The EUR/JPY is our featured technical chart, for not only a technical breakdown is looking increasingly likely, but the macro back backdrop makes for a bearish fundamental backdrop. In short, the euro is undermined because of Europe’s persistent economic and political challenges, while a potential rate hike from the Bank of Japan magnifies the yen's appeal. Against this backdrop, our short-term EUR/JPY forecast is bearish.

EUR/JPY forecast: Political and economic uncertainty risks loom for euro

The euro rebounded slightly across the board amid a firmer risk tone with the DAX and S&P hitting new record highs this week. Still, FX traders are treading cautiously ahead of significant political developments in France and a packed week of US economic data, which could have indirect influence on the JPY through the bond market (i.e., should US data surprise to the upside, this should push US and global bond yields higher, which would be negative for the low-yielding assets like JPY).

Meanwhile, geopolitical tensions are still at the forefront. Donald Trump’s recent threat of trade tariffs, slated for implementation once he assumes office in January, adds an obvious layer of pressure on the euro. Over the weekend, Trump also warned of tariffs targeting BRIC nations not aligned with the US dollar as a reserve currency. In Europe, French Prime Minister Michel Barnier faces mounting pressure, with his coalition government on the verge of collapse. A no-confidence vote is scheduled for tomorrow, and analysts anticipate he will struggle to retain his position. This could usher in further political instability in the eurozone’s second-largest economy, potentially weighing on the EUR/JPY forecast and undermining other euro crosses.

Adding to the bearish sentiment for the euro are weak economic fundamentals. Yesterday’s release of updated Eurozone PMIs showed no improvement, underscoring the region’s deepening manufacturing recession, with little sign of recovery in sight.

Yen gains momentum amid BoJ rate hike speculation

The yen has been strengthening as speculation grows that the Bank of Japan could raise interest rates this month. This anticipation is not only boosting the yen against the dollar but also pressuring other pairs like the GBP/JPY and AUD/JPY.

And it looks like speculators appear eager to capitalize on the yen’s rally, according to the latest CFTC positioning data. Last week, large speculative traders significantly increased their long positions on the yen, driven by renewed expectations of a 25 basis point rate hike by the Bank of Japan this month. Notably, these traders reduced their short positions while boosting long exposure by over 23%, adding nearly 15,000 contracts to their bullish wagers.

Technical EUR/JPY forecast: Key levels and factors to watch

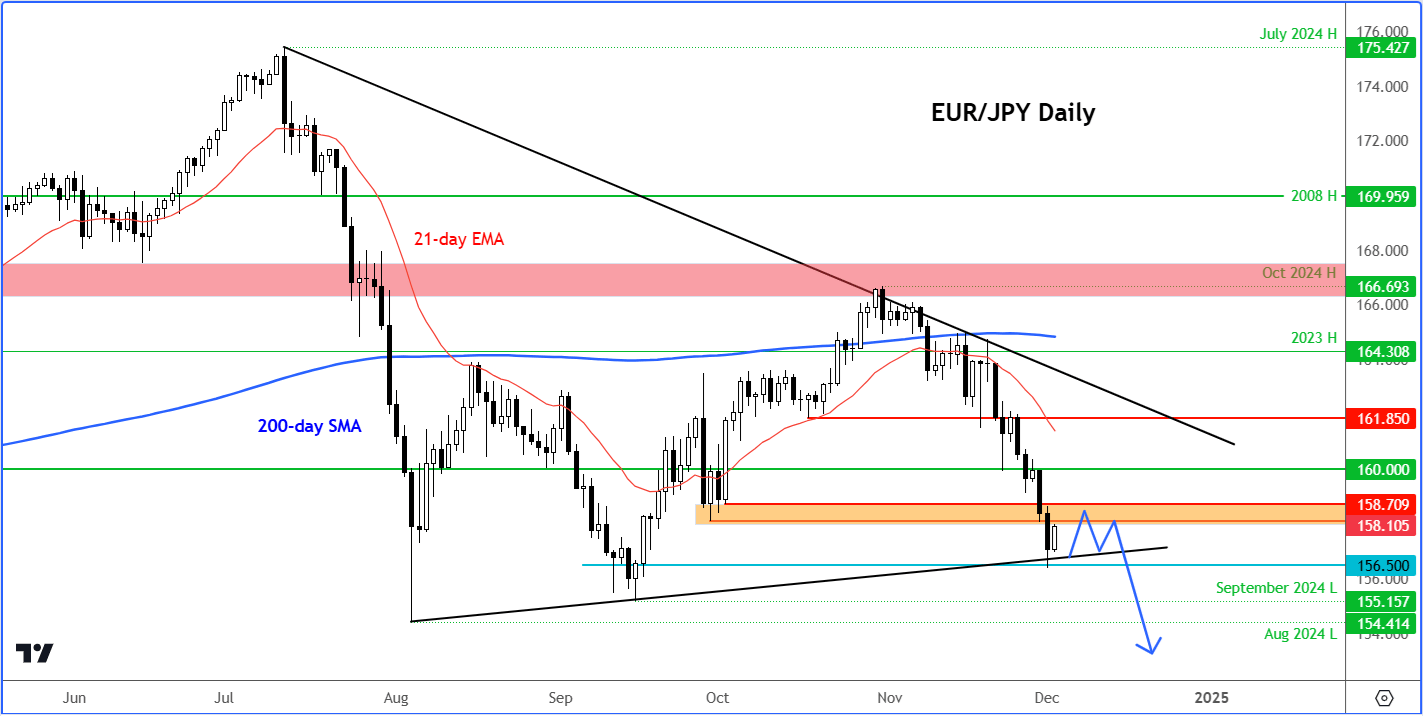

Source: TradingView.com

As far as the technical EUR/JPY forecast is concerned, well this pair slid below the pivotal 160.00 level last week and is now hovering near the 158.00 old support level. Once support, this level could turn into resistance and potentially trigger another drop in this pair. The next level of support comes in around 156.50 to 157.00, which also marks the trend support in place since August. Should the EJ break below this area, then this could pave the way for a potential drop to take out liquidity resting below the lows of September and August at 155.15 and 154.41, respectively.

So, not only is the EUR/JPY under pressure because of a stronger yen, but the euro's ongoing weakness, driven by Europe’s persistent economic and political challenges, further magnifies the yen's appeal. Against this backdrop, our short-term EUR/JPY forecast is bearish, and we expect to see a breakdown below the summer low of 154.41.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R