Key Events for the Week Ahead:

- US Advance GDP (Thursday)

- US Core PCE (Fed’s Favored Inflation Gauge) (Friday)

- Crude Oil Inventories (Wednesday)

Following bearish pressures from declining Chinese GDP, the spotlight now shifts to US GDP. In the first quarter of 2024, the US GDP recorded a significant decline, falling from 3.4% in the final quarter of 2023 to 1.4%.

This contraction, driven by elevated interest rates, has been reflected in leading economic indicators over the past two months. The risk of delaying rate cuts is tied to a contracting economy, which could potentially lead to a recession. This scenario signals bearish implications for oil demand and prices.

Crude Oil Inventories

Crude oil inventories have shown three consecutive and significant drops, reflecting elevated demand during the summer season, and maintaining positive effects on the chart. However, the overall technical outlook for oil remains bearish below the $85 mark.

Fed's Favored Inflation Gauge

The Core PCE reading, set for release on Friday, will be crucial for market volatility this week. A 0.1% drop from the previous reading could signal a retest of 2020 levels, confirming the disinflation trend and supporting a potential rate cut. Conversely, an increase could provide the Fed with justification to keep rates unchanged for the short-term horizon.

Key Levels for the Week Ahead

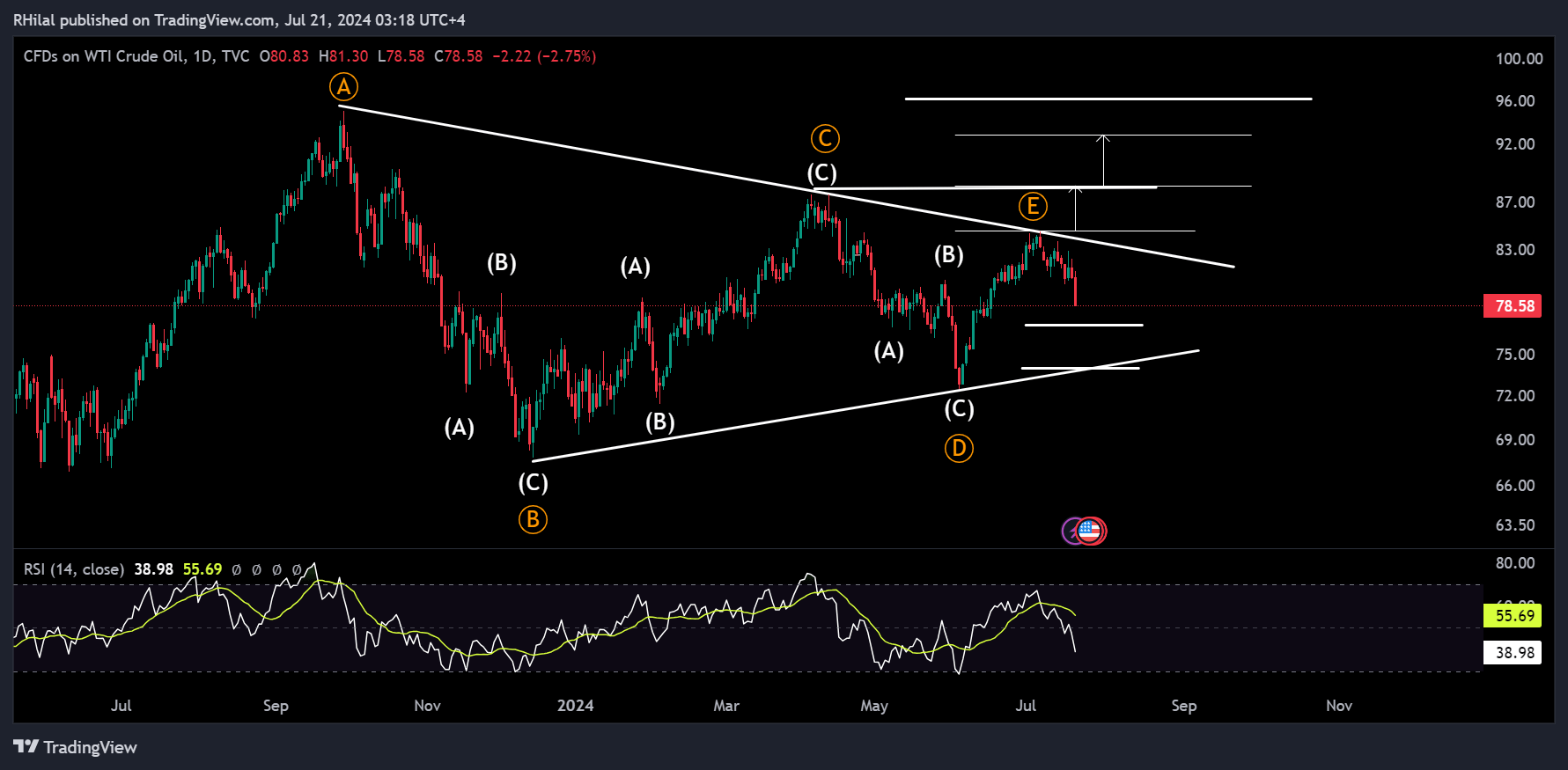

Crude Oil Forecast: USOIL – Daily Time Frame – Logarithmic Scale

Source: Tradingview

Following the respected triangle pattern, oil is delving deeper into its consolidation after retesting the 0.618 Fibonacci retracement of the drop between the high of July 5th and the low of July 16th. Bullish factors, such as inventory reports and geopolitical events, have triggered this retest.

This week's key levels are as follows:

Downside Support Levels:

- Short-term: 77 and 74

- Long-term: 72 and 68

Upside Resistance Levels:

- Short-term: 80 and 82

- Long-term: 84.30-85, 87.30, 92

--- Written by Razan Hilal, CMT