- Crude Oil Analysis: USOIL breaches five-week lows

- Saudi Aramco Base Oil breaks below its yearly lows

- U.S crude oil inventories drop again this week by 2.5M barrels

- Chinese economic data is awaited for an updated outlook on oil demand potential

- OPEC June 1 meeting probabilities lean towards an unchanged output, according to CME Group

Crude Oil analysis lies at a critical juncture with a rising debate between OPEC members: some are unwilling to cut oil production below their capacities, while others seek to shore up crude prices. As previous policies have shown, OPEC members would adhere to supply cut quotas while non-members fulfill the global demand. However, members such as Iraq and UAE are eager to secure higher production levels onto 2025 with their increased production capacities.

U.S CPI metrics cooled down and are still above the Fed’s desired 2% target rate, reflecting a difficulty for a rate cut on the near horizon

In terms of crude, lower inflation levels are preferred for a better demand outlook. However, sticky inflation rates would raise questions about the ease of economic growth and demand potential. From an inventory perspective, crude oil inventories have decreased this week by a 2.5M barrel change, allowing the chart to temporarily hold on its latest 6-week low.

Quantifying the uncertainties:

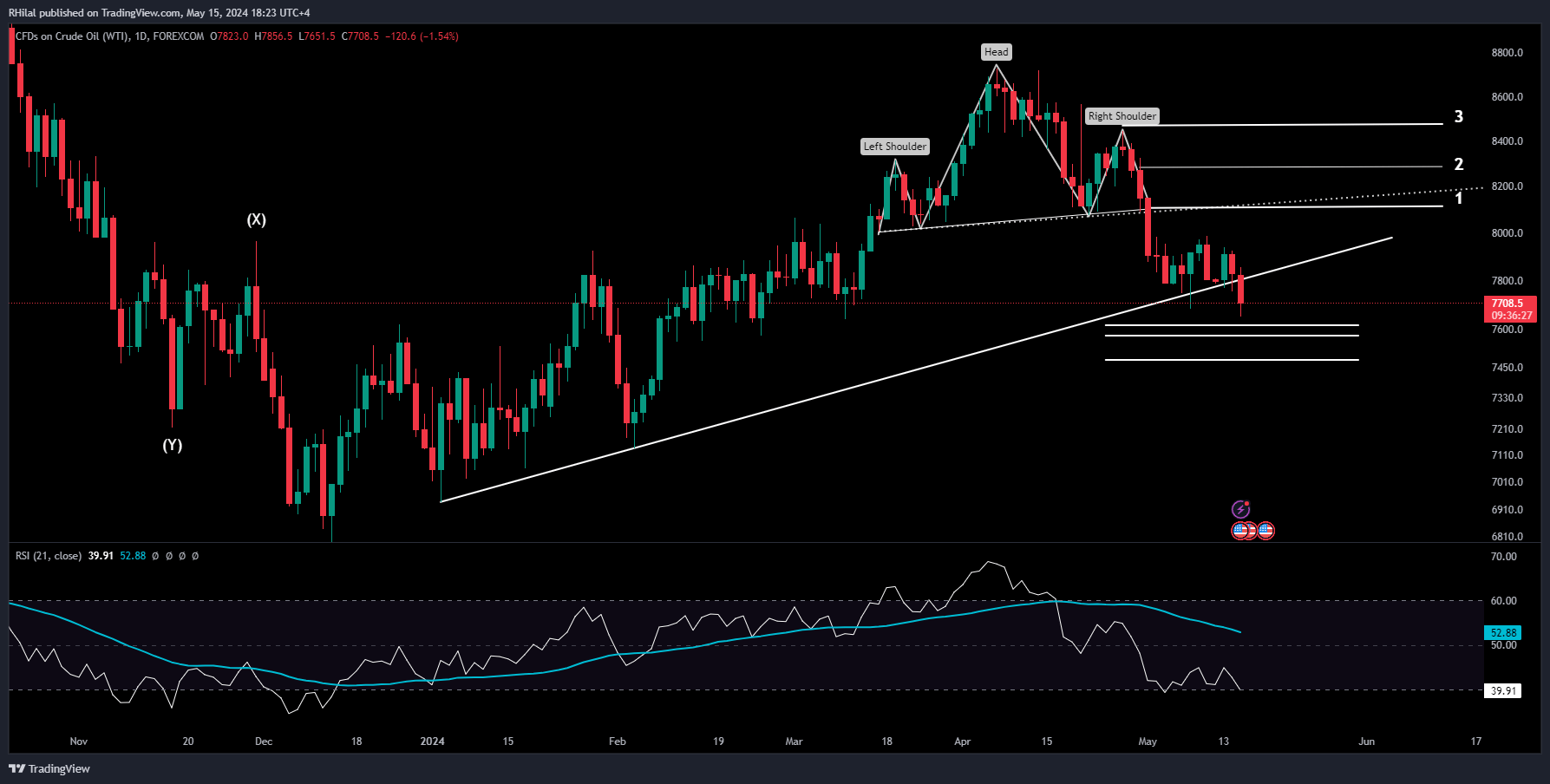

Crude Oil Analysis: USOIL – Daily Time Frame – Logarithmic Scale

USOIL’s largest correction of the year proceeded to a new low of 7651 today, amplifying bearish bias on the chart. Looking at the chart from a pattern perspective, a head and shoulders pattern target could indicate further downtrends if the latest 7651 low is broken. Potential supports can be met near 7620 and 7570 on the short run, and 7530 and 7470 on a longer run. Supporting fundamentals in terms of increasing supply and weaker growth outlooks can confirm a downtrend continuation for crude oil charts. Reversing from the latest lows, upper resistance levels can be met near 81.10, 83, and 84.70 respectively.