US futures

Dow futures -0.28% at 34444

S&P futures -0.06% at 4503

Nasdaq futures +0.12% at 15591

In Europe

FTSE -0.36% at 7290

Dax -0.2% at 16020

- US indices ease after strong gains last week

- US earnings season in focus

- USD steadies around a 15-month low

- Oil falls after weak China GDP data

China GDP hurts sentiment

US stocks are set to fall at the start of the week after China’s GDP data hurt sentiment and after a strong rally in the previous week.

US indices jumped last week, boosted by softer-than-forecast inflation data supporting views that the Fed’s rate hiking cycle is reaching its peak soon.

China data showed that growth missed forecasts with GDP rising 6.3% on an annual basis in Q2, below the 7.3% forecast, raising worries of a slowing recovery in the world’s second-largest economy. While industrial output was robust, retail sales the property sector disappointed.

The US economic calendar is quiet today, with just NY state manufacturing index, which unexpectedly rose to 1.1 in July from 6.3 in June, beating forecasts of -4.3.

Attention is now turning towards earnings season, which kicked off on Friday with the likes of Citibank, JP Morgan, and Black Rock. This week sees big names such as Tesla, Netflix, IBM, Goldman Sachs, and Bank of America update the market.

Corporate news

Activision rises 4% pre-market and Microsoft 0.1% after the latter agreed to keep Call of Duty on Sony’s PlayStation console, a move that could overcome a key hurdle in an antitrust investigation in Europe.

Tesla rises 2.2% after announcing that it had built its first Cybertruck in China after a 2-year delay.

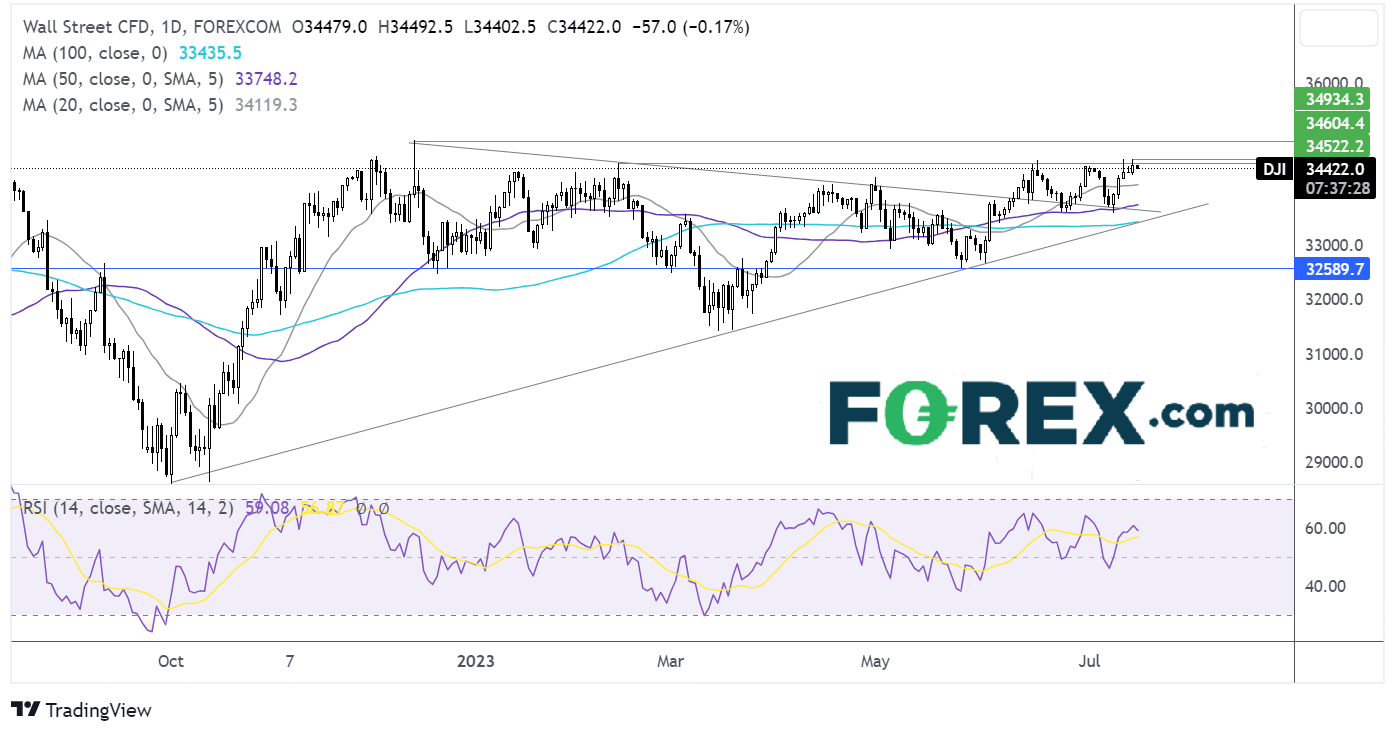

Dow Jones outlook – technical analysis

The Dow Jones hovers just below 34600 last week and is hovering just below here as the new week begins. The price trades at the upper end of a rising triangle, which combined with the RSI above 50 keeps buyers hopeful of further upside. A rise above 34600 creates a higher high and open the door to 34940 the December high. Failure to break above 34600 could see the price test support at 34100 the 20 sma ahead of 33600 the July low.

FX markets – USD falls, GBP, EUR holds steady

The USD is falling, extending losses from last week as the market prices in just one more rate hike this year.

EURUSD is holding steady at 1.1230 in a quiet start to the week. The market has been unmoved by speeches by ECB President Christine Lagarde and ECB chief economist. The price remains supported by expectations of two more rate hikes from the ECB.

GBPUSD is hovering around $1.31 at the start of the week after rising to $1.3144 last week as the market bets that the BoE will keep hiking rates to tame inflation which remains elevated. CPI data is due on Wednesday and is expected to show that CPI remains sticky at 8.2%

EUR/USD +0.7% at 1.1235

GBP/USD +0.1% at 1.3080

Oil falls after weaker China GDP data

Oil prices are falling on Monday, extending losses after China’s GDP data raised concerns over the health of the economic recovery and as Libya resumed production this weekend after output cuts last week.

China’s Q2 GDP rose 0.8% QoQ, down from 2.2% growth in Q1 raising concerns that the recovery in China, the world’s largest importer of oil, is losing steam.

Earlier in the session, oil prices briefly spiked higher after an announcement from Saudi Arabia that it would cut oil production. The announcement was quickly withdrawn, noted as a repeat of the June 4th oil output cut announcement.

The fall in oil prices comes after strong gains last week. Oil booked the third straight week of gains amid a weaker USD, on hopes that a less hawkish Federal Reserve could lower the risk of a recession in the US and as Libyan output fell.

Two of the three Libyan oilfields that were shut last week resumed production over the weekend.

WTI crude trades -1.5% at $74.25

Brent trades at -1.5% at $78.63

Looking ahead

N/A