Canadian Dollar Outlook: USD/CAD

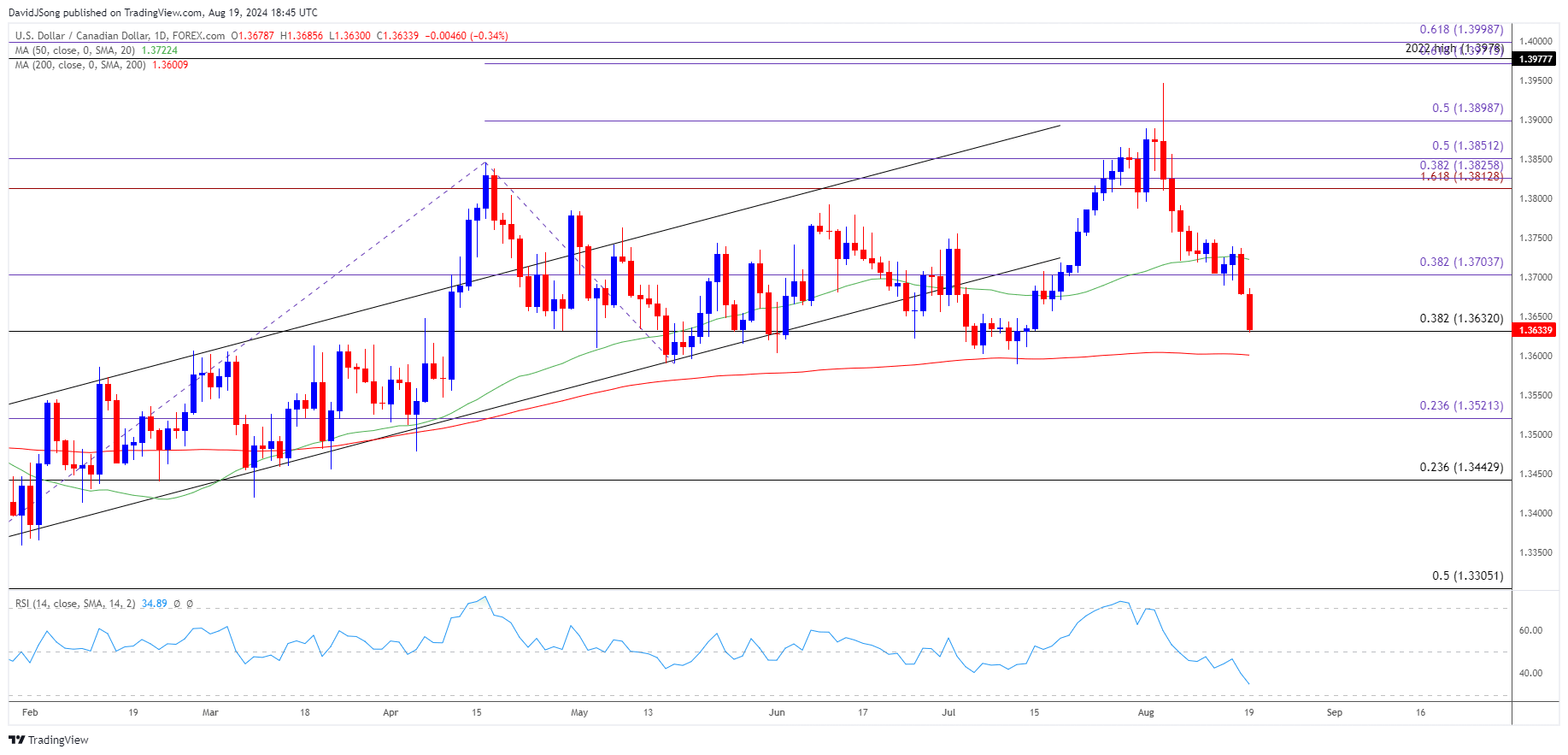

USD/CAD extends the decline from last week to register a fresh monthly low (1.3636), with the weakness in the exchange rate pushing the Relative Strength Index (RSI) to its lowest level since January.

Canadian Dollar Forecast: USD/CAD Susceptible to Test of July Low

USD/CAD may continue to give back the rebound from the July low (1.3589) as it initiates a series of lower highs and lows, but the update to Canada’s Consumer Price Index (CPI) may influence the exchange rate as the headline reading for inflation is anticipated to show slowing inflation.

Nevertheless, a further decline in USD/CAD may push the RSI into oversold territory for the first time this year, and a move below 30 in the oscillator is likely to be accompanied by a further decline in the exchange rate like the price action from last year.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD remains under pressure after failing to test the 2022 high (1.3978) earlier this month, with a break/close below 1.3630 (38.2% Fibonacci retracement) opening up the July low (1.3589).

- Next area of interest comes in around 1.3520 (23.6% Fibonacci extension) but USD/CAD may face range bound conditions amid the flattening slope in the 50-Day SMA (1.3723).

- Need a move above 1.3700 (38.2% Fibonacci extension) to bring the 1.3810 (161.8% Fibonacci extension) to 1.3830 (38.2% Fibonacci extension) region on the radar, with the next area of interest coming in around 1.3900 (50% Fibonacci extension).

Additional Market Outlooks

GBP/USD Forecast: Test of Weekly High in Focus

US Dollar Forecast: AUD/USD Bullish Price Series Persists

US Dollar Forecast: EUR/USD Eyes Monthly High with US CPI on Tap

NZD/USD Rate Outlook Hinges on RBNZ Interest Rate Decision

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong