Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- USD/CAD rebound off downtrend support halted at technical resistance

- Well-defined range intact ahead of Fed rate decision- breakout imminent

- Resistance 1.3613/34, 1.3667(key), 1 .37- Support 1.3553/65, 1.3493-1.3510 (key), 1.3472

The US Dollar is holding a well-define range against the Canadian Dollar with USD/CAD testing holding just below technical resistance ahead of today’s highly anticipated Federal Reserve interest rate decision. Battle lines drawn on the USD/CAD short-term technical charts heading.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In my last Canadian Dollar Short-term Outlook we noted that, “A two-week recovery off support takes USD/CAD into initial resistance hurdles here- risk for topside exhaustion / price inflection in the days ahead. From at trading standpoint, losses would need to be limited to the weekly low IF price is heading higher on this stretch with a close above 1.3634 needed to fuel the next leg in price.” USD/CAD has continued to trade within that same range just below technical resistance at the March high / 38.2% retracement of the August decline around 1.3613/34 and the focus is on a possible breakout this week.

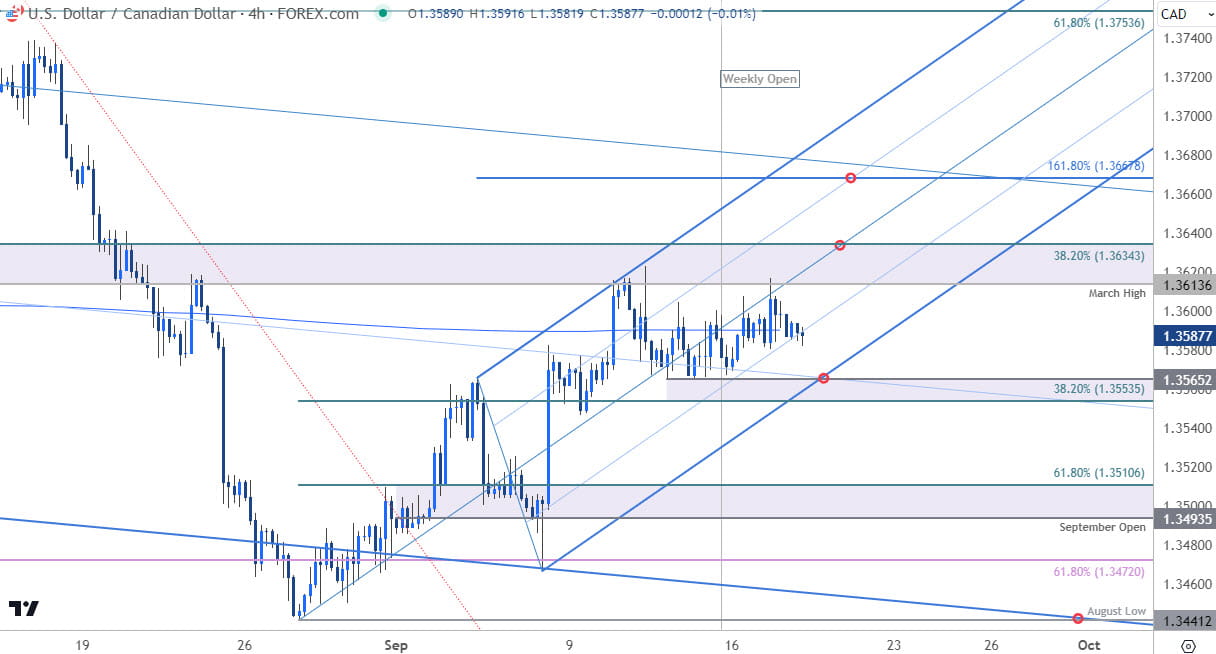

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows USD/CAD continuing to trade within the confines of the ascending pitchfork we’ve been tracking off the August low with the lower parallel further highlighting near-term support here at 1.3553/65. A break / close below this threshold would invalidate the multi-week advance and threaten a test of key support at the objective September open / 61.8% retracement of the late-August advance at 1.3493-1.3510- losses below this threshold would mark downtrend resumption towards subsequent support objectives at 1.3472 and the August low at 1.3441.

A topside breach / close above this key lateral zone exposes the 1.618% extension of the most recent advance at 1.3668. Ultimately, a breach / close above the median-line would be needed to suggest a larger recovery is underway / a more significant low is in place with such a scenario exposing subsequent resistance objectives at the 1.37-handle, and the 61.8% Fibonacci retracement at 1.3753. Look for a larger reaction there IF reached.

Bottom line: USD/CAD is holding a tight range just below resistance with the FOMC interest rate decision on tap later today- we’re on breakout watch. From a trading standpoint, rallies should be limited to 1.3667 IF price is heading lower with a break below 1.3510 needed to mark downtrend resumption.

Keep in mind that markets are currently pricing a 60% chance the Fed will cut by 50bps and with expectations so divided, a 25bps cut could fuel some USD strength- expect volatility. Stay nimble into the releases and watch the weekly close here. Review my latest Canadian Dollar Weekly Technical Forecast for a closer look at the longer-term USD/CAD trade levels.

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold Short-term Technical Outlook: XAU/USD Bulls Eye 2600

- Australian Dollar Short-term Outlook: AUD/USD Bulls Emerge

- Euro Short-term Technical Outlook: EUR/USD Tempts Trend Support

- US Dollar Short-term Outlook: USD Poised for Breakout Ahead of Fed

- British Pound Short-term Outlook: GBP/USD Poised for Breakout

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex