The German DAX index hit a fresh record high on Thursday in the aftermath of the Fed’s dovish rate cut, which lifted global indices. However, it looks like investors are making a more sober assessment of the Fed’s rate cut today, especially outside of the US markets. Investors are realising that perhaps the optimism was exaggerated, especially with concerns about growth in Germany and China being at the forefront of investors’ minds. Today’s drop in the German luxury auto sector underscores those concerns, ahead of global PMI data. Concerns over the escalation of the middle east situation further hurt sentiment in Europe. Still, the DAX forecast is not completely bearish yet given that we have only just hit another record high this week. Bearish speculators will be in need of some downside follow-through to grow in confidence that at least a short-term top is in.

German car markers plunge to dent the bullish DAX forecast

Indeed, the German and Chinese economies are struggling and today we saw more evidence of that with Mercedes-Benz Group shares taking a big tumble to record their largest drop in four years due to a worsening slowdown in China, leading the world's top luxury carmaker to lower its forecast.

Mercedes-Benz shares plummeted by more than 8% in Frankfurt, marking the biggest intraday fall since 2020. The profit warning from Mercedes also impacted the broader industry. BMW shares declined by more 4%, while VW, BMW and Porsche, all found themselves near the bottom of the index.

Looking ahead: Global PMIs due on Monday

The week ahead will be a quieter one after this week’s central bank action. Among the key data highlights will be the global flash PMI data from the UK, Eurozone and US, which will provide us a quick snapshot of the health of the manufacturing and services sectors, relative to the previous month. Eurozone manufacturing has been the weakest spot, leaving the services to do the heavy lifting. Any surprise improvement here should help support the euro, while recession alarm bells could go off again should we see surprisingly weak numbers.

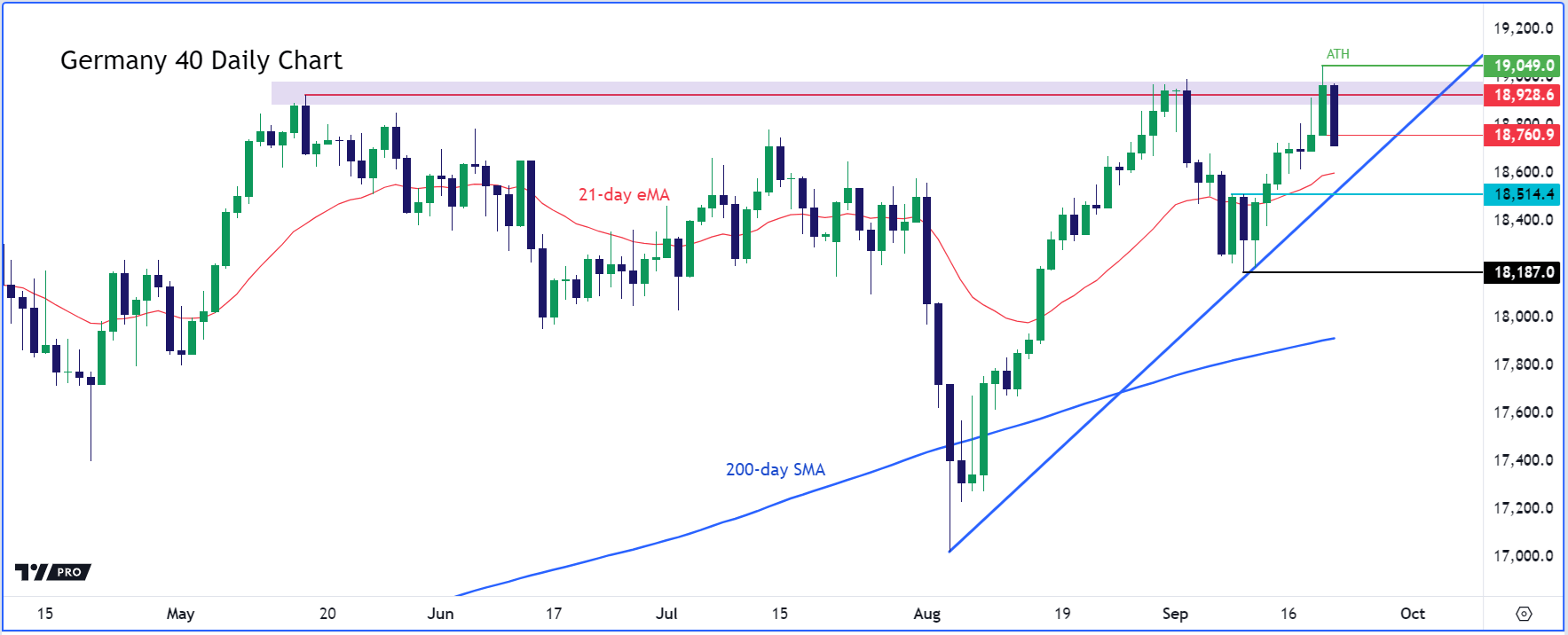

DAX forecast: Technical analysis

Source: TradingView.com

Today’s unconfirmed bearish engulfing candle wouldn’t appease the bulls much, not when you have just managed to push the index to a new all-time. If the index closes around the current levels, we may see some downside follow through as disappointed bulls rush for the exits in early next week. Longer-term investors won’t be too bothered about today’s bearish price action, for as long as we don’t see significant follow-through that causes a major reversal in the trend. Short-term resistance is now the low from Thursday at 18760, followed by that 18930 zone. Short-term support comes in around 18600, marking the trend line, followed by 18,515. The bears will get interested if we get below the recent low of 18,187. If that level is crossed, the technical DAX forecast will turn bearish as we will have out first lower low in place.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R