Forex markets have seen very little action in Thursday’s Asian session post US CPI, with currency pairs trading in very tight ranges ahead of today’s ECB meeting and US producer prices. No change is expected today from the ECB, but with markets pricing in an 80% chance of a June cut, traders will likely be paying very close attention to how the ECB handle their comms in light of the hot US CPI report.

Yes, the European economy may well arrant a cut sooner than later, but does that mean the ECB want to signal that they may be the first (if not one the first) central banks to begin easing? I wouldn’t blame them if they strike a reserved and non-committal tone. And that could prompt some upside for EUR/USD and weigh on the DAX. But if they do indicate easing ahead, EUR/USD bears may want to return and inadvertently support the DAX.

But we also have the US side of the equation, which may end up being the bigger driver for sentiment today. Not only do we have US producer prices which also run the risk of coming in hot for a second consecutive month (just as consumer prices did), but with several Fed members set to speak we also have the potential for some hawkish commentary and another round of US dollar strength.

1-day implied volatility has spiked higher for several forex major pairs, with EUR/USD and USD/JPY over 2.5x their 20-day average. And that makes sense, given the pending ECB meeting, US PPI report, FED member speaking and potential for BOJ jawboning with USD/JPY trading at a 34-year high.

Economic events (times in GMT +1)

- 13:15 – ECB interest rate decision

- 13:30 – US PPI

- 13:45 – FOMC member Williams speaks

- 15:45 – ECB press conference

- 15:00 – FOMC member Barkin speaks

- 15:15 – ECB member Lagarde speaks

- 17:00 – Fed member Collins speaks

- 18:30 – Fed member Bostic speaks

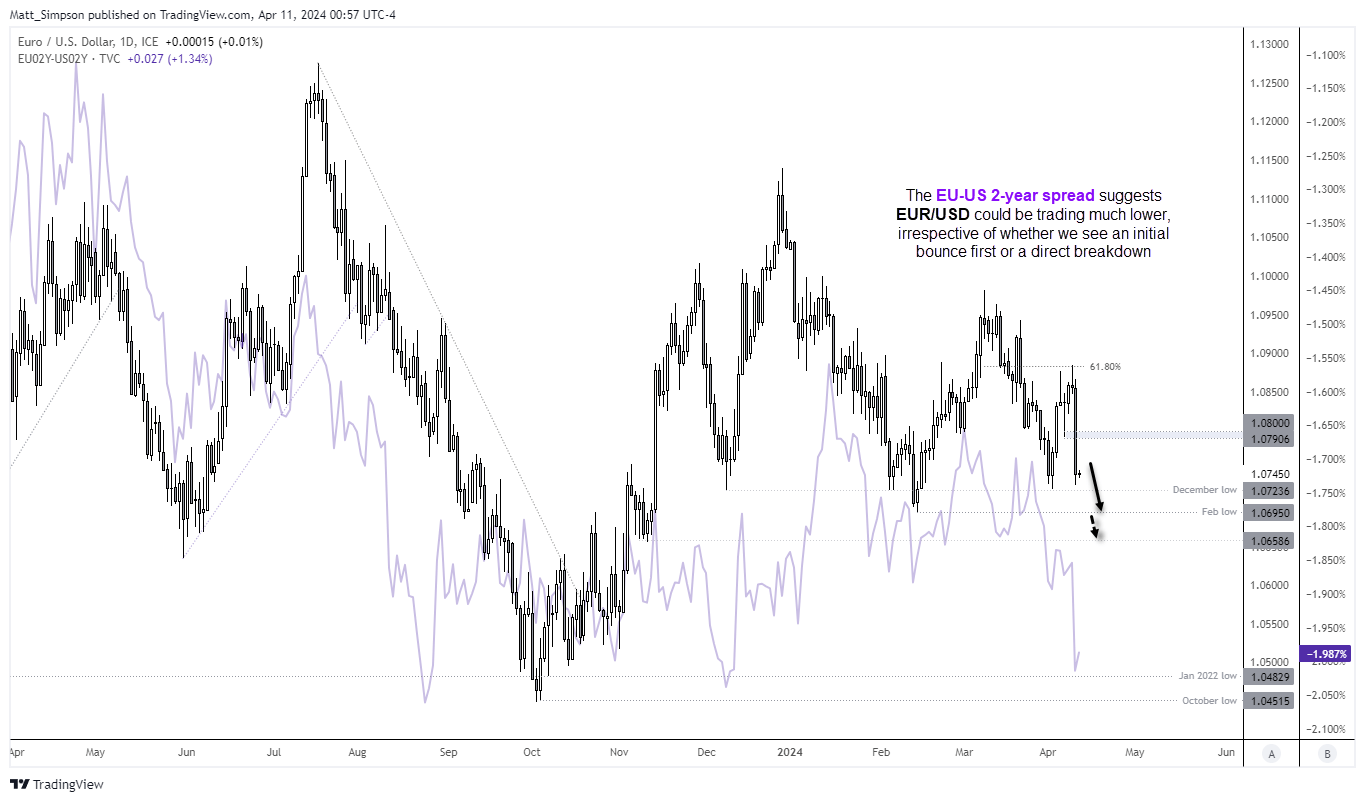

EUR/USD technical analysis (daily chart):

