- Crude oil analysis: Factors supporting oil price include optimism over China, bullish forecast from IEA and general strength in commodities

- Crude oil extends weekly gains to over 3% with Brent above $84, reaching best levels since November

- WTI technical analysis point towards mid-$80s

Crude oil prices have extended their weekly gains to over 3%, with Brent climbing above $84 per barrel to reach its best levels since November and WTI has moved above the key $80 mark. Oil investors are expecting strong demand from China while the ongoing supply cuts by the OPEC+ means there is the potential for a supply deficit. Oil’s latest gains come hot on the heals of a sharp rally in copper and silver prices and following gold’s breakout to a record high last week.

Crude oil analysis: What factors are supporting oil prices?

Support for oil has come from several sources this week, including the International Energy Agency (IEA) warning of a supply deficit throughout the year, hopes over strong demand from China and US crude stockpiles shrinking unexpectedly.

The IEA changed its earlier projections of an excess supply due to expectations that OPEC+ intends to prolong its production reductions in the latter part of the year. Additionally, the IEA raised its estimates for global oil demand growth in 2024 by 110,000 barrels per day to 1.3 million barrels, citing a more robust US economic outlook and heightened demand for marine fuel. This increase in demand is attributed to ships opting for longer routes to evade Houthi attacks in the Red Sea.

In the US, inventories dropped by 1.5 million barrels, marking the first drop in seven weeks, with a drop in stocks at the hub in Cushing also painting a bullish picture for oil.

Why have commodity prices rebounded?

The recovery in oil prices come as key commodities like copper, gold and silver have all rallied sharply in recent days. The rise in key commodity prices is in part due to optimism about a Chinese demand recovery. We have seen metal prices like copper and silver break out this week, with the former rising above $4.00 and the latter hitting $25 per ounce. WTI crude oil has hit $80 per barrel today.

In so far as copper is concerned, it is gains coincided with a report of an agreement being reached among some Chinese smelters to cut production due to a collapse in processing fees, raising fears about a shortage of refined metal. Chinese smelters, which are the leading global producers and consumers of refined copper, are encountering financial difficulties due to declining fees for converting copper concentrate into metal. This situation raises the possibility of production cuts, which could result in a supply shortage.

WTI technical analysis

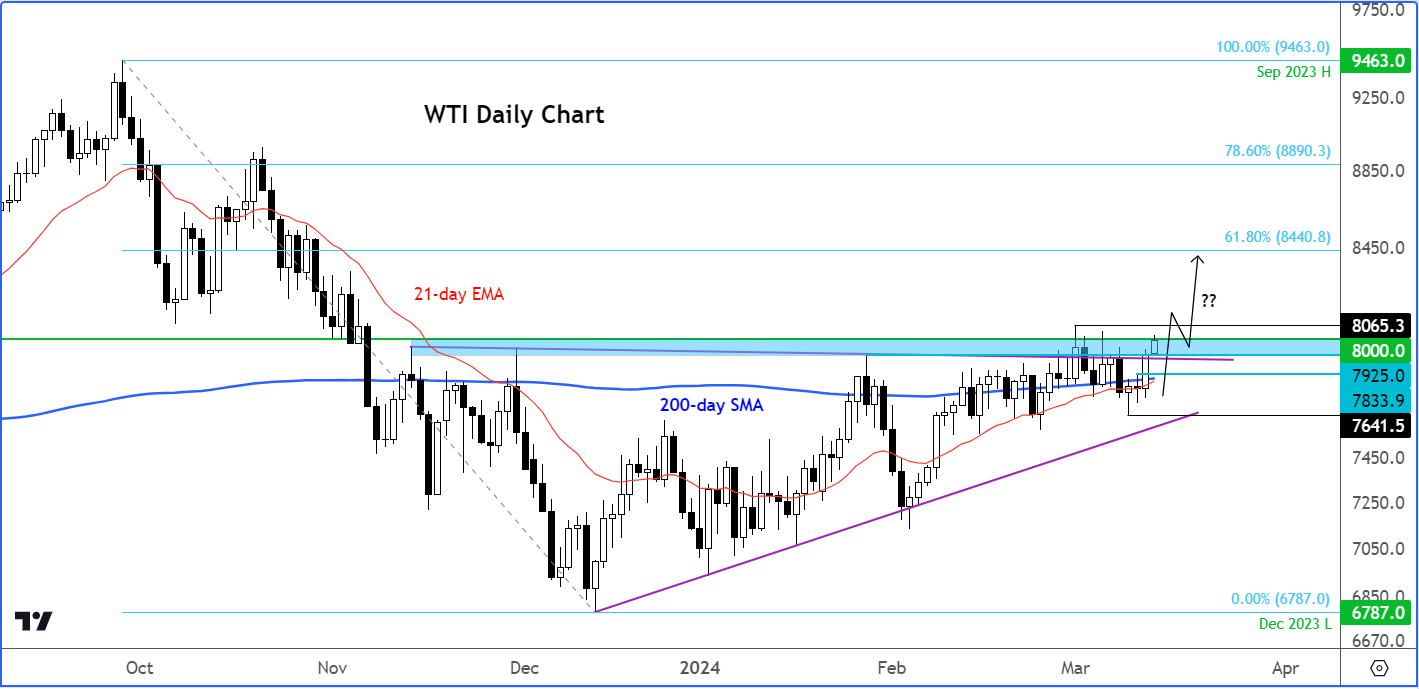

Source: TradingView.com

WTI is looking constructive from a technical point of view, following three months of volatile but rising prices. WTI had repeatedly sold off from around the $79.00 area on multiple occasions since November. Now that we have a clean break above this zone, the technical path of least resistance has been confirmed to the upside.

The bulls would like to see a daily close above $80 to maintain the bullish momentum. If this condition is met, WTI could be heading towards $82.00 next, and potentially climb towards $84.40, which corresponds with the 61.8% Fibonacci retracement level of the downswing from September.

On the downside, key support is seen around $79.25ish, followed by Tuesday’s high at $78.34. The invalidation point form now is at around $76.41 now, where this week’s rally has started. Should oil prices break that level, then this could lead to a sharp withdrawal of bids, leading to a correction. However, this is not my base case scenario.

-- Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R