- EUR/USD was hit hard on the US inflation report, breaking two supports following its release

- Price momentum is also shifting to the downside, although it’s not game over for bulls just yet

- US producer price inflation reports have been a catalyst for USD weakness recently. The next report arrives on Friday

There’s now a very real possibility the European Central Bank will cut interest rates earlier and more aggressively than the US Federal Reserve this year. Just look at the relative economic performance of the world’s largest economic bloc compared to the world’s largest economy over recent months. It’s chalk and cheese with the US operating far above potential levels while the eurozone sits somewhere between stagnation and recession.

Euro area feeling the burn from ECB hikes

The ECB may have started hiking later and done less than the Fed but what it has delivered has got far more traction when it comes to the real economy. That explains why money markets have more than four cuts have priced into the EUR curve whereas there’s just over three in the USD equivalent.

Be in interest rate differentials or expected economic or financial market performance, plenty is working in favour of the US dollar now against the euro, leaving EUR/USD facing the prospect of a prolonged leg lower should those trends be maintained.

EUR/USD looks precarious on the weekly

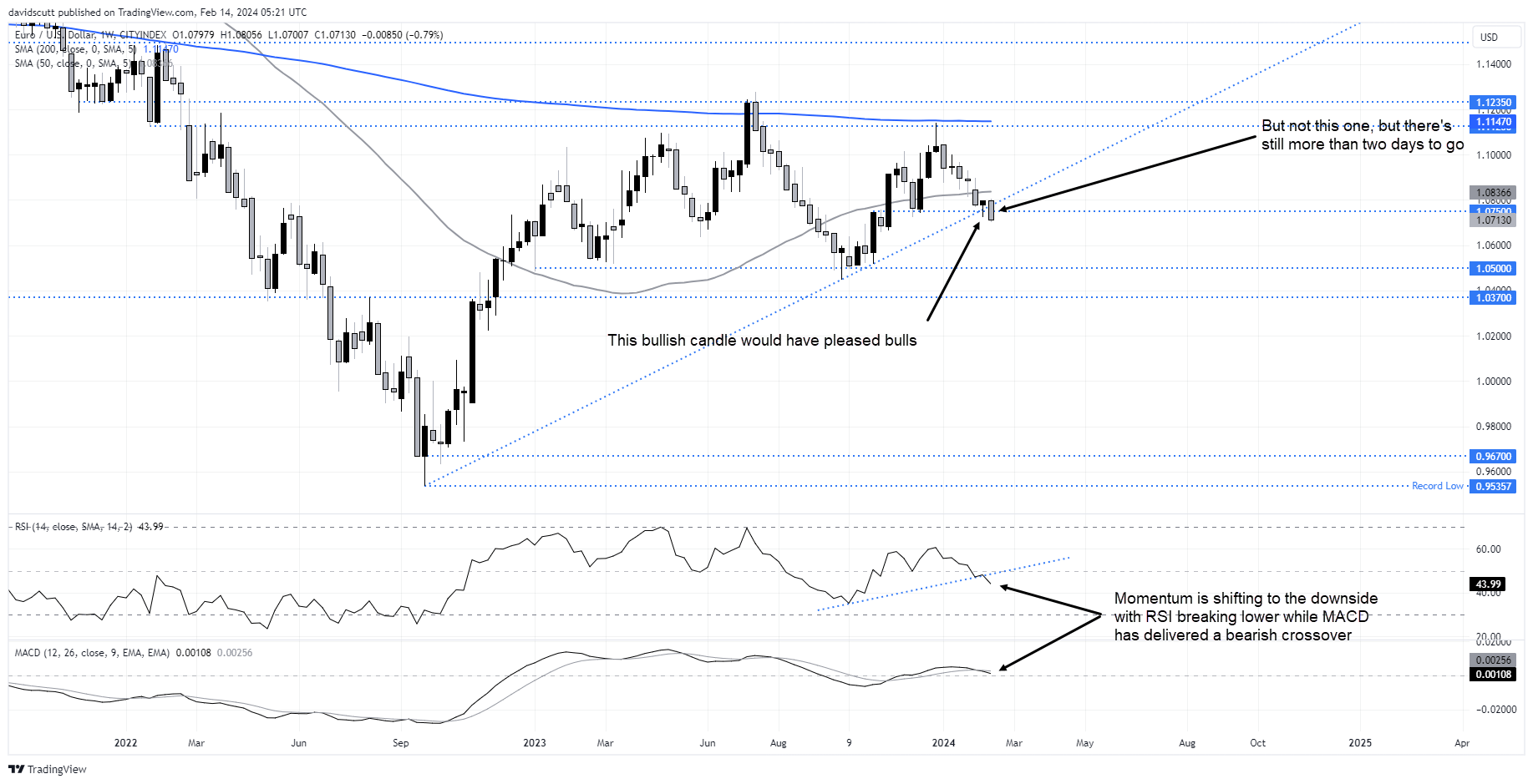

The weekly does not make for pleasant viewing for EUR/USD bulls with the price not only puncturing uptrend support following the US inflation report for January on Tuesday but also horizontal support at 1.0750, leaving it dangling precariously on the chart.

But the candle is not complete yet – there’s still over two days left in the week, leaving plenty of time for the subsequent price action to change the narrative on what might happen next. Just last week the price punctured the uptrend only to get rammed back above, so another similar candle would only reinforce the view that downside may be limited from here. But if it can’t reverse higher, the risk of downside will likely intensify, bringing a push towards 1.05 or even 1.0370 into play in the months ahead.

As such, keep a close eye on how EUR/USD finishes the week.

Looking ahead, the preliminary Q4 GDP report from the Eurozone later Wednesday will generate plenty of headlines but I don’t expect it will tell us anything we didn’t already know. Instead, Fed speakers post the inflation report, alongside US retail sales and January producer price inflation, are the known events most likely to move the EUR/USD heading into the weekend.

The latter has been a particular favourite of rate doves recently, helping to fuel the disinflationary narrative which contributed to mounting rate cut bets. There’s every chance we may see the same dynamic playout in the leadup to the release, providing possible respite for the euro.

-- Written by David Scutt

Follow David on Twitter @scutty