outcome of the French election. Today’s focus is on the upcoming release of US retail sales.

EUR/USD outlook: US retail sales coming up

The US dollar has been little-changed so far this week, after starting the week moderately lower on Monday following a two-week rally and turning slightly higher today against a basket of foreign currency. The highlight of the day is the May US retail sales data.

The consensus is generally positive, with surveyed economists anticipating a 0.3% month-on-month increase in the headline retail sales figure and a 0.4% m/m rise in the core (ex-auto and gas) measure.

Additionally, several Federal Reserve officials, including Thomas Barkin, Alberto Musalem and Adriana Kugler, are scheduled to discuss monetary policy in their upcoming speeches.

If US retail sales come in stronger, then the EUR/USD could potentially drop below the 1.07 handle again. A weaker print should benefit other pairs more than the EUR/USD.

EUR/USD outlook: French election uncertainty to hold the euro back

As mentioned, the stabilisation of French bonds suggests that investors are somewhat less concerned about the EU’s political situation this week compared to last. Still, the 10-year OAT-Bund spread is still about 30 basis points wider than before the snap election announcement in France.

Should investors scale back political risk premium, there would likely be a substantial room for rebound in the EUR/USD. However, this is unlikely to happen before the 30 June first round parliamentary vote in France. This implies that the euro should remain a laggard in any USD-negative dynamics. Investors anticipating a weaker US dollar should concentrate on another pair, in other words.

Economic data to play second fiddle to political risks

On the data front, the June ZEW survey showed institutional investors grew more optimistic over the 6-month economic outlook for Germany and Eurozone.

Economic sentiment towards the German economy improved below forecasts to 47.5 from 47.1, while for eurozone it jumped to 51.3 from 47.0, beating expectations. The more significant data release will be Friday’s publication of PMIs.

That said, investors are not paying too much attention to data right now, as the focus remains firmly fixated on the political situation.

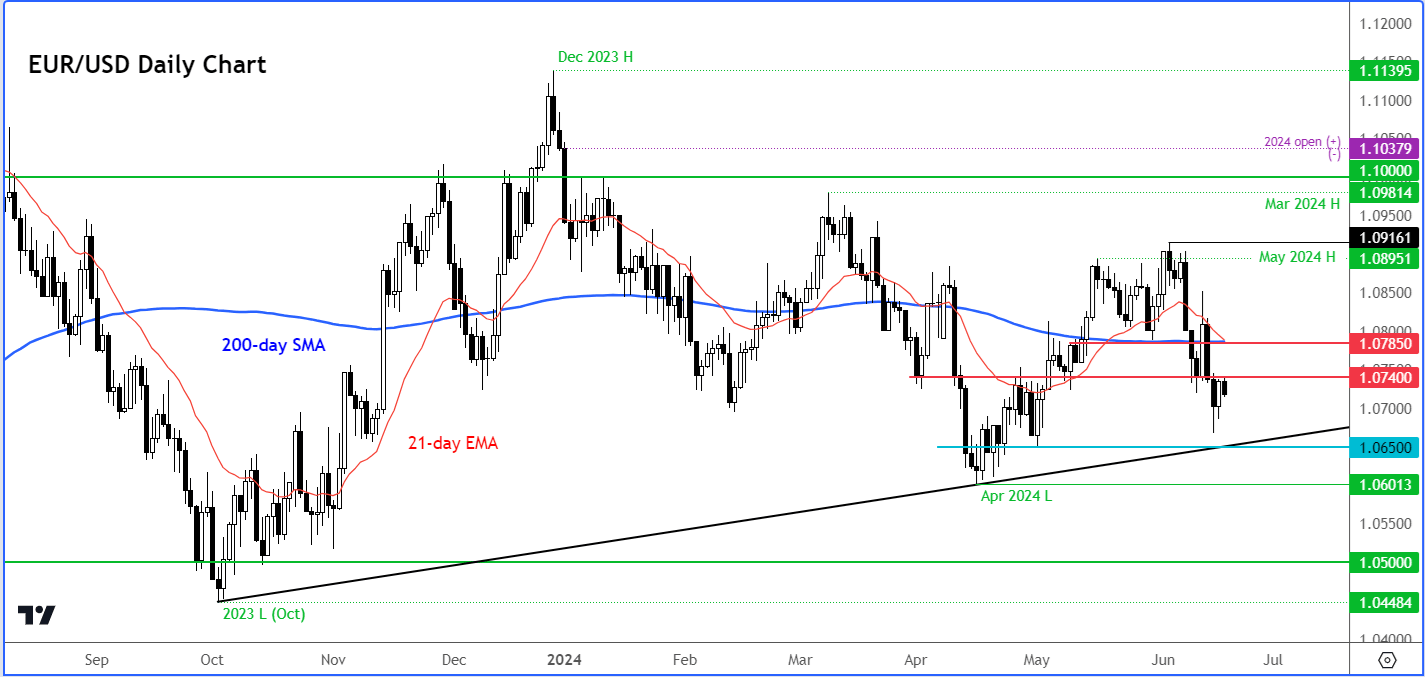

EUR/USD outlook: technical analysis and levels to watch

Source: TradingView.com

The EUR/USD remains largely directionless, as it continues to trade inside its existing ranges from earlier this year. So far, the political fallout in the EU hasn’t caused a major breakdown in the exchange rage, even if the single currency has fallen across the board in recent days. Still, the short-term bias remains slightly tilted to the downside, with rates having broken below a few short-term support levels, including more recently the 200-day average around 1.0785.

On Friday, it broke below the next short-term level around 1.0740, which has since turned into a bit of resistance at the start of this week. The next level of potential support is seen around the 1.0650 area, where the bullish trend line stretching back to October, comes into play.

On the upside, those broken support levels at 1.0740 and 1.0785 are the immediate resistance levels to watch, ahead of a more significant hurdle near 1.0950 area.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R