Wednesday was the most bearish day for EUR/USD in 13 months, thanks to the hot US inflation report. It was swift to cut through the 200-day average, to and well beyond my bearish 1.08 target and come close to testing the December low. The EU-US 2-year spread suggests the euro could be trading much lower, which brings a break of the December low into focus, irrespective of whether it initially bounces higher or simply breaks support later today. Obviously, a dovish ECB meeting could help with a direct break lower, but if the ECB remain steady then a bounce higher could be on the cards.

EUR/USD technical analysis (daily chart):

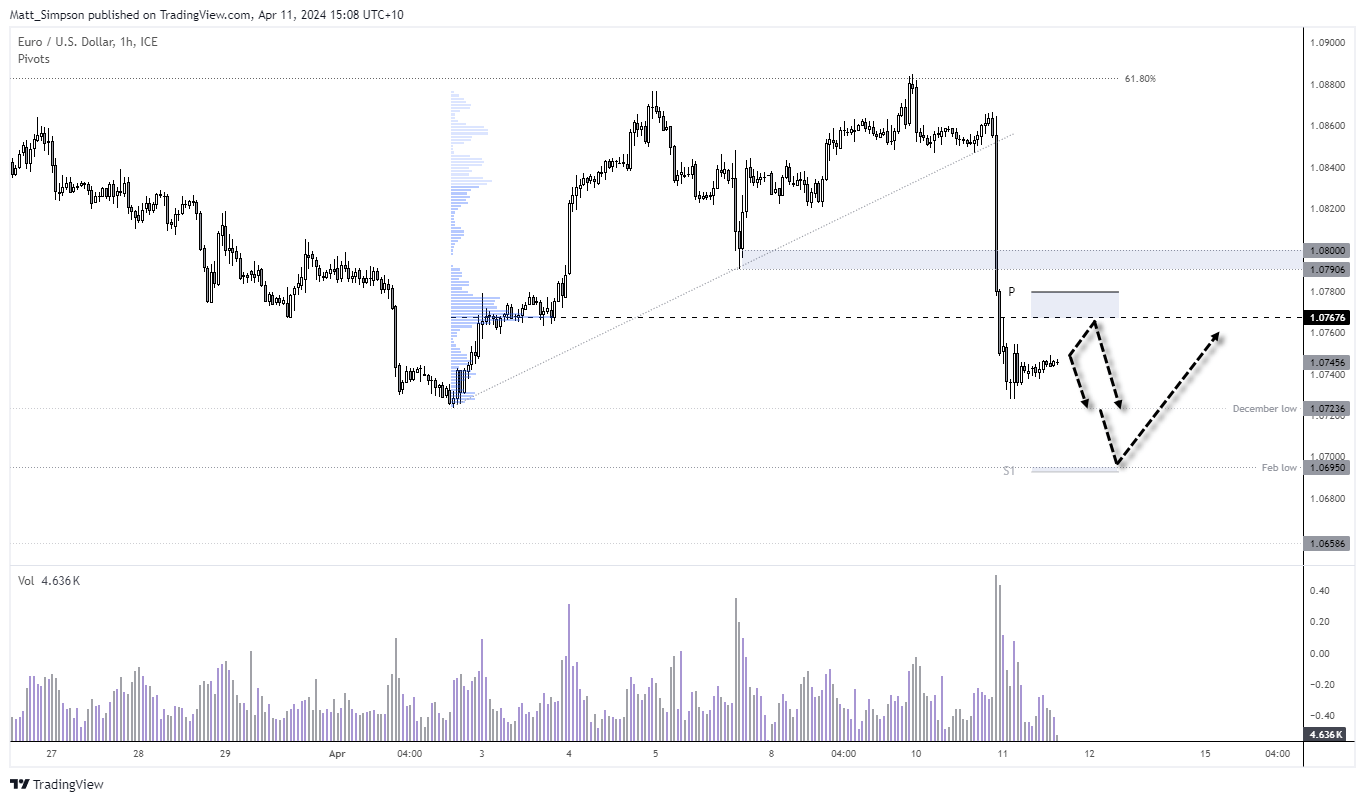

Yesterday’s bearish bias worked a treat, although much of the move lower was seen in the minutes following the CPI release – which made it difficult to capture a decent chink of the move, unless a traders was already short. Still, with the bias on the daily timeframe eventually lower, EUR/USD may provide further opportunity for bears.

In an ideal world, we’ll see EUR/USD trade higher today to allow us to seek short setups at higher prices. The daily pivot point is around 1.0780, although I doubt we’ll see it move this far – unless the ECB were unexpectedly hawkish.

Therefore, the idea is to seek fades below the daily pivot point in anticipation of a retest of (and break beneath) the December low. 1.0700 makes an ideal downside target near the daily S1 pivot and February low.

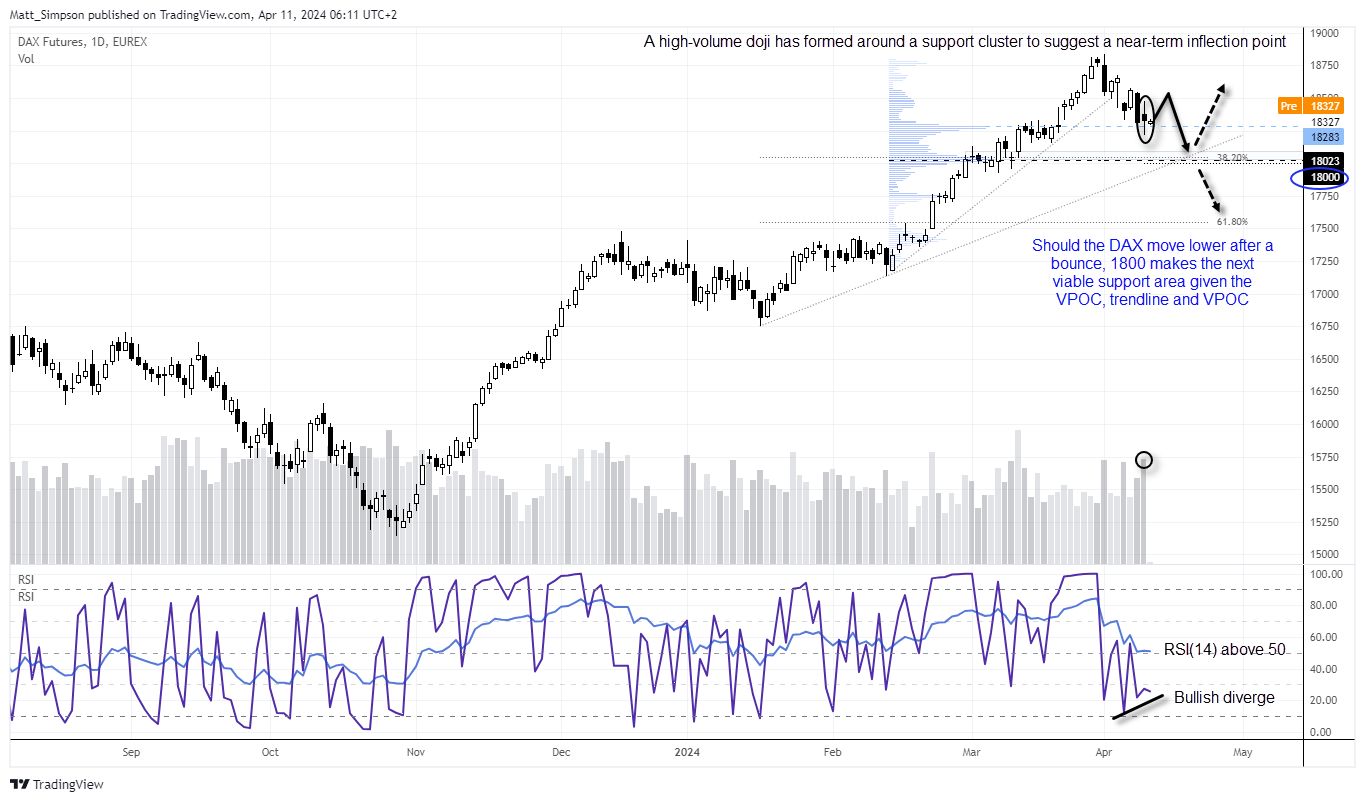

DAX technical analysis (daily chart):

The DAX has retraced around -3.3% from its record high over the past six day. A doji formed on high volume on Wednesday, which can be indicative of a ‘change in hands’ between bears to bulls. The doji formed around a high-volume node, the RSI (14) is holding above 50 to denote positive momentum over this period, and a small bullish divergence has formed on RSI (2). Put together, it brings the potential bounce into focus over the near-term, especially if the ECB deliver a dovish tone to today’s meeting.

However, retracements tend to come in a minimum of three waves, and there seems to be a decent support cluster around 1800 that may make a more viable turning point for the correction further out. Not only do we have the 19k handle around a 38.2% Fibonacci level, but it also marks the VPOC (volume point of control) from the prior rally.

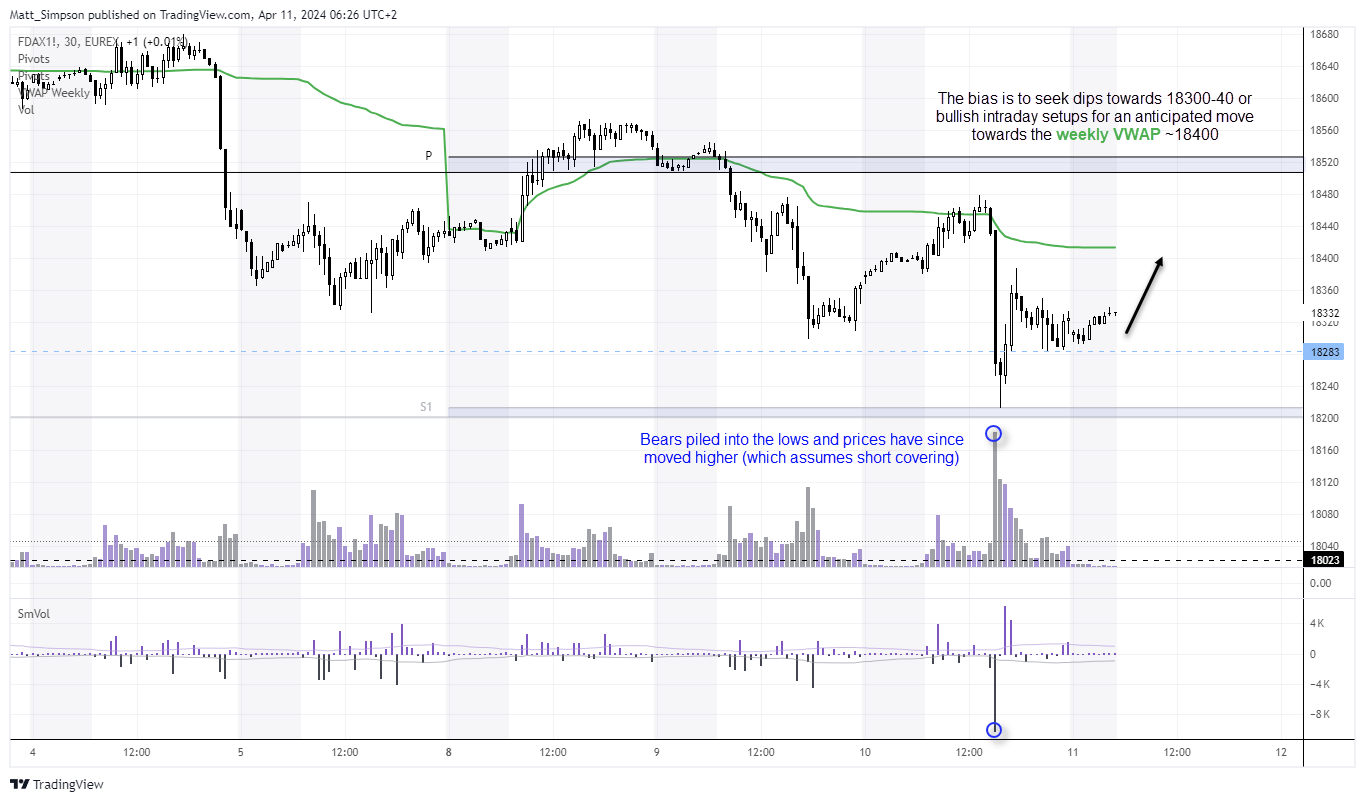

DAX technical analysis (daily chart):

The DAX has retraced around -3.3% from its record high over the past six day. A doji formed on high volume on Wednesday, which can be indicative of a ‘change in hands’ between bears to bulls. The doji formed around a high-volume node, the RSI (14) is holding above 50 to denote positive momentum over this period, and a small bullish divergence has formed on RSI (2). Put together, it brings the potential bounce into focus over the near-term, especially if the ECB deliver a dovish tone to today’s meeting.

However, retracements tend to come in a minimum of three waves, and there seems to be a decent support cluster around 1800 that may make a more viable turning point for the correction further out. Not only do we have the 19k handle around a 38.2% Fibonacci level, but it also marks the VPOC (volume point of control) from the prior rally.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge