Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- USD/CAD rebounds off downtrend support- rallies more than 1.3% off August low

- Recovery vulnerable into initial resistance hurdles- risk for price inflection

- Resistance 1.3613/34, 1.3667(key), 1 .37- Support 1.3573, 1.3546, 1.3472/93(key)

The US Dollar has rallied more than 1.3% against the Canadian Dollar with USD/CAD testing technical resistance on the heels of the today’s US CPI releases. The focus is on a reaction off this mark with the two-week rally vulnerable while below this pivot zone. Battle lines drawn on the USD/CAD short-term technical charts heading.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

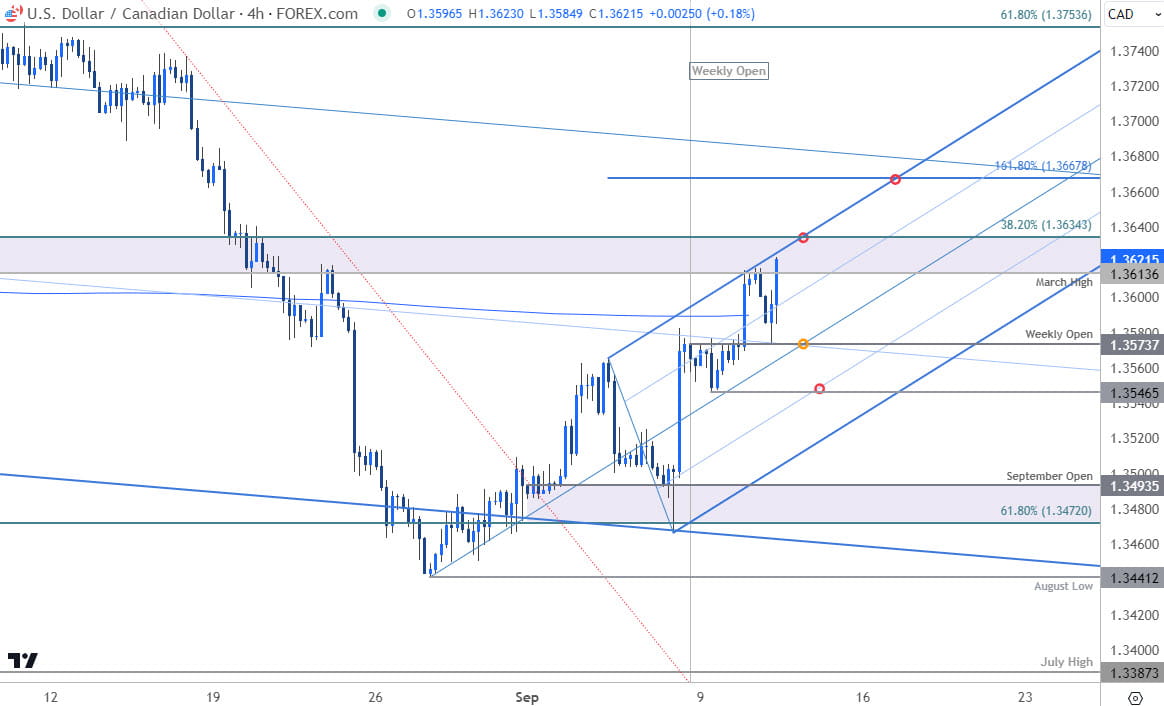

Technical Outlook: In last month’s Canadian Dollar Short-term Outlook we noted to be on the lookout for possible price inflection as USD/CAD was testing confluent support- “rallies should be limited to 1.37 IF price is heading lower on this stretch with a close sub-1.36 needed to keep the bears in control.” USD/CAD plunged lower the following day to mark the largest single-day decline since December.

The sell-off marked a false-break of key support around the 61.8% retracement of the December rally at 1.3472 with the August open registering just above. The recovery is now approaching initial resistance at the December high / 38.2% retracement of the August range at 1.3613/34- looking for possible price inflection into this threshold this week.

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows USD/CAD trading within the confines of an ascending pitchfork formation with the upper parallel further highlighting near-term resistance here at 1.3613/34- looking for a reaction here. Weekly-open support rests at 1.3573 and is backed by the objective weekly range-low at 1.3546. The broader outlook remains constructive while within this structure with key support now seen at 1.3472/93.

A topside breach / close above this pivot-zone exposes the 1.618% extension of the late-August advance at 1.3667- look for a larger reaction there IF reached. Ultimately a close above the median-line of the broader descending structure would needed to suggest a more significant reversal is underway – subsequent resistance objectives eyed at the 1.37-handle and the 61.8% Fibonacci retracement at 1.3753.

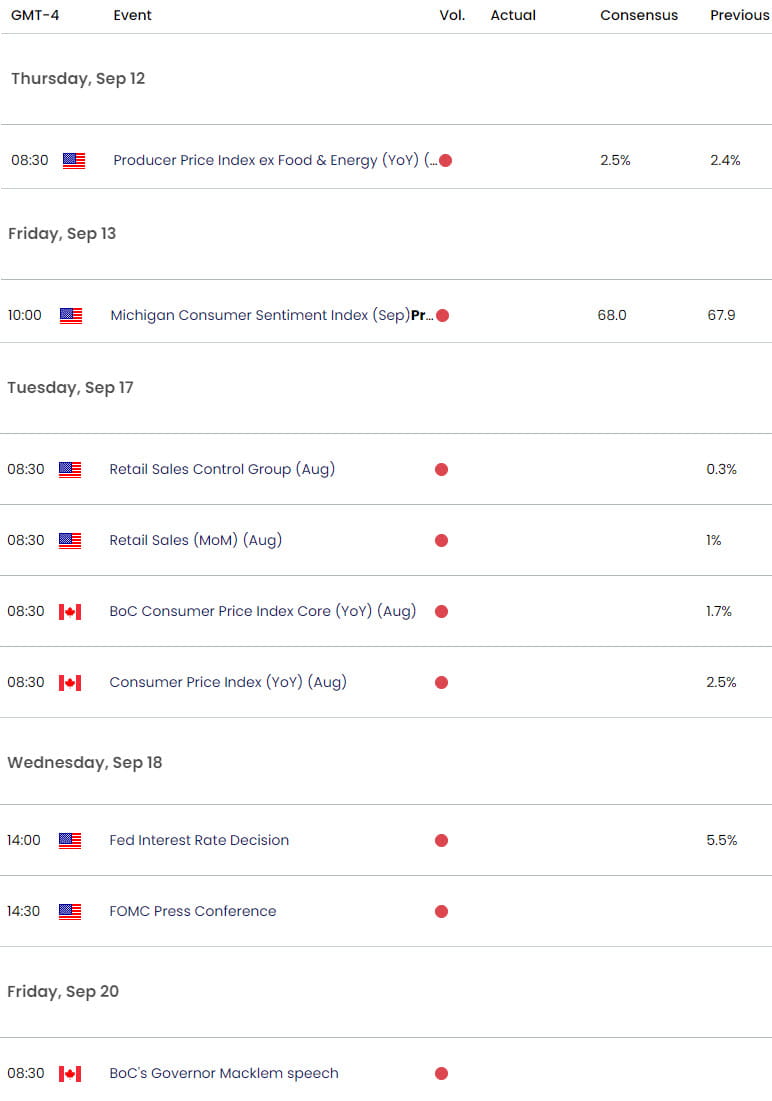

Bottom line: A two-week recovery off support takes USD/CAD into initial resistance hurdles here- risk for topside exhaustion / price inflection in the days ahead. From at trading standpoint, losses would need to be limited to the weekly low IF price is heading higher on this stretch with a close above 1.3634 needed to fuel the next leg in price. Keep in mind the FOMC interest rate decision is on tap next week- stay nimble into the release and watch the weekly close here. Review my latest Canadian Dollar Weekly Technical Forecast for a closer look at the longer-term USD/CAD trade levels.

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- British Pound Short-term Outlook: GBP/USD Poised for Breakout

- Gold Short-term Technical Outlook: XAU/USD Slips into Support

- Australian Dollar Short-term Outlook: AUD/USD into Resistance

- Euro Short-term Technical Outlook: EUR/USD Threatens Correction

- US Dollar Short-term Outlook: USD Bears Slow at Fresh Yearly Low

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex