Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we’re tracking into the open of the week / Jackson Hole

- Next Weekly Strategy Webinar: Monday, September 11 at 8:30am EST

- Review the latest Weekly Strategy Webinars on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Japanese Yen (USD/JPY), EUR/JPY, Canadian Dollar (USD/CAD), Gold (XAU/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX) and Dow Jones (DJI). These are the levels that matter into the close of the month.

US Dollar Index Price Chart – DXY Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Earlier this the month, we highlighted a key resistance zone in our US Dollar Price Forecast at 103.00/50 - a region defined by the 2016 high-close, the 2020 high, the January low-week close, the 61.8% Fibonacci retracement and the objective yearly open. A five-week rally is now testing this key threshold for a second week- the focus is on possible exhaustion / price inflection into this zone.

A topside breach / weekly-close above would be needed to fuel a breakout towards the yearly high-week close / 52-week moving average at 104.63/80 and key resistance at 105.39/67. Initial support rests near the 103-handle backed by 102.71- losses should be limited to this threshold IF price is heading higher on this stretch.

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

The Canadian Dollar is testing a major technical confluence at 1.3545/68- a region defined by the objective yearly open / 61.8% Fibonacci retracement of the yearly. The focus is on a reaction off this level with a daily close / breach above needed to keep the immediate long-bias viable. Daily support rests with the 200-day moving average (~1.3454) backed by 1.3386- losses should be limited to this threshold IF price is heading higher on this stretch. Once again, the USD/CAD levels unchanged into the start of the week.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Keep an eye on this critical support zone in AUD/USD at the 78.6% retracement of the 2022 advance / October reversal-close around 6381/93. A break / close below this threshold would threaten another accelerated decline towards the next key support hurdle at 6200/10- a region defined by the 100% extension of the yearly decline, the 2022 low-week close, and the 2008 low close. Weekly resistance now stands back with the May low-week close at 6607.

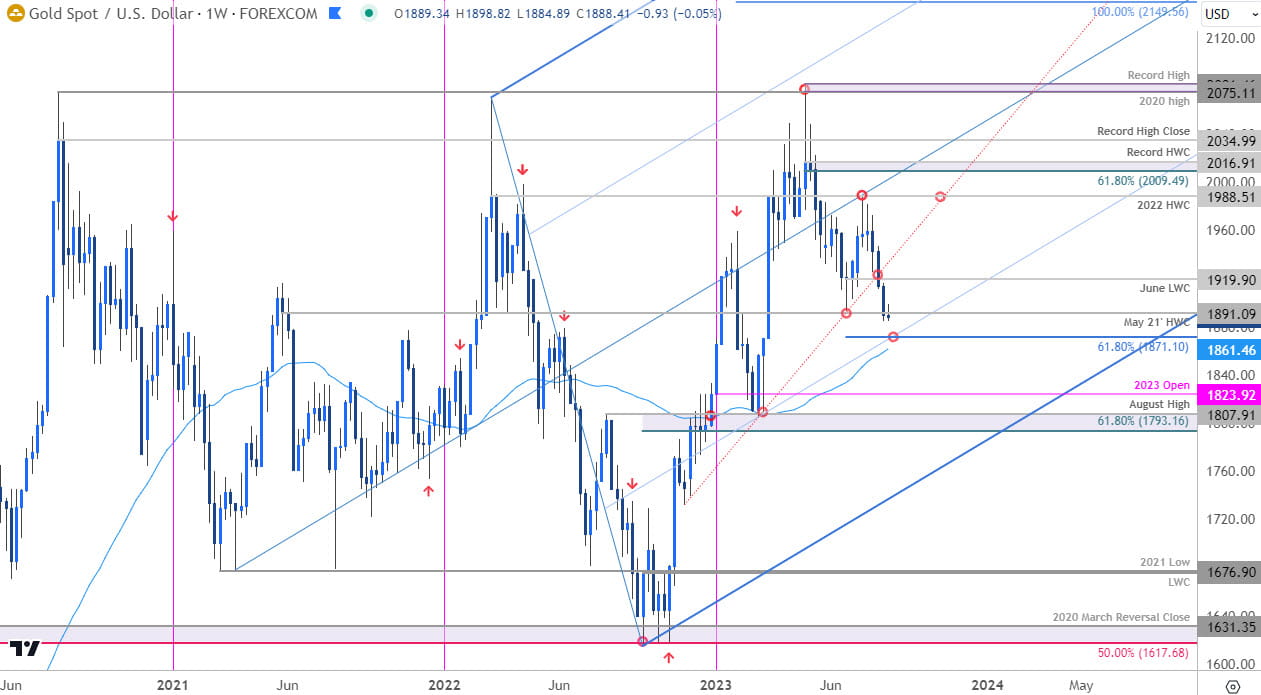

Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

The Gold breakdown may be poised to mark a fourth consecutive weekly loss with a break of the November trendline now within striking distance of key support at 1861/71- a region define by the 52-week moving average and the 61.8% extension of the May decline. Looking for a reaction into this threshold IF reached with a close above 1919 needed to alleviate further downside pressure here. Watch the weekly close.

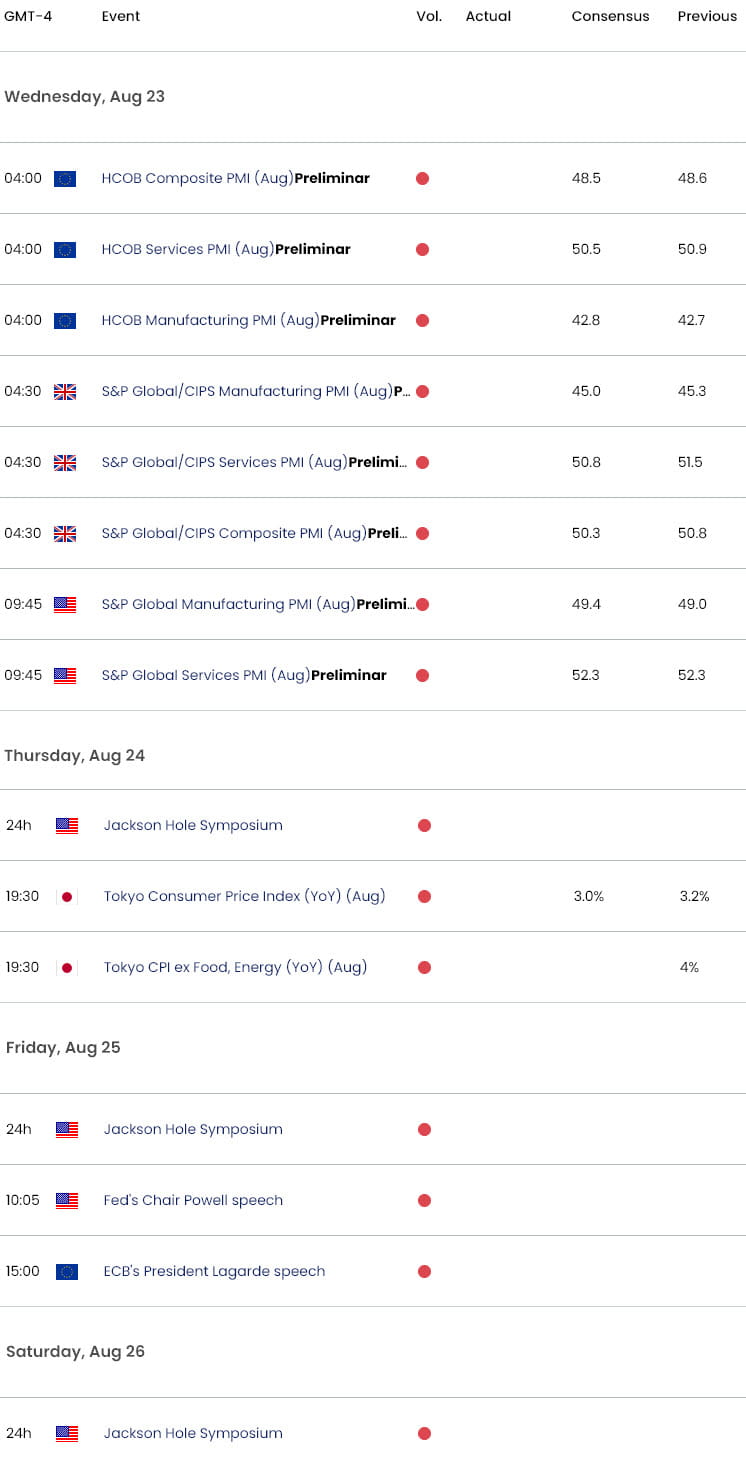

Economic Calendar – Key Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex