Canadian Dollar Outlook: USD/CAD

USD/CAD carves a series of higher highs and lows following the failed attempt to test the March low (1.3420), with the rebound in the exchange rate pulling the Relative Strength Index (RSI) back from its lowest reading this year.

Canadian Dollar Forecast: USD/CAD Rebound Emerges Ahead of March Low

USD/CAD extends the advance from the monthly low (1.3441) despite the slowdown in the US Personal Consumption Expenditure (PCE) Price Index, and a move above 30 in the RSI is likely to be accompanied by a further advance in the exchange rate like the price action from last year.

However, the bearish momentum may persist as long as the RSI holds in oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Canada Economic Calendar

Looking ahead, it remains to be seen if the update to Canada’s 2Q Gross Domestic Product (GDP) report will influence the Bank of Canada (BoC) as the economy expands 2.1% versus forecasts for 1.6% print, but the Governing Council may continue to unwind its restrictive policy as the ‘Bank’s preferred measures of core inflation have been below 3% for several months.’

With that said, the Canadian Dollar may face headwinds next week as the BoC is expected to implement its third consecutive rate-cut, but the policy meeting may generate a bullish reaction in Loonie should Governing Tiff Macklem and Co. keep Canadian interest rates on hold.

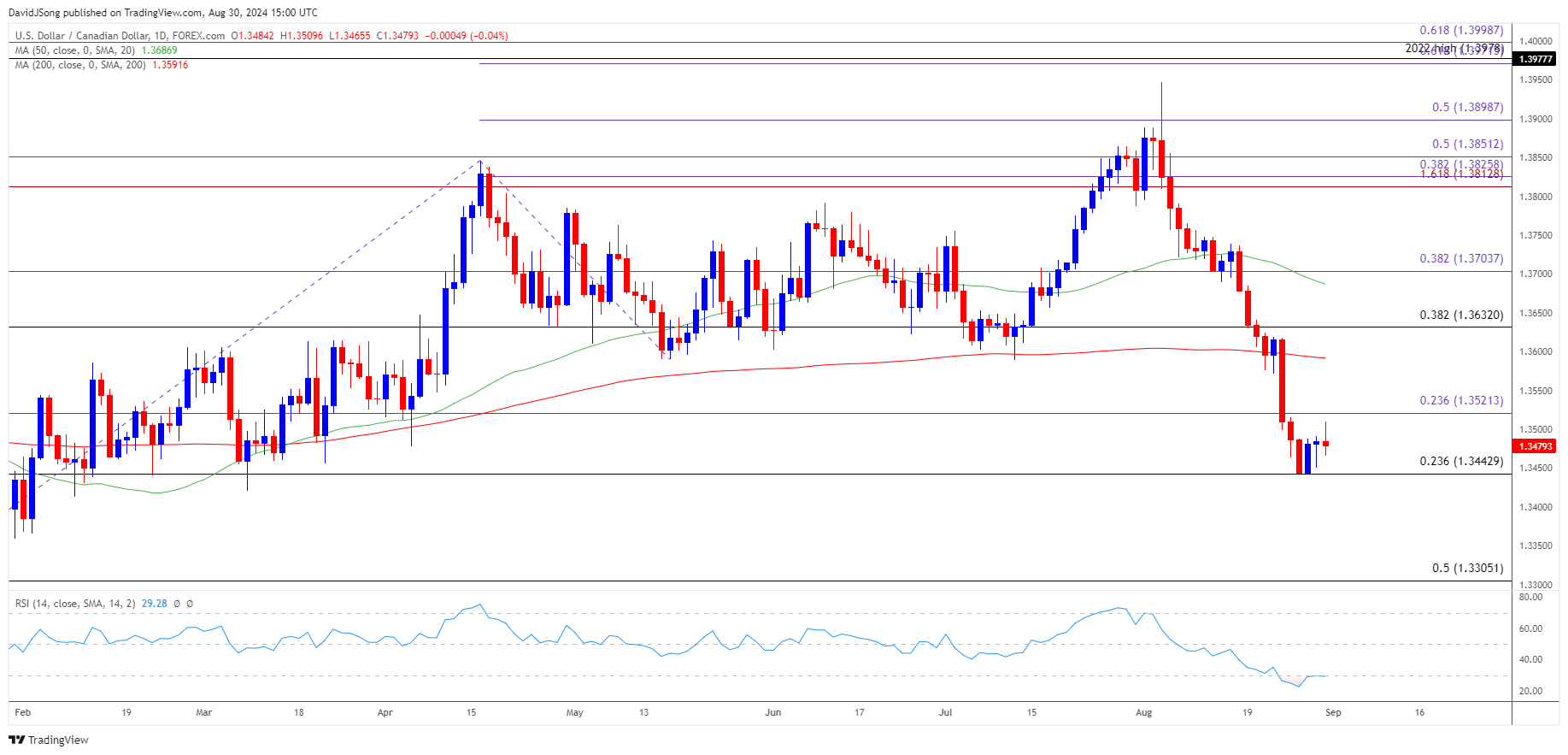

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD registers a fresh weekly high (1.3510) after struggling to test the March low (1.3420), with a break/close above 1.3520 (23.6% Fibonacci extension) raising the scope for a move back towards 1.3630 (38.2% Fibonacci retracement).

- Need a break/close above 1.3700 (38.2% Fibonacci extension) to bring the 1.3810 (161.8% Fibonacci extension) to 1.3850 (50% Fibonacci extension) region back on the radar but the recent rebound in USD/CAD may unravel should it fail to extend the recent series of higher highs and lows.

- A close below 1.3440 (23.6% Fibonacci retracement) may raises the scope for a test of the March low (1.3420), with a breach below the February low (1.3366) opening 1.3310 (50% Fibonacci retracement).

Additional Market Outlooks

GBP/USD Pullback Brings RSI Back from Overbought Zone

AUD/USD Vulnerable amid Struggle to Test January High

Euro Forecast: EUR/USD Preserves Advance Following Fed Symposium

USD/JPY Rebounds Ahead of Monthly Low to Keep RSI Above 30

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong