- Some commodity prices are starting to run hard

- Bloomberg’s commodity price index has broken its downtrend from early 2022

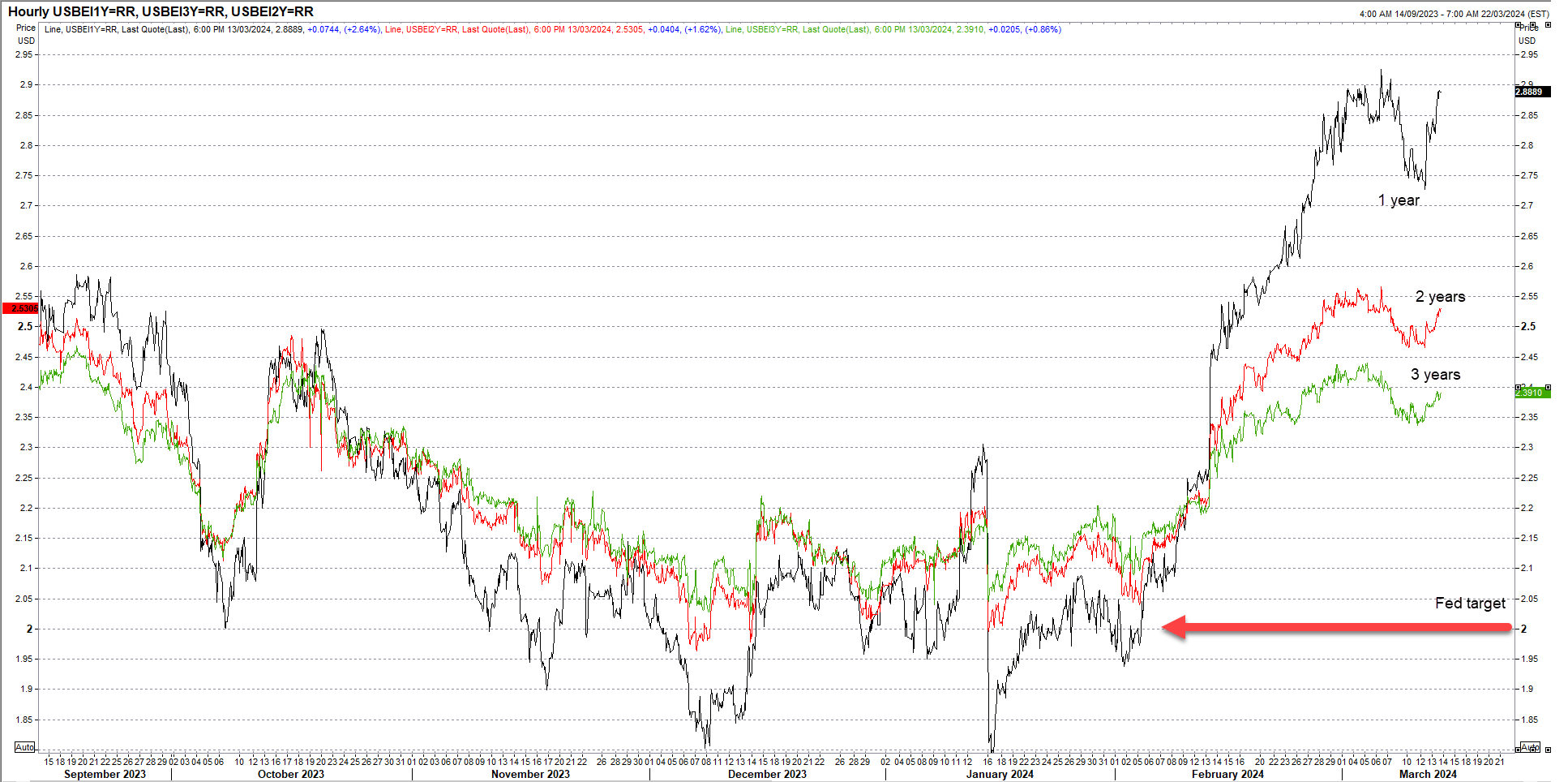

- US inflation expectations are heating up and moving further away from the Fed’s 2% target

Gold, copper, silver, crude, cocoa – it’s a rarity to not come across a particular commodity that’s suddenly running hard. Every day there seems to be another one joining the increasingly lengthy list, providing a sense we may be at a turning point for the broader commodity complex.

It’s not just a feeling but something you can visually see, such as Bloomberg’s Commodity Price Index below. You can read up more about its composition here, but it’s heavily weighted towards energy at nearly a third of index. BCOM, as it’s known, broke the downtrend dating back to when Russia invaded Ukraine earlier this month, triggering another signal that we may be nearing a turning point for commodity prices.

Source: Refinitiv

Commodities sending a message on USD?

Given commodities are universally priced in US dollars as the global reserve currency, the trend break in BCOM may also be sending a message on directional risks for the buck. I’m not a doomer or gloomer but one look as surging market-based US inflation expectations suggests a sense of unease about the Fed being able to, or more to the point willing, to bring inflation back to its mandated 2% target.

Source: Refinitiv

It’s continuing to flag rate cuts while inflation expectations continue to move further away from its target, at a time when the US economy is running beyond capacity, with unemployment still low and wages growth high and the government running the largest non-crisis era fiscal deficits on record, a trend that’s set to continue.

Source: US CBO

As such, it’s not surprising that some commodities are starting to hard, especially when you look at the fragile geopolitical environment, mining sector capital investment and China, the largest commodity consumer globally with daylight second, yet to see economic activity fulfil its true potential.

While you can trade BCOM futures through several exchanges, the point of this note is there’s growing evidence to suggest we may be at turning point for broader commodity prices. Individual commodities where demand is likely to outstrip demand moving forward are likely to fare best, as are existing miners that are already in production. Commodity currencies are another area worth considering, including the likes of the AUD, CAD and select emerging market names. Prior commodity bull markets have been measured in years or even decades, so if this is one of those, the move could have a lot further to play out.

-- Written by David Scutt

Follow David on Twitter @scutty