US Dollar Talking Points:

- The US Dollar remains in a state of consolidation similar to what’s shown for most of 2023 trade so far, and a similar statement can be made regarding EUR/USD. But, given dynamics from last week there may be a push point that can break the impasse, at some point.

- For bearish USD scenarios, GBP/USD can remain compelling as the pair has held higher-low support after setting a fresh yearly high a couple of weeks ago. And on the bullish side of the US Dollar, USD/JPY could remain of interest for now as the pair is continuing the bullish breakout that’s been running since the last BoJ rate decision.

- This is an archived webinar that’s hosted every Tuesday at 1PM ET. If you’d like to join, you can register with the following link: Click here to register.

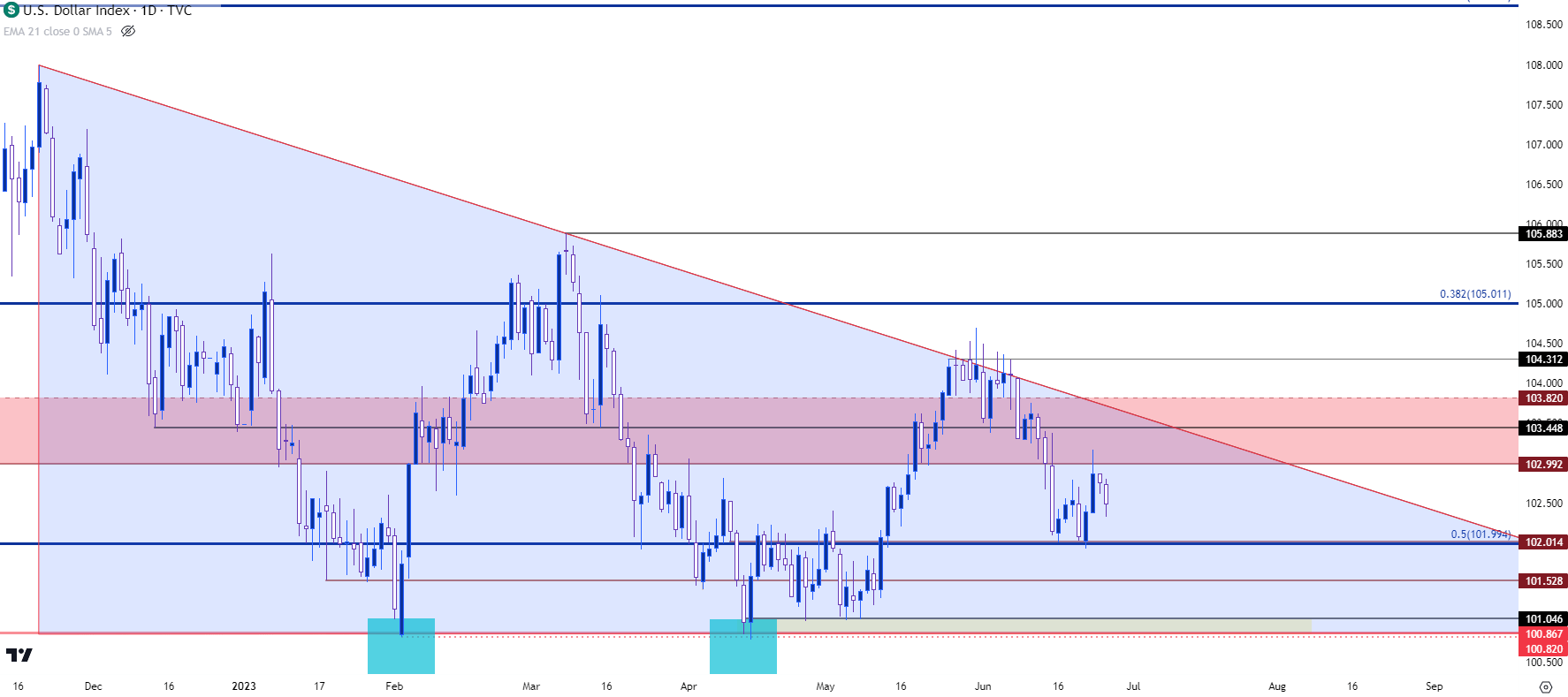

The US Dollar remains in consolidation, although last week may have provided some clues of interest after the pair found support at the 102 handle again, which led to a quick push up to the 103 level, which held as resistance. Price has been pulling back since that 103 test on Friday and the big question here is whether buyers show up to hold support above the prior low around the 102 handle, or whether price sinks down towards the 101 level which was previously the swing-low in late-April and early-May.

The 102 level was in-play the week before last, and the driver from last week that pushed price back into that support seemed to show after Chair Powell’s first day of testimony at the semi-annual Humphrey Hawkins event in front of Congress.

Interestingly, it was EUR/USD tagging the 1.1000 level and a disappointing set of PMI reports out of Europe on Friday morning that seemed to be the main bullish driver for the USD, helping to provoke that bullish push back-up to the 103 handle.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

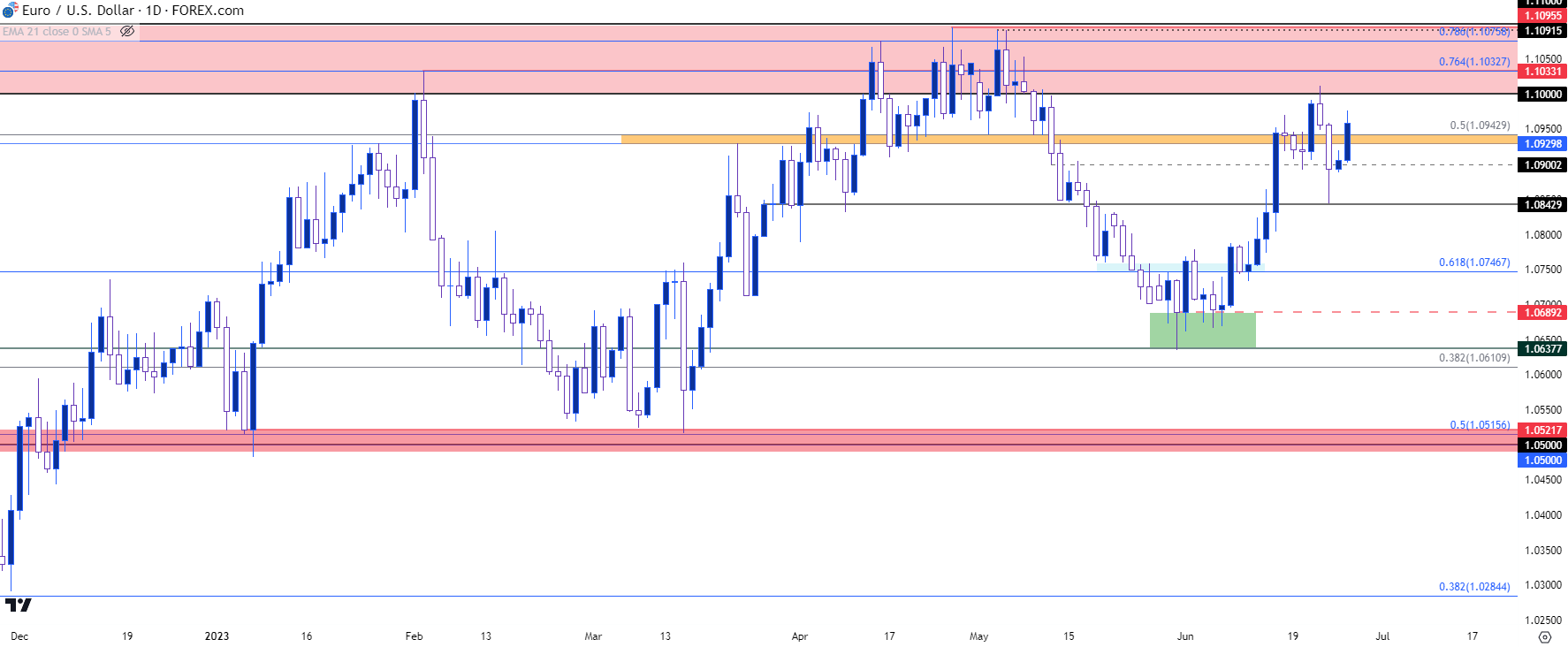

EUR/USD 1.1000

Last week saw re-test of the 1.1000 handle in EUR/USD, and in short order bears had taken that for a 150 pip-plus pullback. But support showed at a familiar spot of 1.0843, which I had looked at in last week’s webinar.

That support softened the lows into last week’s close and that’s continued with a bullish movement so far this week, with focus on that same 1.1000 level for a possible re-test.

This morning saw more hawkish commentary from Christine Lagarde of the ECB and that continues the tone that we’ve heard from the European Central Bank of late; but as we saw last week, the big question is whether growth in Europe will allow for the ECB to remain more hawkish than the FOMC. Inflation remains a problem in Europe and it seems that the bank wants as much headwind as they can get in fighting the problem.

In EUR/USD, the big question is whether the ECB can sound hawkish enough to provoke a push above the 1.1100 level that bulls did not want to test back in April/May.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

GBP/USD

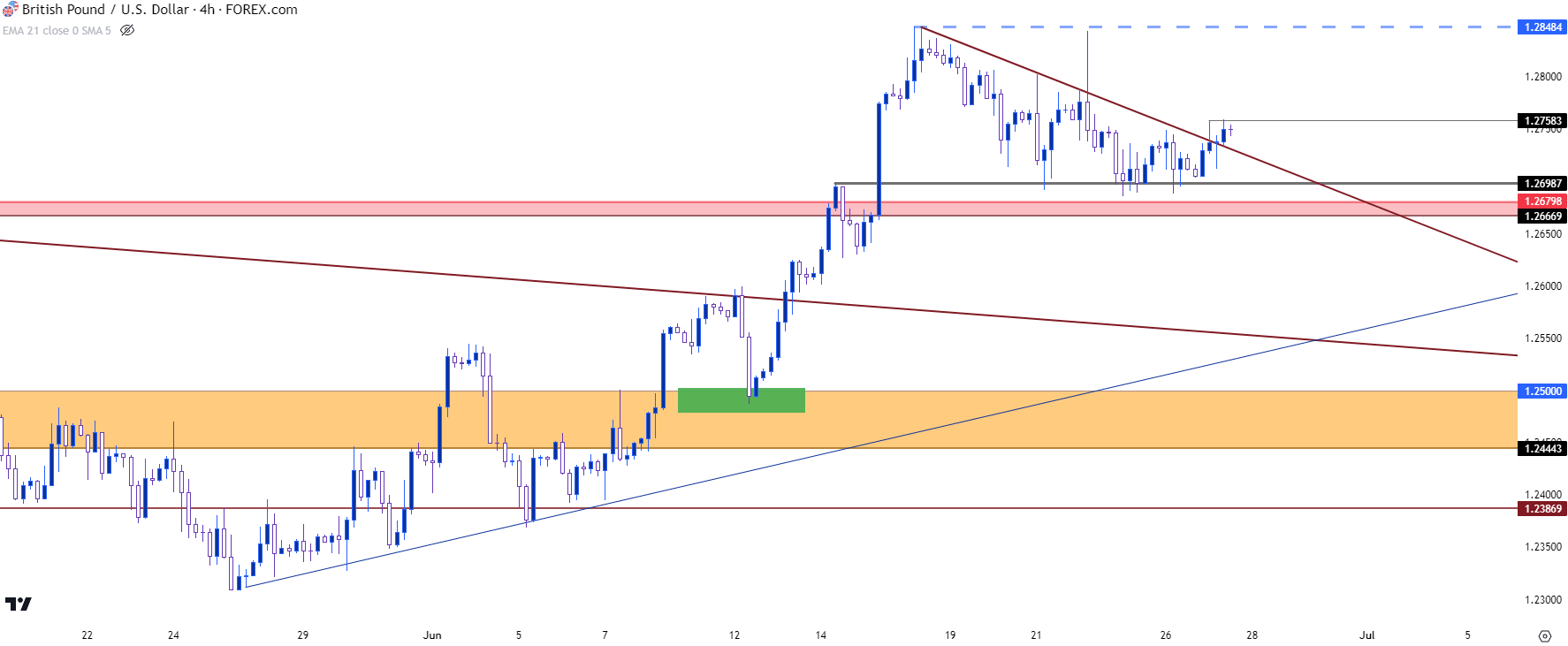

For bearish USD scenarios, GBP/USD may remain as one of the more attractive venues, largely on the back of recent price action after the pair pushed up to a fresh yearly high two weeks ago.

Last week saw another elevated inflation print out of the UK followed by a 50 bp hike from the Bank of England and, interestingly, that hike almost produced a fresh breakout – but buyers shied away just five pips below the prior swing high. Price meandered back to support after that, and the 1.2700 level came into play and held Friday lows into Monday, with Tuesday seeing bulls make a bit of a forward-push.

From the below four-hour chart, we can see that dynamic playing out; but perhaps notable is the fact that the 1.2700 support held above a large level of prior resistance at the 1.2667 level. That was a big spot of resistance as it held the highs in May of last year and then again in early-May of this year, when that price was confluent with the bearish trendline. The fact that bulls held the lows above that level without allowing for re-test could be construed as a deductively bullish factor in the matter.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

USD/JPY

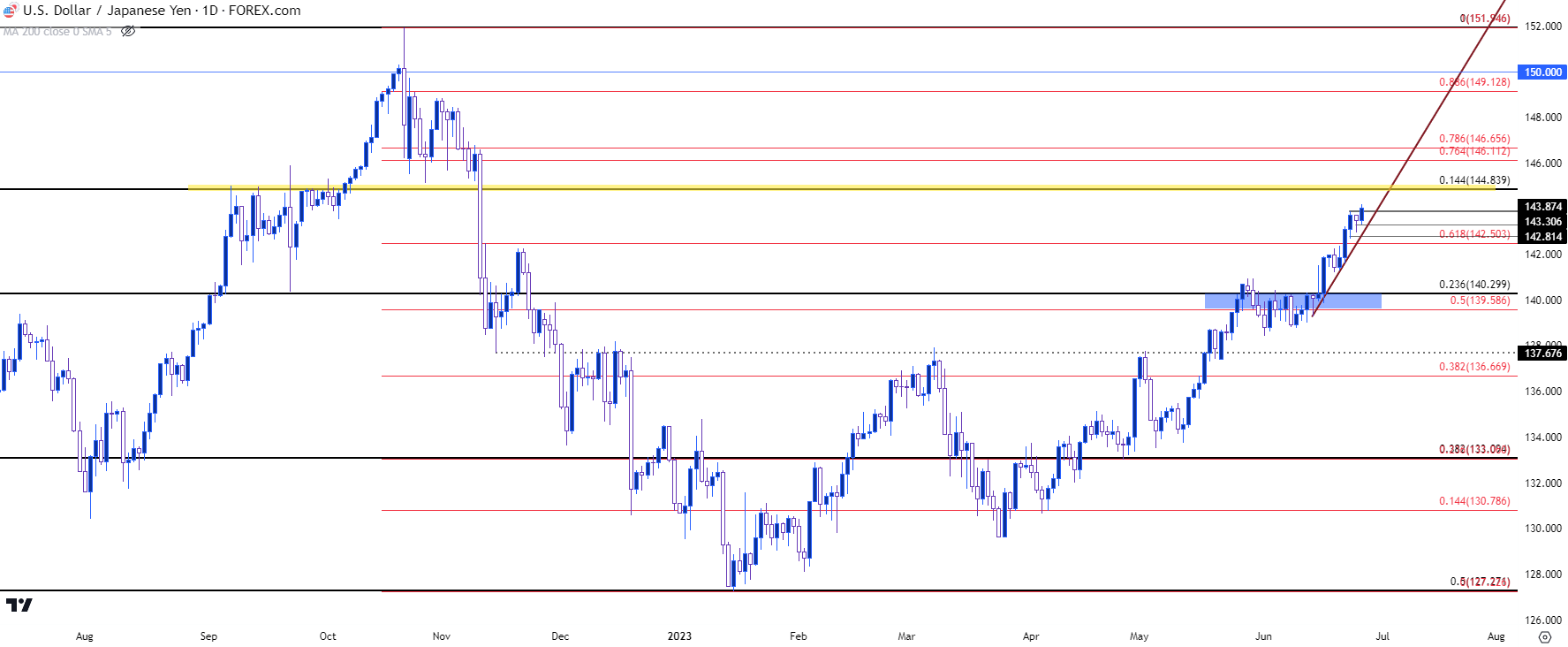

On the bullish side of the US Dollar, USD/JPY may remain as one of the more attractive venues for now. But we’re fast approaching a similar saga that came into the picture last year when USD/JPY strength ran unabated for much of the summer.

While BoJ monetary policy continues to encourage Yen-weakness against most major counterparts, we heard multiple comments from the Ministry of Finance regarding fast and one-sided moves in the currency. And much as we saw in Europe last year, currency weakness can really drive inflation, and while the BoJ claims to have little worry about inflation the fact of the matter is that Core CPI has printed above 2% for 14 consecutive months in Japan.

Nonetheless, the BoJ has signaled no change on the horizon. We’ve started to hear from the Ministry of Finance again and from the USD/JPY chart, it makes sense as last year saw that commentary get more attention around the 145 spot level in USD/JPY. Prices in the pair are fast approaching that same zone.

Last year – the 145 level held the highs for about a month before another breakout pushed up to the 150 level, and that’s when we had the intervention announcement out of Japan.

Currency intervention in that manner doesn’t seem to be a sustainable long-term solution, as it’s essentially using finite FX reserves to buy Yen when the BoJ’s very own monetary policy is encouraging Yen-weakness. Luckily for the bank this didn’t become an issue last year as USD-weakness appeared in Q4, helping USD/JPY to temper those prior gains.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist