This is an excerpt from our full Crude Oil 2024 Outlook report, one of nine detailed reports about what to expect in the coming year. Click the banner at the bottom to download the full report.

Crude Oil 2023 in Review

Concerns over a recession (that never materialized) and decreased global demand weighed on oil prices early in the year. A decline of nearly 46% off the 2022 highs had erased the rally towards 130 with crude prices on the defensive for the entire first-half of 2023.

A technical breakout in July fueled a rally of more than 49% with WTI reversing sharply in September off downtrend resistance. WTI plunged nearly 29% off the 2023 highs with price trading just above multi-year downtrend support into the close of year. A decline of more than 11% year-to-date was marked by a seven-week decline into December with WTI trading at 71.40 at the time of this report. Heading into 2024, the focus is on a key support hurdle in price and with global production shifting to non-OPEC+ nations, the supply-demand outlook continues to favor of the bears. . . for now.

Oil Production

Source: EIA

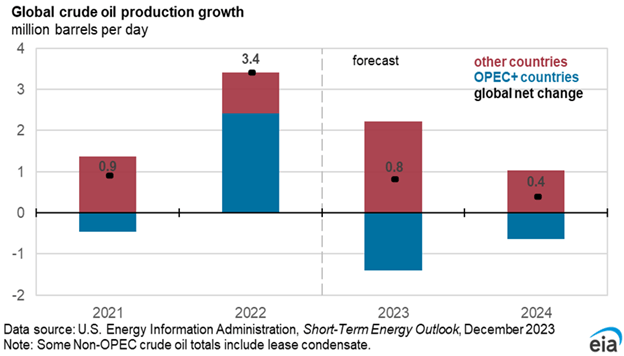

OPEC+ production cuts were extended this year in an attempt to support oil prices but have been ineffective as of yet in stemming the recent sell-off. At the same time, US oil production has steadily increased since the 2020 plunge with this year marking fresh record highs in output. While production has since pulled off, the International Energy Agency (IEA) outlook for 2024 is projecting another record year of output in the US with increases Brazilian, Guyanese, and Iranian flows further lifting supply. The agency expects that non-OPEC+ nations will once again drive global supply gains in 2024 as OPEC+ continues to deepen voluntary production cuts.

Source: EIA

This shift in the global supply remains a central challenge for OPEC and the cartel may take further measures to support oil prices as their market share contracts. Along with the threat of rising geopolitical tensions / aggressions in the Middle East and Asia Pacific (which could impact production / transport), these two threats represent the largest “X” factors for oil prices heading into next year.

What about the outlook for crude oil demand? What are the key technical levels to watch moving forward? See our full guide to explore these themes and more!