- Crude oil outlook boosted above all by OPEC+ supply cuts

- Supply fears re Middle East could intensify again

- Oil prices are demand inelastic

Earlier, crude oil prices were lower, extending their losses for four days. But then prices bounced sharply off their lows, presumably on the back of a WSJ report that Israel has agreed to a request from the US to delay a ground incursion into Gaza. On the surface, the news should have been bearish for oil. But the report goes on to say that the delay is so the US can get more missile defences in place. What’s more, the WSJ article says the air defences could be in place "as early as later this week." In other words, there is no de-escalation in the situation and a ground invasion remains very likely.

Crude oil prices had struggled to rise further lately. Fears about demand had replaced concerns about tight supplies and supply-side shocks that could arise if the situation between Israel and Hamas draws in oil-producing nations into the conflict. So far, this has thankfully not happened.

But the premium that was built in oil prices on Middle East fears have now been mostly removed. The downside should therefore be limited from here, as oil prices are quite demand inelastic. It is a supply-driven market. Right now, the OPEC and its allies like Russia continue to intervene by withholding supply. This argues against a big drop in oil prices. Until they change tact or non-OPEC supply increases massively, oil prices should continue to find support on any sizeable dips.

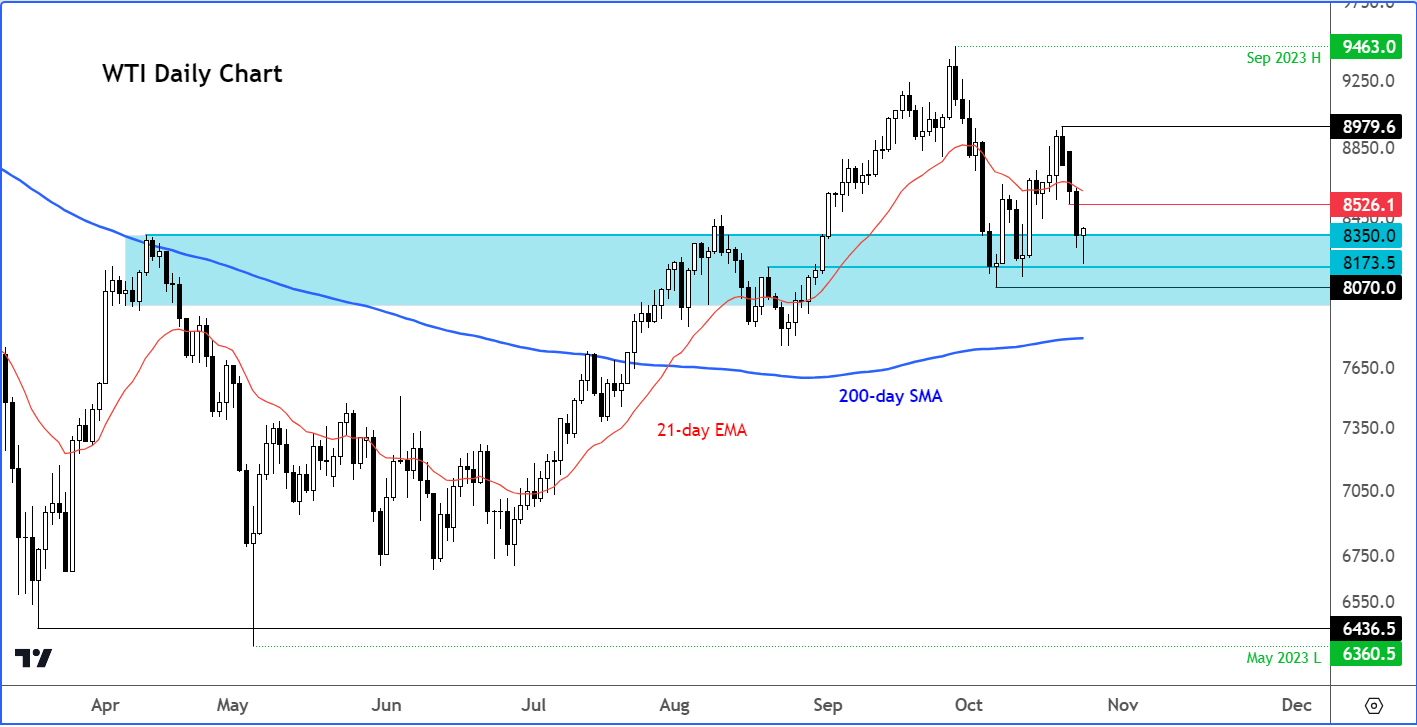

WTI Technical analysis

Source: TradingView.com

At the time of writing, WTI was fast recovering from its earlier lows in a potential bullish reversal sign for oil prices following three days of losses. WTI found support from around $82.00 area, which happens to be inside a larger support zone I have highlighted on my chart in blue shading. Previously, WTI had consistently found strong resistance in this zone. But now that price is testing it from above, could we possibly see the start of the next leg up from here?

What I would be looking for from a bullish point of view is the formation of hammer-like candle today to signal a potential turning point for oil prices. If that happens, then the next area of trouble to look out for would be around $85.26, the low from Monday. A close above that level would put the bears in a spot of bother, potentially leading to a short-squeeze rally.

However, if there are no signs of support today, then the wait must continue for the bulls. But just because oil prices cannot find support does not make it a market to short. Given the situation in the Middle East and the OPEC+ ongoing intervention, shorting oil in the current environment is akin to playing with fire. So, I am not even entertaining the idea of it.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R