Crude oil analysis: After a small rebound on Monday, both crude contracts have now turned negative on the week, with oil prices threatening to fall for the third consecutive month. With prices drifting lower with short-lived recovery phases here and there, there is an increased probability we could see prices break down, especially with no signs of any acceleration in import demand in China, Europe or North America, or a change in OPEC plans of slowly increasing withheld crude supplies. The upcoming release of the ISM manufacturing PMI is likely to have only a modest impact on oil prices, potentially unable to change its current bearish course.

Why have oil prices fallen?

Hopes that the US driving season would propel prices to new 2024 highs this summer failed to materialise as demand remained weak in key economic regions like China. At the same time, the OPEC+ appeared content with plans to increase output from the fourth quarter. The optimistic demand forecasts from the OPEC have failed to materialise, with China, the world’s largest crude importer, struggling for economic growth. European economies have also struggled, while growth in the US has slowed down markedly.

The fact that recent data shows no signs of any acceleration in import demand in China, Europe or North America points to a situation where the oil market is not going to be as tight as expected a few months ago. The excess supply will need to be worked off either through reduced oil production or a sudden lift in global economic recovery. Neither of these scenarios appear likely or imminent.

Crude oil analysis: What could the OPEC+ do to turn the tide?

As mentioned, the OPEC+ is apparently content with plans to increase output from the fourth quarter. “Content” is obviously being happy even if they don't get and achieve what they wanted i.e., high oil prices. But “content” may turn into disappointment if prices do not change course, and soon. Should oil prices fall further, then the OPEC will have a big decision to make.

They could bite the bullet and let oil prices fall. This will cause short-term pain but may have a more positive long-term impact. By letting prices slide, they will once again drive out competition from high-cost US shale oil producers. What’s more, the resulting lower prices could boost the global economy and help in the disinflationary process, causing central banks to lower interest rates and eventually a rightward shift in the global demand curve. But this strategy may not go down too well, especially with countries that rely heavily on higher oil prices. They may not be able to tolerate lower prices for a long period of time.

Instead, the group could simply change its mind and kick the can further down the road. That it, the OPEC+ may have to surprise the market and refuse to lower output just yet. It may be able to buy some time with global inflation and oil prices now not as high as they once were, and risks of a major escalation in the Middle East conflict appears to be low. This strategy could well provide at least another short-term boost to oil prices.

Crude oil technical analysis: Key levels to watch on WTI

Source: TradingView.com

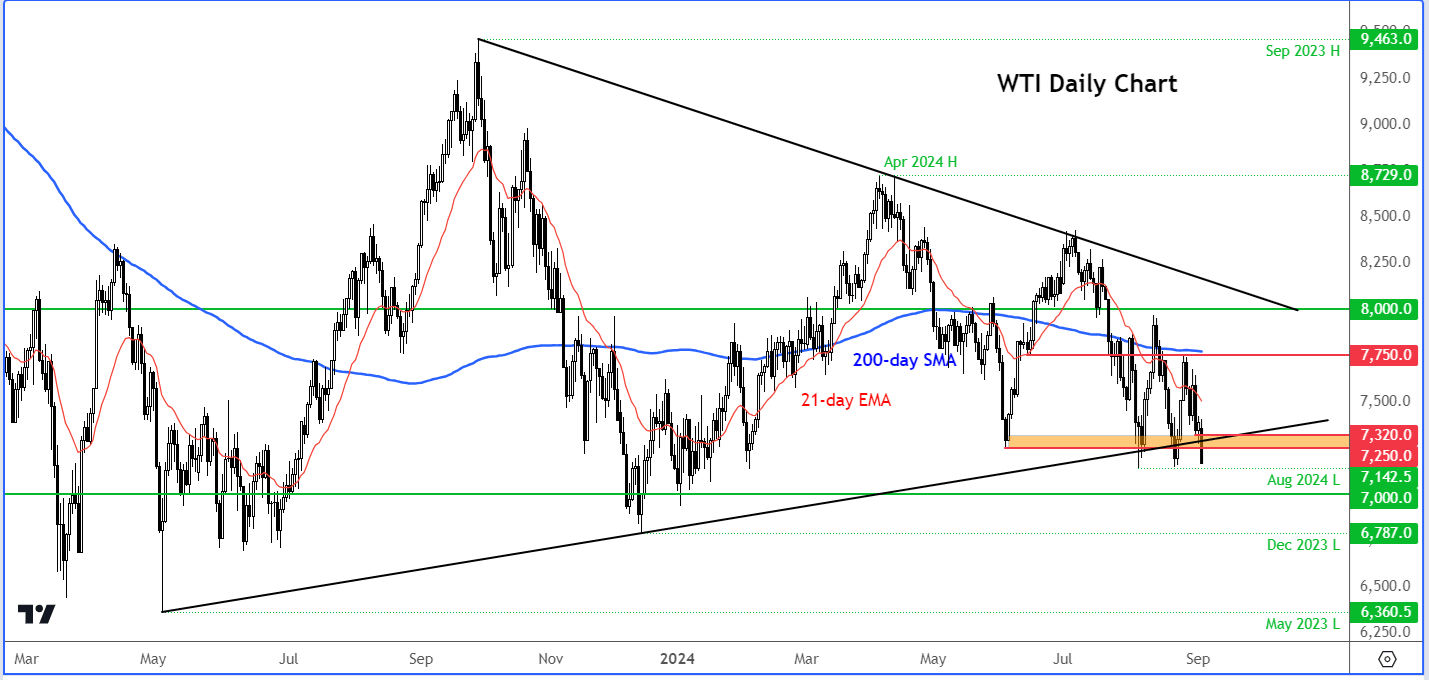

Given the lower lows and lower highs observed in oil prices in recent weeks, a breakdown appears likely especially with WTI now below the bullish trend line that had been in place since May 2023. From a here, a dip below the August low of $71.42 looks likely, with $70.00 likely to be the next downside target for the bears. Below that, the December low comes in at $67.87.

In terms of resistance levels to watch, the area shaded in orange between $72.50 to $73.20 marks a key short-term resistance area. Here, oil prices had bounced from back in June and again in August. But now it could offer resistance instead.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R