Canadian Dollar Outlook: USD/CAD

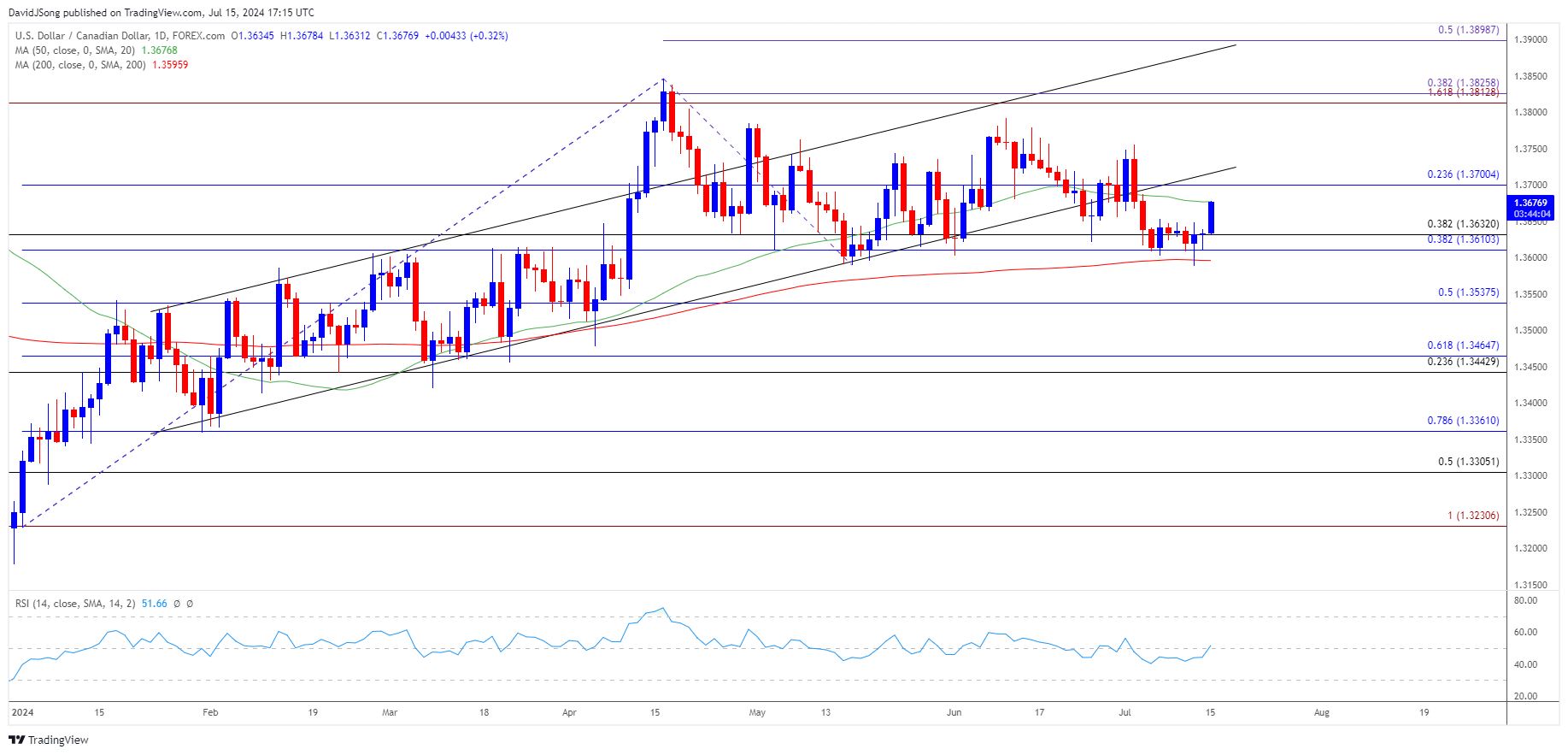

USD/CAD may retrace the decline from the monthly high (1.3755) as it breaks above the range bound price action from last week, but the exchange rate may track the flattening slope in the 50-Day SMA (1.3677) as it no longer trades within the ascending channel from earlier this year.

Canadian Dollar Forecast: USD/CAD Rebound Emerges Ahead of Canada CPI

Keep in mind, USD/CAD failed to defend the May low (1.3590) following the slowdown in the US Consumer Price Index (CPI), and speculation surrounding the Federal Reserve may continue to influence the exchange rate as the central bank appears to be on track to switch gears later this year.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

At the same time, the Bank of Canada (BoC) may take additional steps to support the economy as Canada Employment contracts 1.4K in June, and the central bank may continue to alter the path for monetary policy after delivering a 25bp rate-cut at its last meeting.

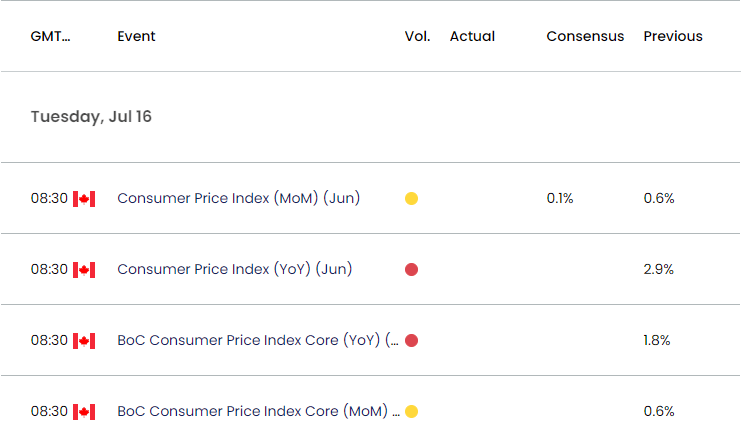

Canada Economic Calendar

In turn, the update to Canada’s CPI may sway USD/CAD as the BoC continues to look for ‘evidence that underlying inflation is easing,’ and a further slowdown in consumer prices may prop up the exchange rate as it fuels speculation for another rate-cut.

However, signs of persistent price growth may push Governor Tiff Macklem and Co. to retain the current policy at its next meeting on July 24, and the CPI report may curb the recent advance in USD/CAD if the update limits the scope for back-to-back BoC rate cuts.

With that said, USD/CAD may face range bound conditions should it track the flattening slope in the 50-Day SMA (1.3677), but the exchange rate may struggle to retain the advance from the monthly low (1.3589) as it no longer trades within the ascending channel from earlier this year.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD bounces back after failing to defend the May low (1.3590) and a move above 1.3700 (23.6% Fibonacci retracement) may push USD/CAD towards the monthly high (1.3755).

- Next area of interest comes in around the June high (1.3792), but USD/CAD may track the flattening slope in the 50-Day SMA (1.3677) as it no longer trades within the ascending channel from earlier this year.

- At the same time, a close below the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region may push USD/CAD towards 1.3540 (50% Fibonacci retracement), with the next area of interest coming in around the April low (1.3478).

Additional Market Outlooks

Euro Forecast: EUR/USD Eyes June High Ahead of ECB Rate Decision

US Dollar Forecast: GBP/USD Rally Pushes RSI Towards Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong