US futures

Dow futures -0.07% at 38971

S&P futures -0.00% at 5180

Nasdaq futures -0.01% at 18059

In Europe

FTSE 0.56% at 8381

Dax 0.84% at 18637

- Fed speakers continue to support high rates for longer

- US jobless claims rise by more than expected

- Arm drops despite earnings & revenue beating forecasts

- Oil rises after upbeat Chinese data

Fed speakers support high rates for longer, jobless claims rise

US stocks are pointing to a muted open as the recent recovery appears to have run out of momentum. Investors are digesting more corporate earnings and hawkish comments from Federal Reserve officials as well as weaker than forecast jobless claims.

Yesterday, Boston Fed president Susan Collins became the latest Fed official to warn that interest rates would need to stay high for longer than previously thought in order to bring inflation back down to the central bank's 2% target.

Her comments come after Minneapolis Fed President Neel Kashkari said earlier in the week that he believed rates would need to be held at current levels for an extended period, raising questions over whether the Fed would even cut this year.

His comments sparked a rebound in the US dollar and treasury yields and weighed on stocks on Thursday.

Looking ahead, attention will remain on Fed speakers. San Francisco Fed President Mary Daly and Chicago Fed President Austin Goolsby will speak on Friday.

Meanwhile, the US economic calendar has been quiet this week. Today, only US jobless claims are in focus, and they rose by 231k, ahead of forecast and the highest level for weeks. The data comes after the softer US non-farm payrolls suggesting the jobs market could be cooling.

Corporate news

Warner Brothers Discovery is set to open lower after missing forecasts on both the top and bottom lines. The firm posted a loss per share of $0.40 versus $0.24 expected on revenue of $9.96 billion, which was below the $10.23 billion expected and down 7% from the previous year. Earlier this week, the company announced that it would be offering a streaming bundle with Disney.

Arm reported Q4 revenue of $928 million marking a 47% annual rise. However, revenue guidance failed to impress investors. The chip maker forecast revenue to come in between $3.8 billion and $4.1 billion for the full year 2025. This was against the expectation of $3.99 billion.

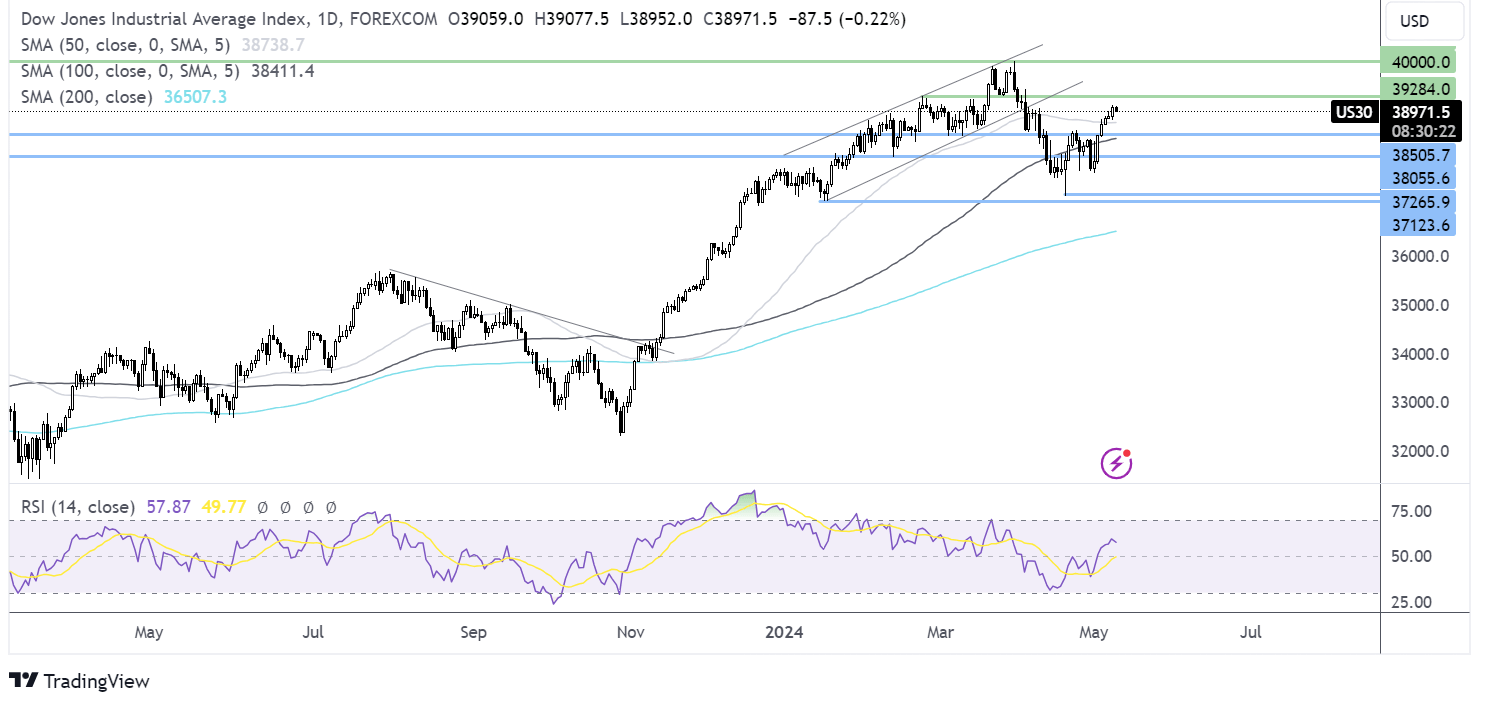

Dow Jones forecast – technical analysis.

The Dow Jones' recovery has run into resistance at 39000, a level that it will need t overcome to continue its grind higher towards 40,000. The rise above the 50 & 100 SMA combined with the RSI above 50 keeps buyers hopeful of further gains. Sellers would need to push the price below 38500 to negate the near-term uptrend, bringing 38000 back into focus.

FX markets – USD rises, GBP/USD falls

The USD is rising on expectations that the Federal Reserve will keep interest rates high for longer. Boston Fed president Susan Collins added to the chorus of Fed officials supporting high rates for longer.

EUR/USD is falling despite a lack of fresh fundamental data and growing expectations that the ECB will cut interest rates in June. With eurozone inflation cooling and signs that service sector inflation is also easing, the ECB could well start a rate-cutting cycle.

GBP/USD is falling after the Bank of England left interest rates unchanged at 5.25% in line with expectations; however, the vote split was more dovish at 7 to 2 (2 votes to cut) compared to 8 to 1 in the previous meeting. This means the Bank of England is a step closer to cutting interest rates, and the market is now pricing in a 50% probability of a rate cut in June. It's fully pricing in a 25 basis point rate cut in August.

Oil steadies after steep losses last week

Oil prices are pushing higher after a draw in US crude inventories and after encouraging data from China.

Crude oil inventories in the US fell by 1.4 million barrels in the previous week, a draw that was higher than analysts' expectations. However, gasoline stockpiles grew by more than 900,000 barrels. The market shrugged off the building gasoline levels and focused on the draw in oil inventories, which offset the unexpected rise from the API crude oil inventory data.

Meanwhile, crude oil shipments to China, the world's largest oil importer, rose 5.45% in April from a year earlier. Chinese imports and exports were higher than expected, boosting optimism about a recovery in the world's second-largest economy.

Meanwhile, hopes of a ceasefire in the Israel-Hamas conflict are limiting the rise in oil prices. There is some hope that negotiations this week should be able to close the gaps between the two sides.