- EUR/USD analysis: Dollar in sharp focus with key data on tap

- Mixed Eurozone data supports euro

- EUR/USD technical analysis still point lower

The euro rose across the board this morning after the services PMI for several countries in the Eurozone were surprisingly revised higher. But a sharp drop in Eurozone retail sales reminded investors the troubles facing the Eurozone economy, and that the single currency is not out of the woods yet. The EUR/USD had climbed above the 1.05 handle where it was testing a key resistance area ahead of the release of key US data.

EUR/USD analysis: Dollar in sharp focus with key data on tap

The US dollar took a breather as risk sentiment improved in the first half of Wednesday’s session when European markets and US index futures recovered from their earlier losses. But we have seen this sort of price action in the past, when a strong start to the fades late in the session. Will it be the case again today?

A lot depends on what happens in the bond markets, which continue to dictate direction for nearly all risk assets. Overnight saw yields on the US 10-year bonds rise to a fresh multi-year high of 4.884% before pulling back. The latest bond market sell-off has been triggered by improvement in US data, which has supported the calls for US monetary policy to remain tight for longer. This time it was JOLTS Job Openings, which showed more jobs had become available than expected.

So, what happens to yields and the dollar, and by extension stocks, will now depend on the outcome of US data due for release shortly. ADP Non-Farm payrolls are expected to print 154K versus 177K expected, while the ISM services PMI is seen printing 53.5 vs. 54.5. Factory orders are expected to print 0.2% m/m vs. -2.1% in the previous month.

If the latest data continue to show the world’s largest economy remains resilient, then this will revive concerns about interest rates remaining high for longer. As a result, the dollar may find renewed support and push the euro lower again.

I do think there is more room to the upside for the dollar, although the pace of the rally is likely to slow down as US data should start to deteriorate moving forward, raising the possibility of a sooner-than-expected rate cut by the Fed in 2024. Even though the Fed is most likely done with hiking, the fact that they have indicated they will keep rates high for longer, this alone should help to keep the dollar support on the dips, as it has.

Mixed Eurozone data supports euro

As mentioned, the Euro has found some love because of stronger Eurozone services data, although the gains have been capped by the fact we saw retail sales coming in sharply lower. Here is a recap of today’s Eurozone data and a summary of macro indicators to look forward to from the US.

Source: TradingView.com

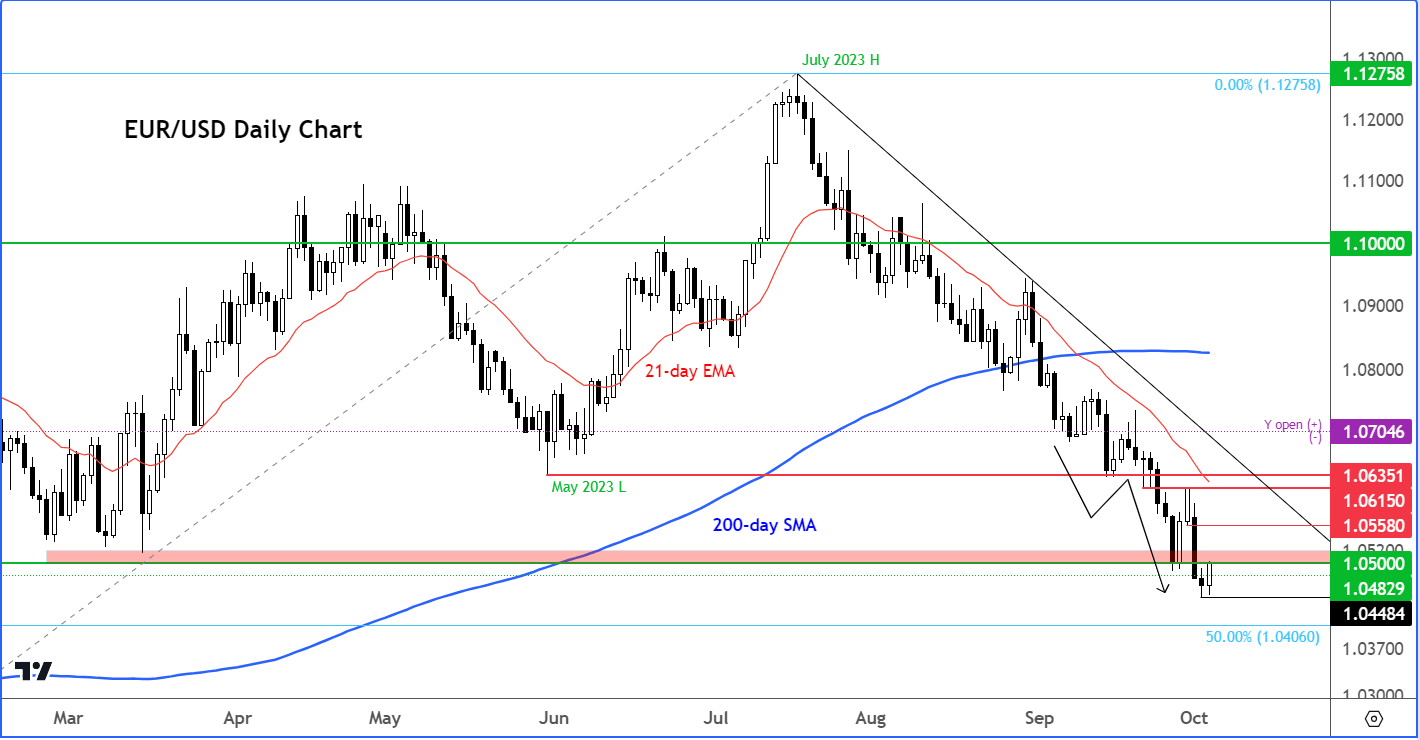

EUR/USD technical analysis

The EUR/USD remains in a bearish trend despite the firmer tone in markets in the first half of Wednesday’s session. It is important to treat any short-term strength as a counter-trend move, one that typically fades after 1-3 days, until we see a concrete reversal in the trend. So, today’s recovery in the EUR/USD could well prove to be just a short-term recovery before we see more losses. In fact, the EUR/USD was now testing a major resistance zone around the 1.05 area, which was previously support. I wouldn’t be surprised to see the bears step in around here, especially as the trend of the weak Eurozone data continues.

From here, a move down below 1.0450 is the first bearish objective i.e., this week’s low. Thereafter, the 50% retracement of the entire upswing from the September 2022 low would come into focus at just above the 1.04 handle.

On the upside, the next level of resistance beyond the shaded region on the chart (of around 1.05) is 1.0560, followed by 1.0615-35 range, where the latest sell-off occurred from. Any move above the 1.0615-35 range would probably mark the end of the bearish trend, for we will then have a higher high in place.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R