Canadian Dollar Outlook: USD/CAD

USD/CAD trades to a fresh monthly high (1.3810) as the Bank of Canada (BoC) keeps the overnight interest rate at 5.00%, and the exchange rate may stage further attempts to test the yearly high (1.3862) as it appears to be tracking the positive slope in the 50-Day SMA (1.3594).

Canadian Dollar Forecast: USD/CAD Eyes Yearly High with BoC on Hold

USD/CAD clears the opening range for October as the BoC warns that ‘past interest rate increases are dampening economic activity,’ and it remains to be seen if Governor Tiff Macklem and Co. will adjust the forward guidance at its next meeting on December 6 as the central bank ‘is prepared to raise the policy rate further if needed.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Until then, the Canadian Dollar may underperform against its US counterpart as the Federal Reserve keeps the door open to implement higher interest rates, but the update to the Personal Consumption Expenditure (PCE) Price Index may drag on the Greenback as the report is anticipated to show slowing inflation.

US Economic Calendar

The core PCE, the Fed’s preferred gauge for inflation, is seen narrowing to 3.7% in September from 3.9% per annum the month prior, and evidence of slower price growth may keep the Federal Open Market Committee (FOMC) on the sidelines as Chairman Jerome Powell warns that ‘financial conditions have tightened significantly in recent months.’

However, a stronger-than-expected core PCE print may keep USD/CAD afloat as it puts pressure on the Fed to further combat inflation, and the exchange rate may stage further attempts to test the yearly high (1.3862) as it clears the opening range for October.

With that said, developments coming out of the US may influence the near-term outlook for USD/CAD as the BoC moves to the sidelines, and USD/CAD may track the positive slope in the 50-Day SMA (1.3594).

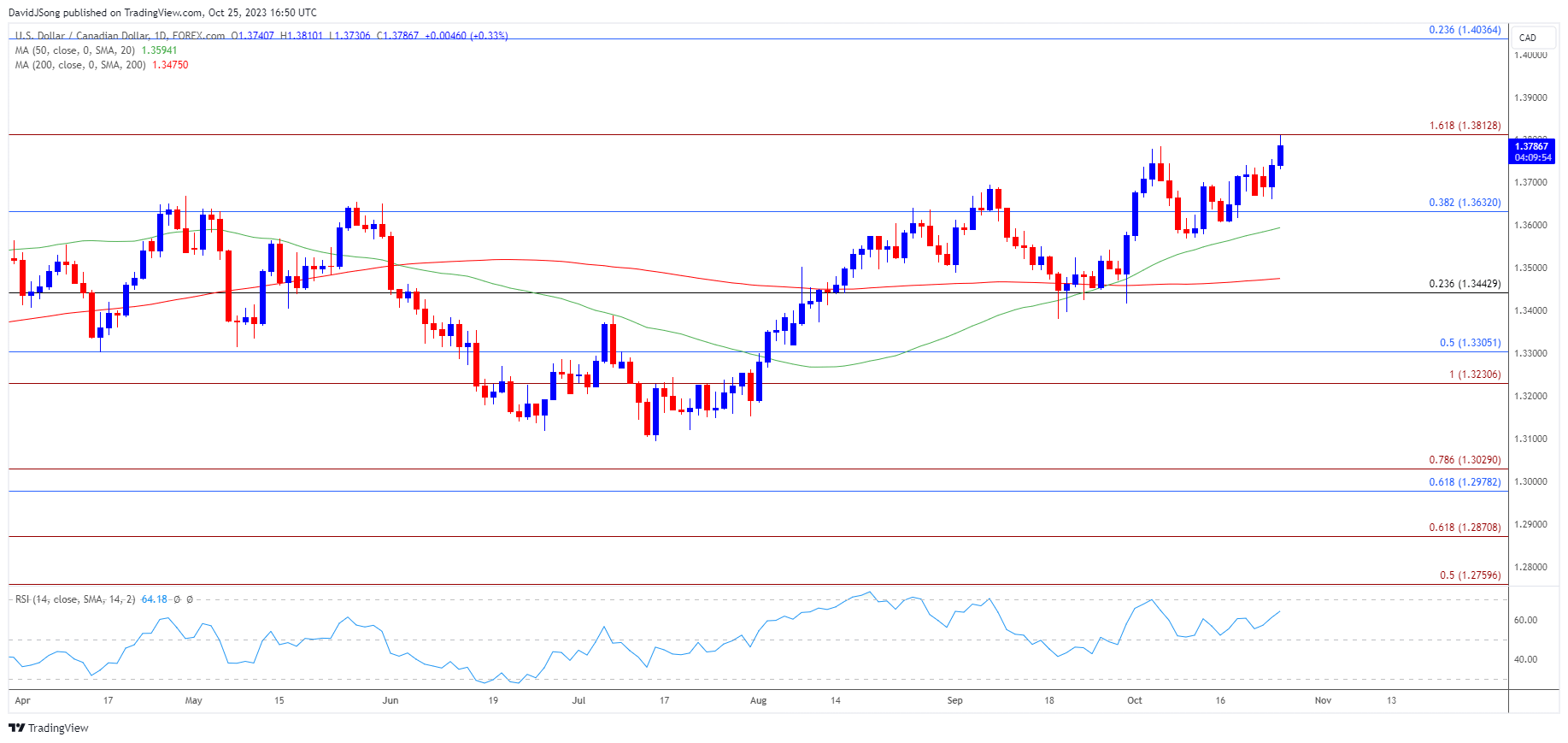

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to be tracking the positive slope in the 50-Day SMA (1.3590) as it clears the monthly opening range, with a close above 1.3810 (161.8% Fibonacci extension) raising the scope for a test of the yearly high (1.3862).

- Next area of interest comes in around the 2022 high (1.3978), but failure to clear the March high (1.3862) may keep USD/CAD within the yearly range.

- Lack of momentum to hold above 1.3630 (38.2% Fibonacci retracement) may push USD/CAD towards the moving average, with a breach of the monthly low (1.3562) opening up the 1.3440 (23.6% Fibonacci retracement) region.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Stalls Again at Former Support Zone

Australian Dollar Forecast: AUD/USD Rebounds Ahead of Australia CPI

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong