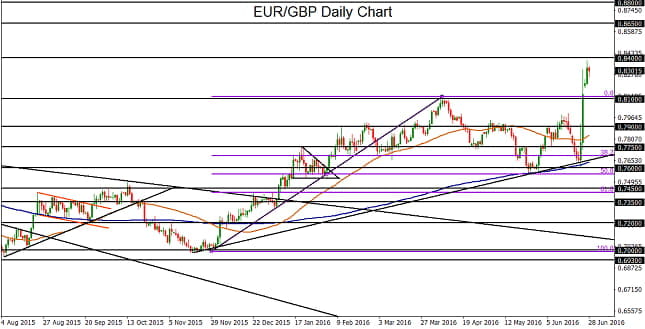

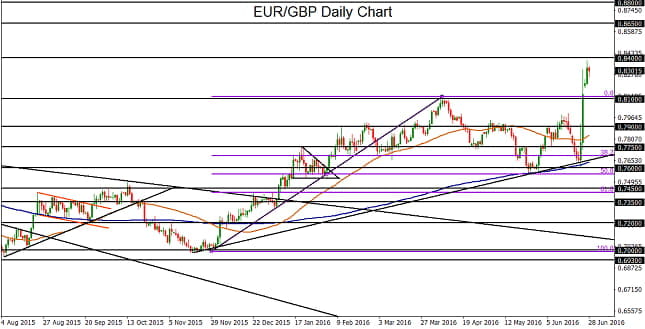

Although the euro and pound both suffered massive hits as a result of last week’s Brexit decision, the euro has fared substantially better than sterling in the aftermath of Thursday’s EU referendum. While both currencies were expected to plunge on a Brexit outcome, it was also projected that the British pound would endure a significantly more severe blow. This was indeed to be the case, as the EUR/GBP chart displays an exceptionally sharp surge from the pre-Brexit 0.7600 low, representing a swift and sudden appreciation of the euro against the pound after the UK voted to leave the EU.

Post-Brexit, EUR/GBP continued its rise to hit a new two-year high of 0.8377 on Monday, just short of key resistance around 0.8400, before making a modest pullback on Tuesday as both the euro and pound tentatively stabilized. In the process of that quick climb, the currency pair broke out above a major previous resistance level around 0.8100, which represented the last major high back in April.

Since the 0.7000-area lows in November, EUR/GBP has exhibited a strong bullish trend outlined by a key uptrend line and the 200-day moving average. In the past couple of months, that uptrend has been interrupted by pullbacks during periods of waning concern over the possibility of a Brexit. When the actual Brexit outcome surprised the markets last week, those diminished concerns instantly transformed into shock and uncertainty over the future of the UK and EU, placing tremendous pressure on the pound and immediately extending the uptrend for EUR/GBP.

Although the euro has indeed sustained significant damage from Brexit consequences and could continue to do so, it is likely to persist in maintaining an edge over the severely battered British pound, at least for the time being. As long as EUR/GBP remains above the noted 0.8100 level, now as support, the bullish bias remains intact. In this event, any bullish breakout above the key 0.8400 resistance level could see the currency pair rise to higher resistance targets at 0.8650 and 0.8800.