Central Bank galore with BOJ, Fed, BOE, SNB and RBA on tap: The Week Ahead

We have no fewer than five central bank meetings of major currencies next week, kicking off with the RBA and BOJ on Tuesday, FOMC on Wednesday before SNB and BOE on Thursday. This clearly makes the US dollar a focal point alongside classic major pairs such as AUD/USD, USD/JPY, GBP/USD and USD/CHF. But it can also bring crosses into the mix such as AUD/JPY and GBP/CHF for traders to seek moves on the relative shift of currencies between such pairs.

The week that was:

- A combination of hotter-than-expected CPI and PPI data for the US bought into doubt whether the Fed will actually cut their interest rate in June

- Bond yields jumped and dragged the US dollar higher as bears ran for cover, helping the US dollar index recoup some of the prior week’s losses sustained on ‘BOJ hike’ bets

- Gold snapped its 9-day rally at a record high after the CPI print, although as of yet we’re yet to see a material pullback despite the subsequent hot PPI print

- Bitcoin reached a record high at the beginning of the week before the usual volatility ensues that tends to occur around record highs

- Crude oil prices rose to a 4-month high which saw WTI break comfortably above $80, thanks to the IEA raising their demand outlook for 2024 and Ukraine drone attack on Russia’s oil refineries

- Copper prices rallied above $4 to a 7-month high as China’s top smelters agreed to production cuts

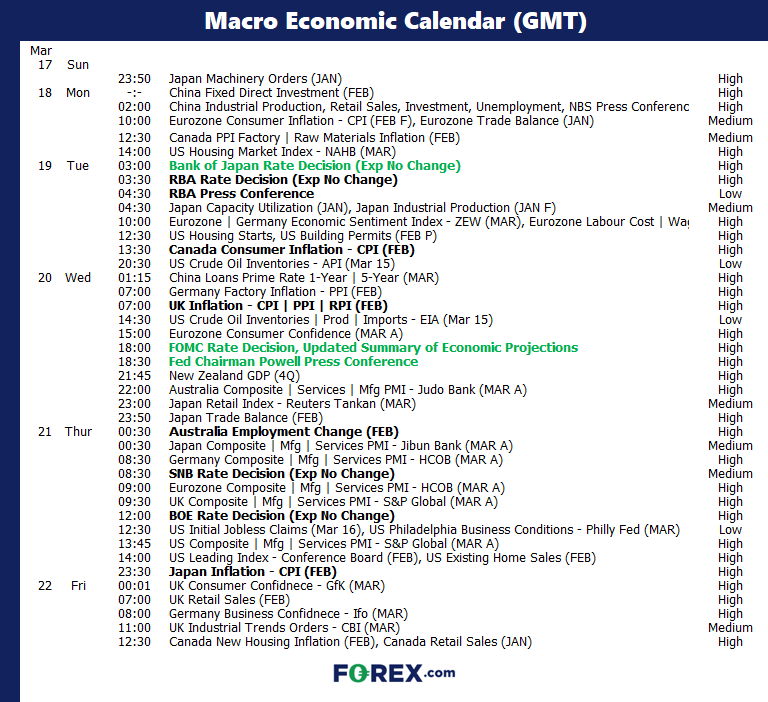

The week ahead (calendar):

The week ahead (key events and themes):

- FOMC meeting

- BOJ interest rate decision

- BOE interest rate decision

- RBA cash rate decision

RBA cash rate decision

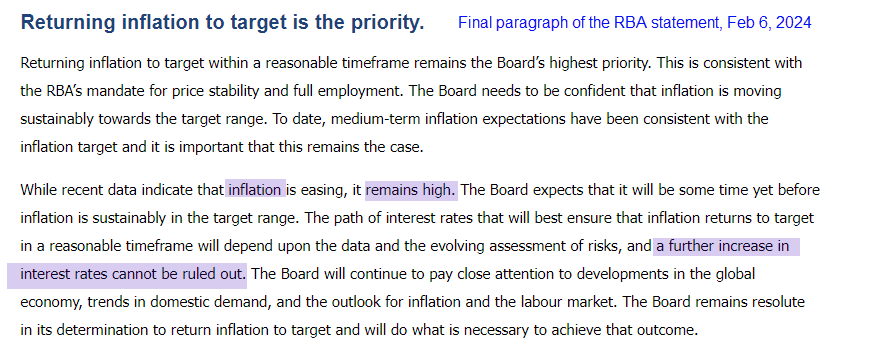

This is arguably the least interesting of all of the meeting, but sometimes less can be more. The RBA surprised traders by retaining their hawkish bias in their statement, so the big question remains; will the RBA remove their hawkish bias next week?

Like many, I’ll be going straight to the final paragraph to see if “a further increase in the interest rate cannot be ruled out” has been removed or altered, alongside inflation being “too high”. The OIS curve remains beneath the RBA’s cash rate of 4.35%, and the cash rate futures curve has fully priced in a 25bp cut for September. Ultimately, markets don’t anticipate another hike given the steady stream of slightly weaker data that has appeared this year.

All polled economists favour a hold according to Reuters, which I am in agreement with. Interestingly, Bloomberg pricing estimates a 33.6% chance of a cut – which I suspect seem dovishly-optimistic given their ‘reserved’ style and slight hawkish bias. Bloomberg pricing and RBA cash rate futures have fully priced in the first RBA cut to arrive in September.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

BOJ interest rate decision

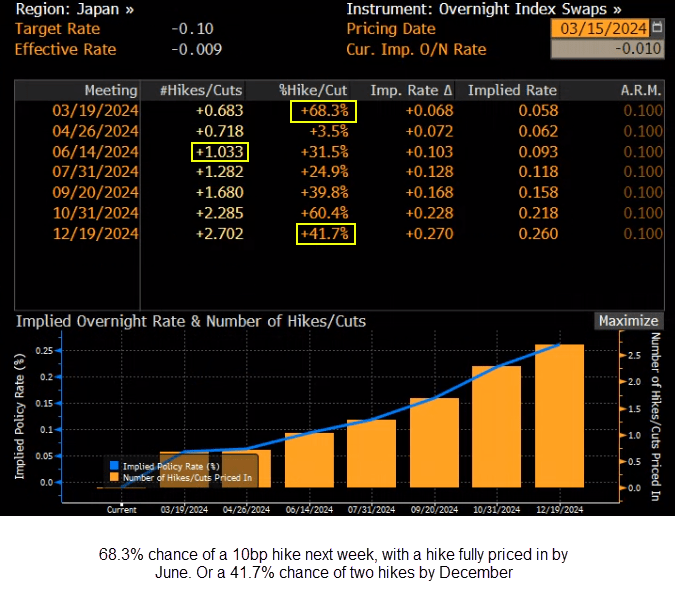

Next week’s BOJ meeting is arguably the most interesting, simply because they might hike rates and ditch negative interest rate for the first time in eight years.

And there’s good reason to believe they just might. Wage negotiations have gone well for the Unions, where large corporations have met all of their demands. Tokyo’s inflation rate (which provides a 3-week lead on nationwide CPI) increased sharply and remains above the BOJ’s 2% target. And we have also had a number of hawkish comments form BOJ governors, and ‘sources’ revealing that the BOJ are contemplating hiking next week.

According to Bloomberg, there is a 68.3% chance the BOJ will hike by 10bp on Tuesday to take rates to zero, with a 31.5% chance it could be delayed until June. And there is a 60.4% chance of a second hike in October.

So with a hike expected between March and June, the bigger question is how much of an impact this could have on USD/JPY, given it 2% during its last week in eight months in anticipation of the cut.

Trader’s watchlist: USD/JPY, AUD/JPY, GBP/JPY, EUR/JPY, Nikkei 225

FOMC meeting

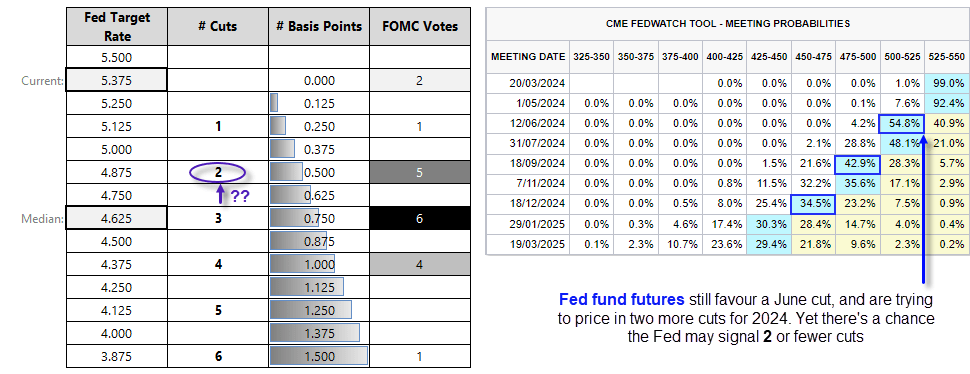

It is practically a given that the Fed will not change policy next week. So once again it is about sharing investors expectation of the future path and trajectory of any potential cuts. Yet this week’s CPI and PPI reports has thrown a spanner in the works for doves, simply because they came in too hot and makes it harder for the Fed to signal any such move at their March meeting.

Bloomberg pricing estimates a 54.2% chance of their first cut to arrive in June and a cut has been fully priced in by July. They also estimate a 67.4% chance of three cuts to arrive by December, which would place it in line with the Fed’s median estimate to three cuts form their December 2023 dot plot.

However, think there’s a real chance the Fed’s median Fed Funds forecast for 2024 may be reduced to two cuts, given the majority of voters who didn’t favour three cuts were dovish. And that could prompt another bout of USD strength as bears cover their short, like we saw after the CPI and PPI figures.

Trader’s watchlist: US dollar index, EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

BOE interest rate decision

Incoming data has seen some banks call for 100bp of BOE cuts this year, potentially beginning in June. For that to become realistic, I imagine we’ll need to see more than the single vote for a cut we saw at their last meeting (which was the first time an MPC member voted for a cut since March 2020). And we’ll likely need to see a particularly soft set of inflation figures on Tuesday.

As it stood last month, two members vote for a hike, one for a cut and six to hold. I therefore doubt we’ll get the dovish go-ahead traders want to hear at next week’s meeting. Yes, wages and employment are lower – but has it really deteriorated fast enough to warrant a drastic change of mind among the 6 who voted to hold and 2 for a hike? I remain sceptical.

Bloomberg pricing estimates a 56.2% chance of a 25bp cut in August and a 64.5% chance of a second cut arriving in November, which seems more realistic to me. The question then becomes whether the BOE will have the appetite to signal this next week, and again I remain sceptic.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

As for the rest:

AU employment: The RBA meeting ahead of Thursday’s employment report, which detracts from its potency. But it we see unemployment continue to rise and job growth falter, it builds a case for a rate cut sooner than September and could weigh on AUD/USD.

SNB interest rate decision: No change is expected, although Bloomberg estimates an 82.6% probability of a cut in June.

Inflation figures: CPI reports for UK, Canada, and Japan are released. The BOJ meeting would have already been and gone, and its likely we’ll see it move higher anyway as that is what we saw on Tokyo’s data. But if its hotter than expected, odds increase for a hike in June – assuming the BOJ didn’t hike next week already.

UK inflation is released ahead of the BOE meeting, but as mentioned above it would take quite a set of weak data to convince the BOE to get too dovish next week IMO.

Canada’s inflation figures have continued to soften, and should that trend persist then it could weaken the Canadian dollar on bets of a sooner BOC cut. Bloomberg estimates a 51.5% chance of a 25bp cut in July.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge