Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly open

- Next Weekly Strategy Webinar: Monday, August 26 at 8:30am EST

- Review the latest Video Updates or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), 10yr Treasury Yields, Swiss Franc (USD/CHF), EUR/JPY, GBP/JPY, Gold (XAU/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX) and the Dow Jones (DJI). These are the levels that matter on the technical charts heading into the weekly open.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

The Euro breakout is extending through a major technical zone early in the week at 1.1038- a region defined by December high-week close (HWC) and the objective 2024 yearly open. We need a weekly close above this threshold to keep the long-bias viable. Initial resistance eyed at the 2023 high-week reversal close at 1.1108- look for a larger reaction there IF reached. The outlook remains constructive while above 1.0933/42 (bullish invalidation). Review my latest Euro Short-term Technical Outlook for a closer look at the longer-term EUR/USD trade levels.

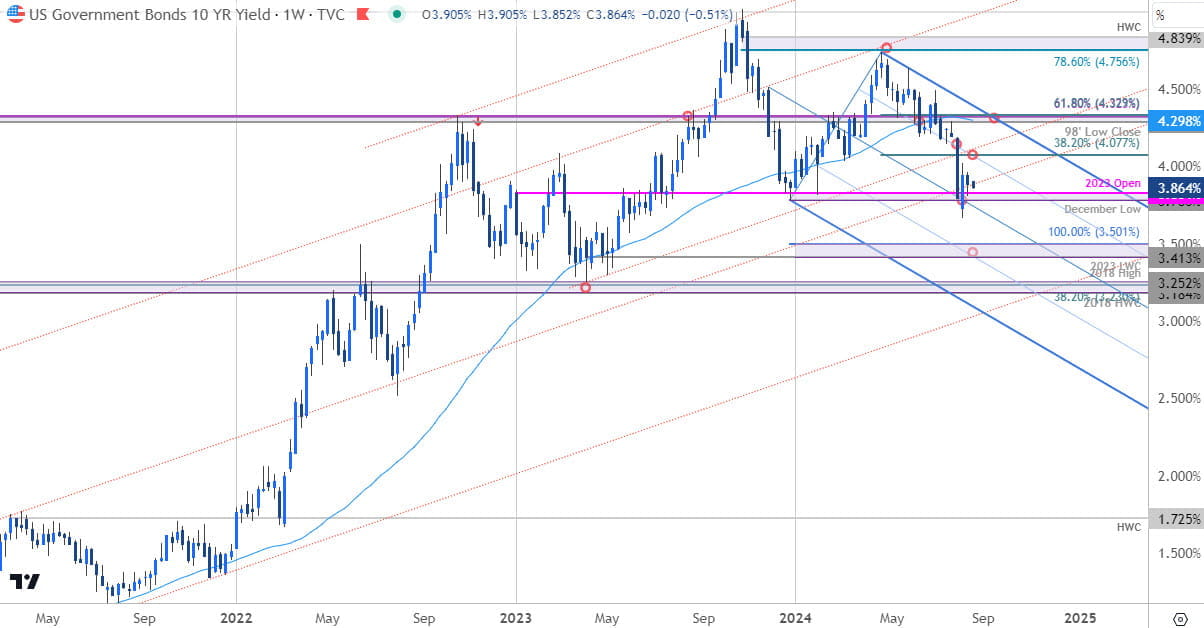

US 10yr Treasury Yield – US10YR Weekly

Chart Prepared by Michael Boutros, Technical Strategist; US10Y on TradingView

We have been tracking this key support confluence on the US 10-year for months now at 3.78/83- a region defined by the December low and the 2023 objective yearly open. Yields have been unable to make a weekly low below this threshold and the focus is on possible inflection off this key pivot zone.

Initial resistance eyed at 4.08 with bearish invalidation steady at 4.29/32. A break / weekly close below the median-line is needed to mark downtrend resumption with subsequent support objectives seen at 3.41/50 and 3.18/25 – both areas of interest for possible downside exhaustion IF reached. Keep in mind the Jackson Hole Economic Symposium kicks-off on Thursday with Fed Chair Powell slated to speak on Friday- watch the weekly close here.

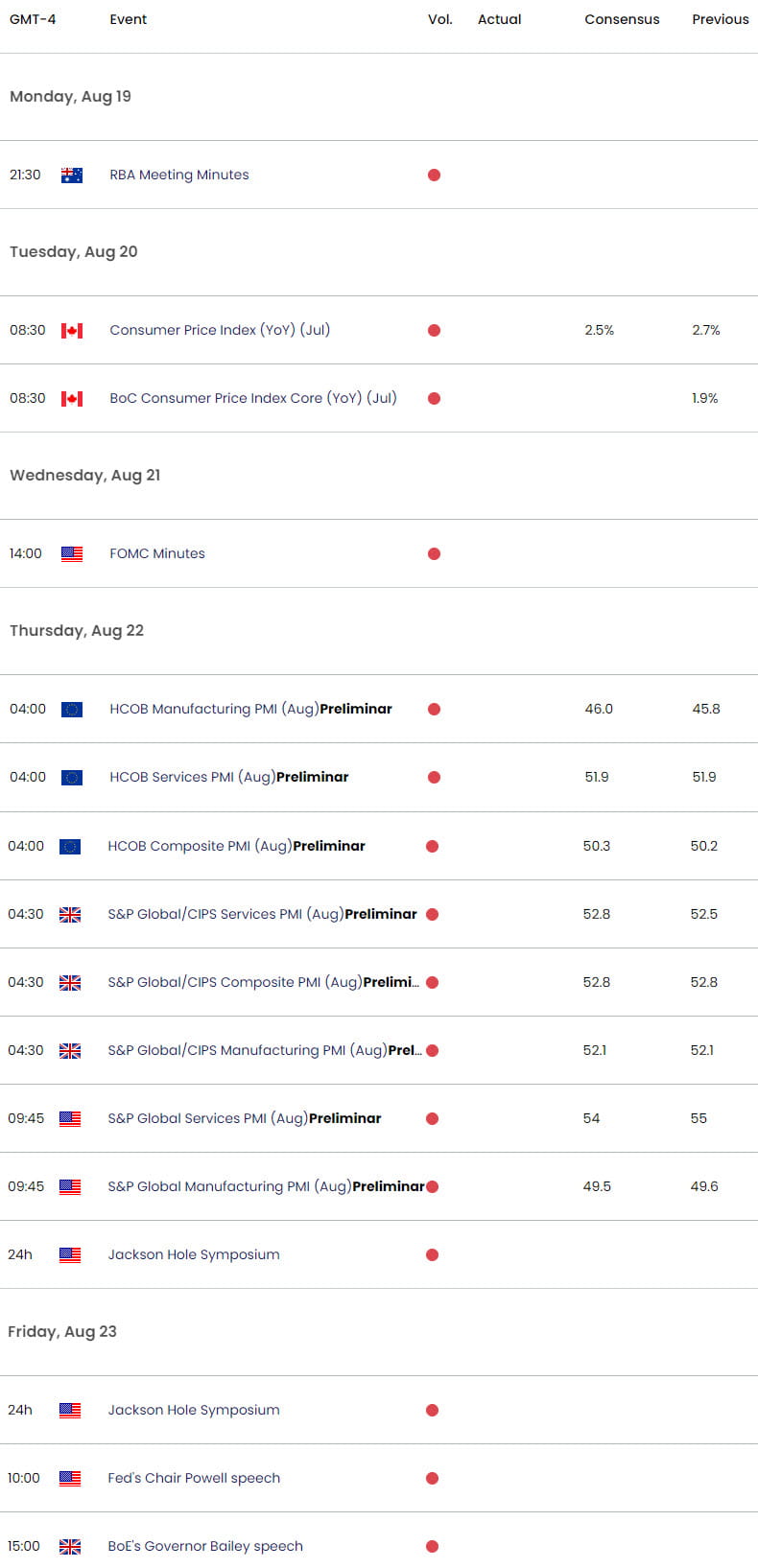

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex