Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- Canadian Dollar counter-offensive underway- threatens larger recovery

- USD/CAD rally reverses sharply off uptrend resistance- correction levels in view

- Resistance 1.3640, 1.3698, 1.3761– Support 1.3545/68, 1.3509, 1.3465/66

The Canadian Dollar reprieve continues with USD/CAD poised for a third consecutive daily decline. A reversal off technical resistance now threatens a deeper correction within the multi-month uptrend and the focus is on identifying a possible exhaustion low in the weeks ahead. These are the updated targets and invalidation levels that matter on the USD/CAD short-term technical charts ahead of next week’s highly anticipated FOMC rate decision.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In last month’s Canadian Dollar Short-term Outlook we noted that an impressive four-week rally was approaching technical resistance and that, " Pullbacks should be limited to the 1.33-handle for the long-bias to remain viable with a breach above 1.3568 needed to fuel the next leg higher.” USD/CAD registered an intraday low at 1.3372 two-days later before mounting a rally of more than 2.4% into the September open. The advance faltered into channel resistance on building momentum divergence last week with price plunging nearly 1% off the highs- the threat now rises for a larger correction within the July uptrend.

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows USD/CAD continuing to trade within the confines of the ascending pitchfork formation we’ve been tracking since last month. Loonie has set the weekly opening-range just above a key pivot zone at 1.3545/68- a region defined by the 2023 yearly open and the 61.8% Fibonacci retracement of the yearly range. A break / close below this threshold would expose a more significant support confluence at the 38.2% retracement of the July advance / 200-day moving average at ~1.3465/66- we’ll reserve this threshold as our near-term bullish invalidation level.

Initial resistance is eyed at the weekly open / May high-close at 1.3640 and is backed by the 78.6% retracement around 1.37- a breach / close above this threshold is needed to mark resumption of the broader uptrend towards the yearly high-day close at 1.3761 and the high close at 1.3828.

Bottom line: USD/CAD has responded to uptrend resistance and threatens a larger correction in the days ahead. From a trading standpoint, the near-term risk remains weighted to the downside while below 1.3640– be on the lookout of an exhaustion low in the weeks ahead. Losses should be limited to 1.3465 for the July uptrend to remain viable with a breach above 1.37 needed to fuel the next leg higher in price. Review my latest Canadian Dollar Weekly Technical Forecast for a look at the longer-term USD/CAD trade levels.

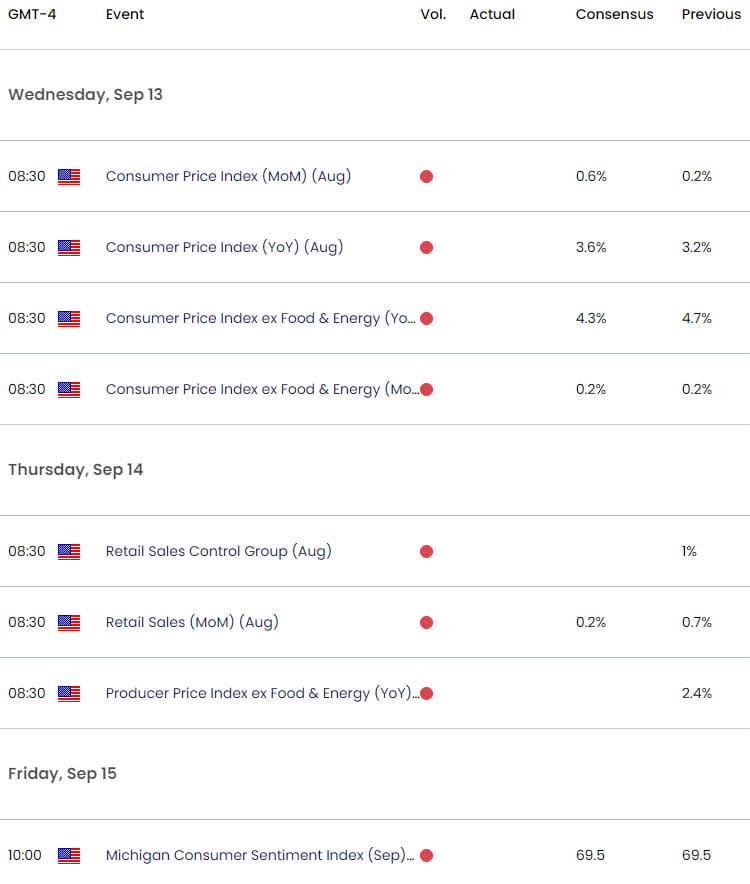

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- S&P 500 Short-term Price Outlook: Gap Trap

- Crude Oil Short-term Outlook: Oil Spill Searches for Support

- Gold Price Short-term Outlook: XAU/USD Searches Support Sub-1900

- US Dollar Short-term Outlook: USD Rally Set to Snap

- British Pound Short-Term Outlook: GBP/USD Breakout Imminent

- Euro Short-term Outlook: EUR/USD Poised for August Breakout

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex