Canadian Dollar Outlook: USD/CAD

USD/CAD approaches the monthly high (1.3755) ahead of the Bank of Canada (BoC) interest rate decision as it extends the series of higher highs and lows from earlier this week.

Canadian Dollar Forecast: USD/CAD Eyes Monthly High Ahead of BoC

USD/CAD stages a three-day rally following the slowdown in Canada’s Consumer Price Index (CPI), and signs of easing inflation may lead the BoC to reflect a dovish forward guidance as the headline reading narrows to 2.7% in June from 2.9% the month prior.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It remains to be seen if the BoC will respond to the recent data print after the Governing Council delivered a 25bp rate-cut in June, and USD/CAD may track the flattening slope in the 50-Day SMA (1.3676) as it no longer trades within the ascending channel from earlier this year.

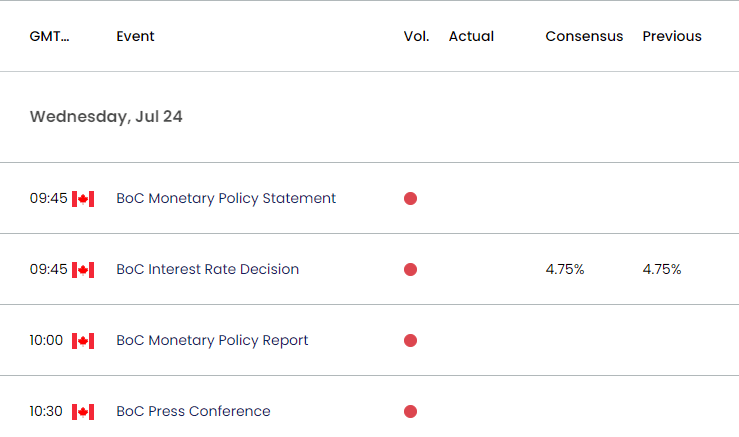

Canada Economic Calendar

Ahead of the quarterly meeting, the BoC is expected to keep interest rates on hold, and the update to the Monetary Policy Report (MPR) may curb the recent advance in USD/CAD should the central bank endorse a wait-and-see approach in managing monetary policy.

At the same time, the BoC may continue to switch gears in 2024 as ‘monetary policy no longer needs to be as restrictive,’ and the meeting may keep USD/CAD afloat should Governor Tiff Macklem and Co. prepare Canadian households and businesses for lower interest rates.

With that said, USD/CAD may test the monthly high (1.3755) ahead of the BoC rate decision as it carves a series of higher highs and lows, but the exchange rate may track the flattening slope in the 50-Day SMA (1.3676) as it no longer trades within the ascending channel from earlier this year.

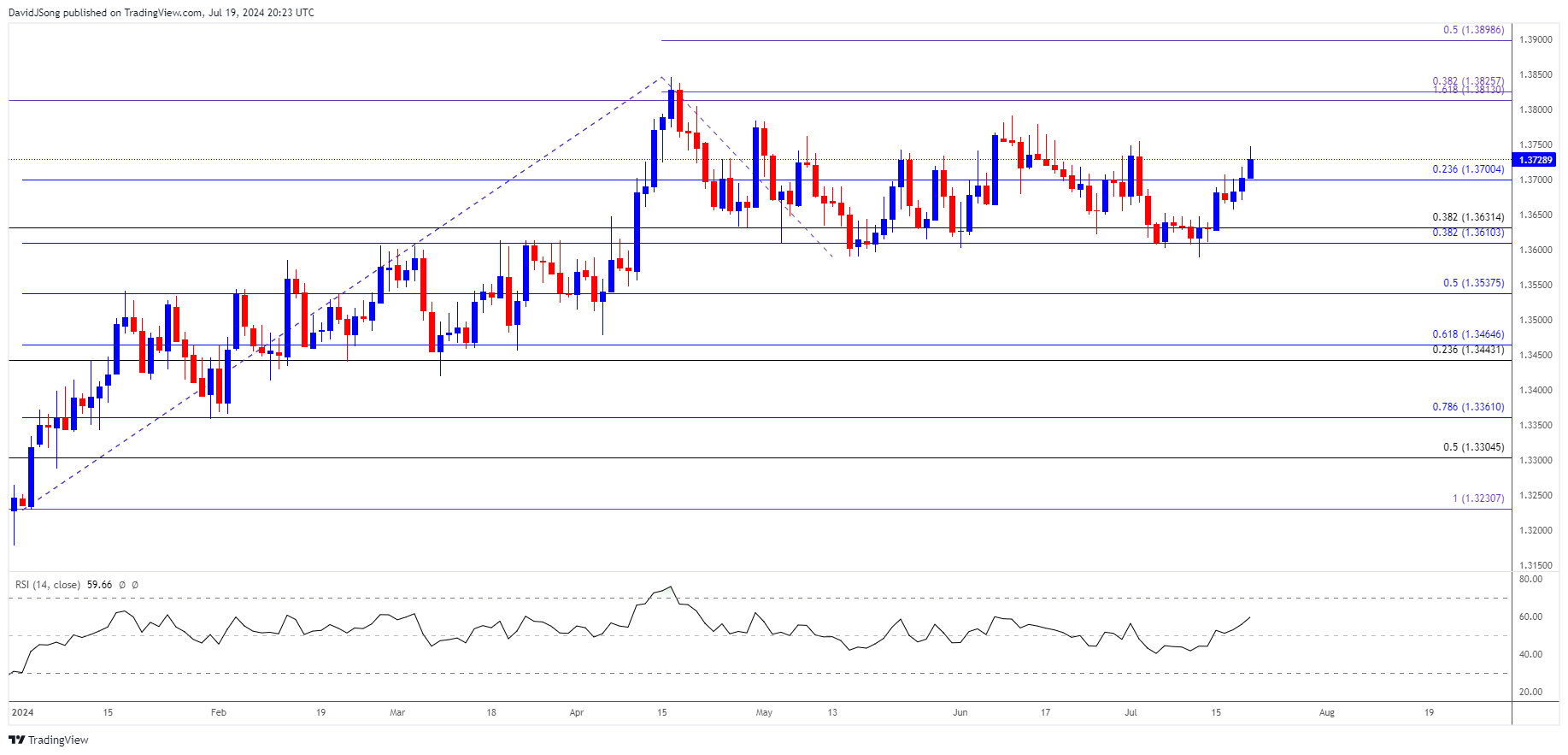

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- Keep in mind, the recent recovery in USD/CAD emerged even though it failed to defend the May low (1.3590), with a breach above the monthly high (1.3755) bringing the June high (1.3792) on the radar.

- A break/close above the 1.3810 (161.8% Fibonacci extension) to 1.3830 (38.2% Fibonacci extension) region opens up the April high (1.3846) but USD/CAD may face range bound conditions as it no longer trades within the ascending channel from earlier this year.

- As a result, USD/CAD may track the flattening slope in the 50-Day SMA (1.3676), with a move below 1.3700 (23.6% Fibonacci retracement) bringing the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) area back on the radar.

Additional Market Outlooks

GBP/USD Forecast: RSI Falls Back from Overbought Zone

Australian Dollar Forecast: AUD/USD Reverses Ahead of January High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong