US futures

Dow future -0.4% at 38,720

S&P futures -0.47% at 5330

Nasdaq futures -0.4% at 18950

In Europe

FTSE -0.66% at 8227

Dax -0.9% at 18470

- NFP +272k vs 185k expected

- Unemployment rose to 4%, but average earnings also rose

- FOMC & CPI next week

- Oil rises but is set to fall across the week

Stronger NFP data pushes back rate cut bets ahead of CPI next week

U.S. stocks are falling after a stronger than expected non-farm payroll report.

272k jobs were added in May, up from a downwardly revised 165k in April and well ahead of the 185k forecast. Meanwhile, the unemployment rate ticked higher to 4%, up from 3.9% but average earnings unexpectedly rose by 0.4% MoM and 4.1% YoY, defying expectations of a decline to 3.9%.

The stronger report came after mixed data across the week. The ISM manufacturing PMI was weaker than expected, but the ISM services PMI was much stronger than forecast. The data is by no means screaming that the Fed needs to cut rates soon. That said, the narrative could slowly be building toward a rate cut.

Looking ahead to next week, CPI inflation will be released on the same day as the Federal Reserve will announce its interest rate decision.

The market will look for signs that inflation continues to cool, supporting a more dovish-sounding Fed. However, with the CPI set to be released just hours ahead of the Fed rate decision, a quieter-than-expected inflation print could create a star.

The market is pricing in a 55% probability of a rate cut in September down from 69% prior to the data.

Corporate news

GameStop tumbled 20% premarket after the video, and retailers posted a sharp drop in net sales in Q1 while also suffering a loss of $2.3 million during the quarter. The stock had been steeply higher off to Keith Gale, also known as we're in Kitty, who displayed a position last week.

Apple rose 0.3% ahead of the iPhone makers' developers conference on Monday, where it could unveil details on its next major software update.

DocuSign is set to open over 6% lower after the software firm posted second-quarter guidance that disappointed the market even though it beat current first-quarter expectations.

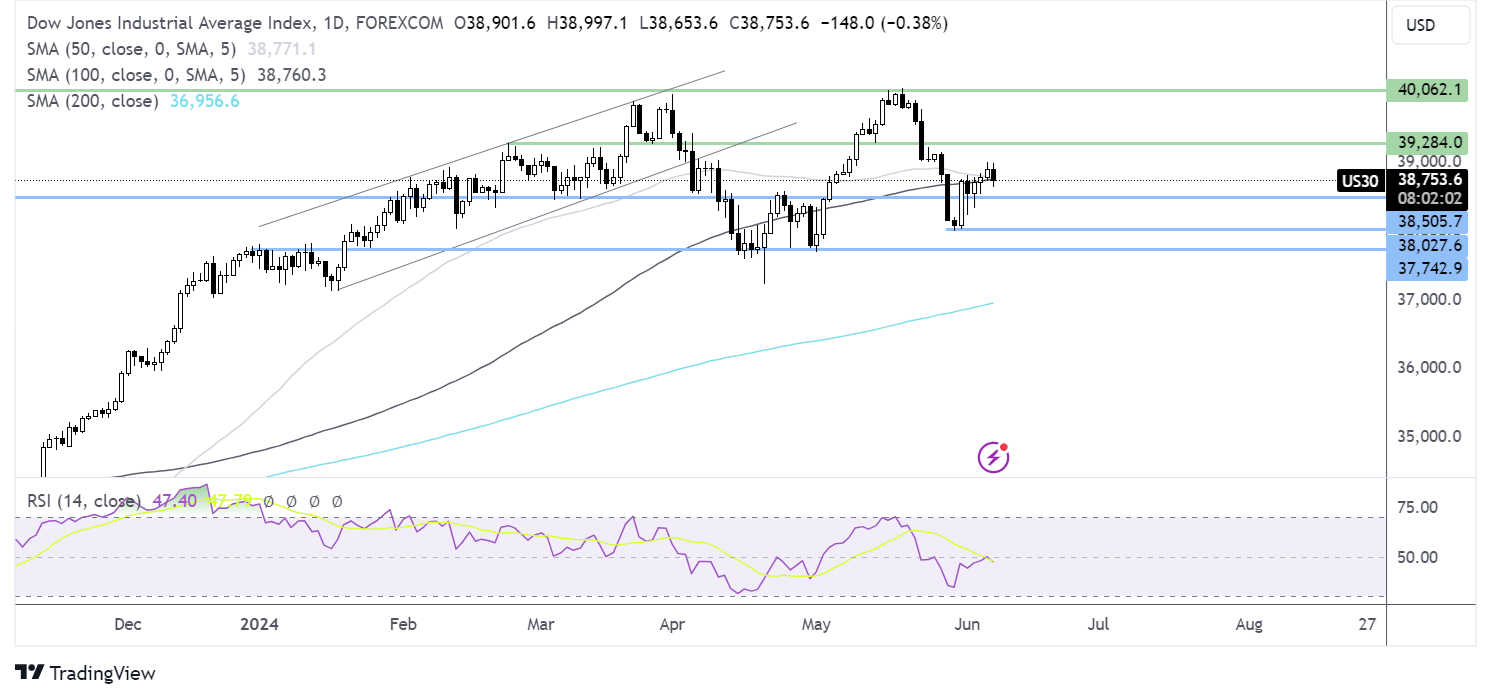

Dow Jones forecast – technical analysis.

The Dow Jones ran into resistance at 39k and is reversing lower, testing the 100 SMA support at 38750. A break below here brings support at 38,500 into play ahead of 38000, the May low. On the upside, should the 100 SMA hold, buyers will look for a rise towards 39,000 and on towards 39284, the March high.

FX markets – USD holds steady, GBP/USD falls

The USD is rising after the US nonfarm payroll data, which has seen the market push back Federal Reserve rate cut expectations. The Fed meeting is next week, along with key inflation data.

EUR/USD is falling after the US NFP report, and as investors continue to digest the ECB interest rate decision yesterday—the central bank cut rates by 25 basis points for the first time since 2019. The ECB failed to commit to a future path for rate cutting, which offered some support to the euro. GDP data showed that the eurozone returned to growth in the first quarter of this year.

USD/JPY is rising after the US non-farm payroll report. Investors now look ahead to next week, which will see both the Federal Reserve and the Bank of Japan make interest rate decisions. A dovish-sounding Fed and a hawkish-sounding Bank of Japan could help the pair below the 155 level.

Oil rises but falls across the week.

Oil prices are extending gains for a third straight day as they recover from the 4-month low reached earlier in the week. However, oil prices are still set to fall over 1% across the week, marking the third straight weekly decline.

Oil prices are set to fall across the week after OPEC+ Sunday's decision to start phasing out voluntary oil cuts towards the end of this year, increasing supply.

Meanwhile, oil is weighing up the demand picture. Chinese data showed that exports grew for a second straight month in May. Although import data underlined concerns about weak domestic demand, and crude oil imports also fell.

Concerns over China are being offset by stronger and then optimism that the Federal Reserve could start cutting interest rates soon, which would be a good sign for the demand outlook.