Dow Forecast Update: The Dow has reached its 4th record high in as many days, on a day when the Nasdaq was plunging. Sector rotation is the name of the game. This has helped to lift non-tech stocks as tighter US chip sales restrictions to China triggered a sell-off in shares such as Nvidia (-6%), AMD (-8%), Microsoft (-2%) and others in the so-called magnificent 7 group. The Dow has also been boosted by a big rebound in oil prices, lifting energy names.

Why is the Dow rallying despite tech selloff?

The Dow, and the small-cap Russell 200 have both enjoyed a big rally in the last several days, presumably because of the inflation report released last week which showed consumer prices falling to 3.0% y/y in June, which was better than expected. Small caps, energy and financials have all benefited while technology stocks have fallen amid rotation into value from growth.

So, despite the tech slump, sentiment remains positive towards US stocks amid confidence that the Federal Reserve will cut rates. It is just that the tech sector is no longer looking valuable at these still-high levels for many. As we have seen repeatedly in the past, correction like the one we have seen this week in the tech sector have been bought fairly quickly. Don’t be surprised if we witness another dip-buying into the sector once profit-taking pressure subsides.

Dow Forecast: XLE and XLF extend rally

Supporting the big breakout in the Dow, we have seen two major sectors rally sharply in the last few days.

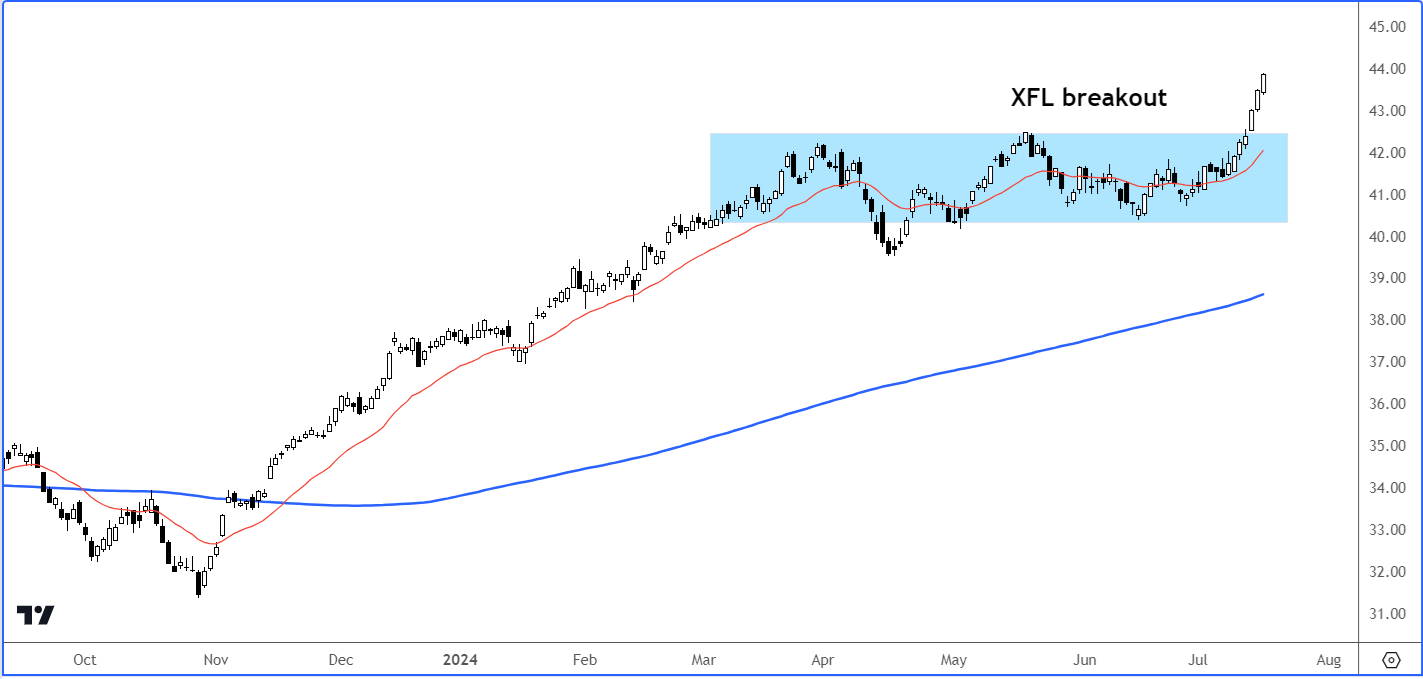

As per the chart of the Financial Select Sector SPDR Fund (XLF), we have seen a breakout in the sector after a multi-month consolidation ended last Friday. The XLF broke out and hasn’t looked back since:

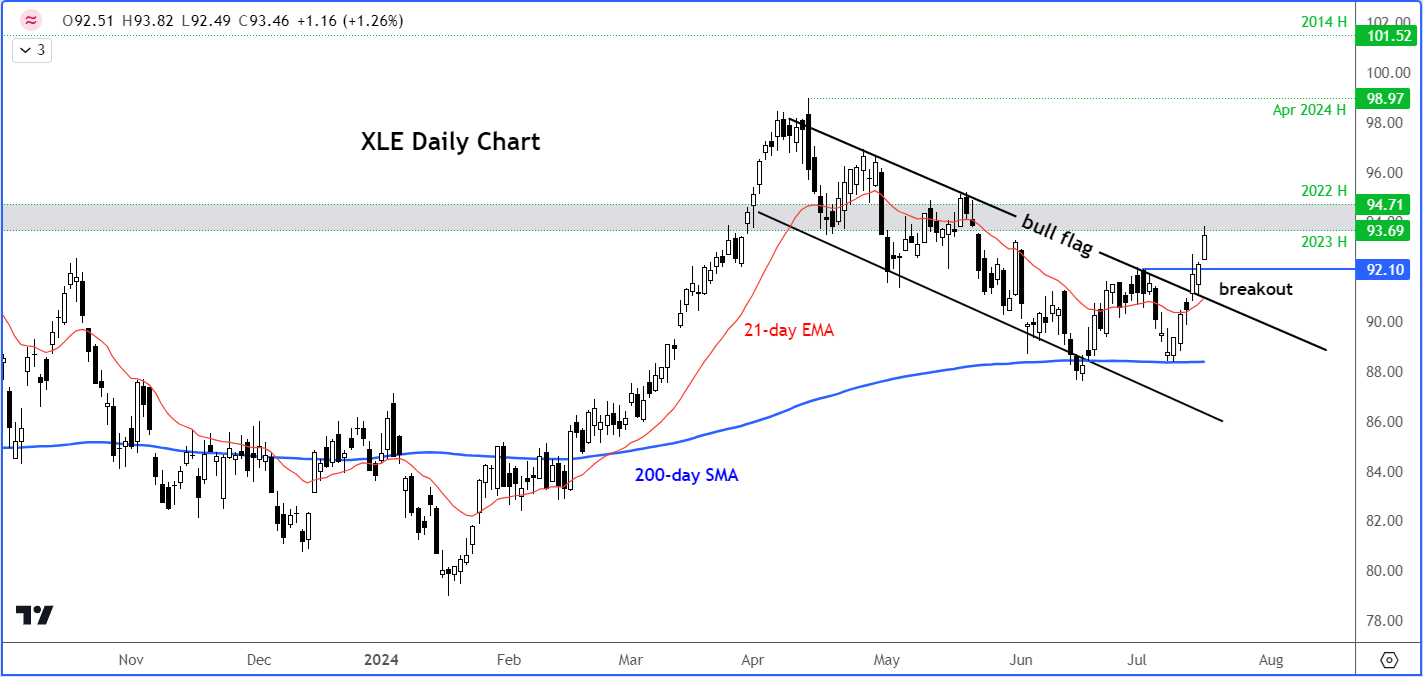

Similarly, the chart of the Energy Select Sector SPDR Fund (XLE) has broken out of its own continuation pattern to the upside – this one being a bull flag:

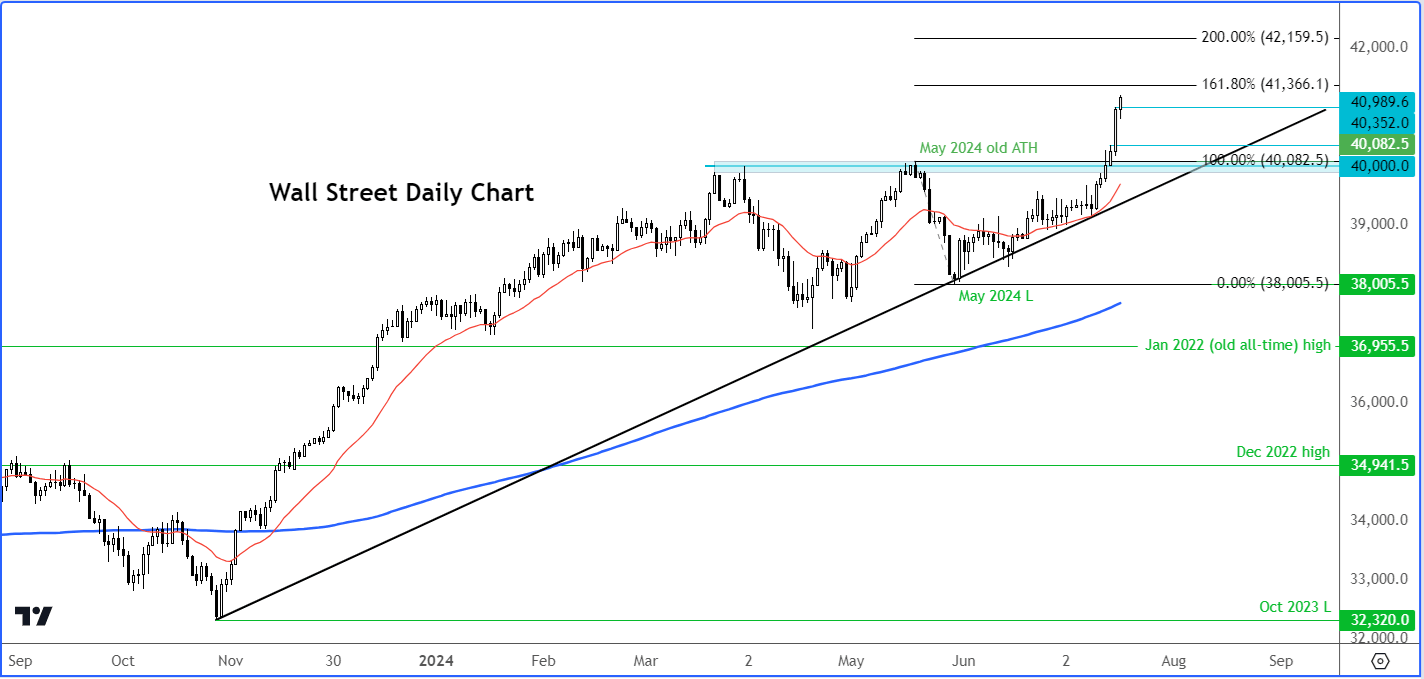

Dow Forecast: Technical analysis

Given this week’s bullish breakout, the path of least resistance on the Dow Jones remains to the upside. Now that it has broken above key resistance and a psychological hurdle of 40,000, this area is going to be the most important support on any future dips. Below that area, the 39450-39680 zone would be the next key area to watch. On the upside, the next Fibonacci-based extension level comes in at 41,366, marking the 161.8% extension of the last significant move down from the May high.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R